B) False

Correct Answer

verified

Correct Answer

verified

True/False

An estate may be a shareholder of an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a resident alien shareholder moves outside the U.S.,the S election is terminated.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

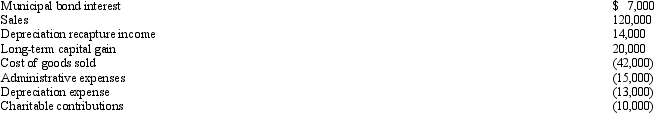

Estela,Inc.,a calendar year S corporation,incurred the following items in 2013.

Calculate Estela's nonseparately computed income.

Calculate Estela's nonseparately computed income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

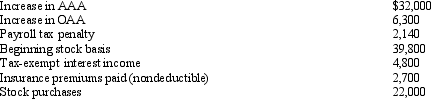

You are given the following facts about a 50% owner of an S corporation.Compute his ending stock basis.

A) $80,950.

B) $85,750.

C) $100,100.

D) $106,225.

E) Some other amount.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The carryover period for the NOLs of a C corporation does not continue to run during S corporation years.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

As with partnerships,the income,deductions,and tax credits of an S corporation ____________________ to the shareholders annually. flow through

Correct Answer

verified

Correct Answer

verified

True/False

Any distribution of cash or property by a corporation that does not exceed the balance of AAA with respect to S stock during a post-termination transition period of approximately one year is applied against and reduces the basis of the S stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation does not recognize a loss when distributing assets that are worth less than their basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is incorrect?

A) S corporations are treated as corporations under state law.

B) S corporations are treated as partnerships for Federal income tax purposes.

C) Distributions of appreciated property are taxable to the S corporation.

D) None of the above statements is incorrect.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax provision does not apply to an S corporation?

A) DPAD.

B) Section 1244 stock.

C) Penalty for failure to file.

D) 10% charitable contribution limitation.

E) Estimated tax payments.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Most IRAs cannot own stock in an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What statement is correct with respect to an S corporation?

A) There are now more LLCs than S corporations.

B) S corporation status allows shareholders immediately to realize tax benefits from corporate losses.

C) An S corporation is prohibited from being a member of an affiliated group.

D) An LLP may own stock in an S corporation.

E) None of the above statements is correct.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Tax-exempt income is listed on Schedule ____________________ of Form 1120S. K

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A calendar year C corporation reports a $41,000 NOL in 2012,but it elects S status for 2013 and generates an NOL of $30,000 in that year.At all times during 2013,the stock of the corporation was owned by the same 10 shareholders,each of whom owned 10% of the stock.Kris,one of the 10 shareholders,holds an S stock basis of $2,300 at the beginning of 2013.How much of the 2013 loss,if any,is deductible by Kris?

A) $0.

B) $2,300.

C) $3,000.

D) $7,100.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation that has total assets of at least $10 million on Schedule L at the end of the tax year must file a Schedule M-3.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item does not appear on Schedule K of Form 1120S?

A) Intangible drilling costs.

B) Foreign loss.

C) Utilities expense.

D) Recovery of a tax benefit.

E) All of the above items appear on Schedule K.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An S election is made on the shareholder's Form 2553.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Depletion in excess of basis in property causes a(n)____________________ adjustment to an S shareholder's basis. upward or increase

Correct Answer

verified

Correct Answer

verified

Short Answer

An S corporation recognizes a ____________________ on any distribution of appreciated property. gain

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 146

Related Exams