A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

A unitary business applies a combined apportionment formula, including data from operations of all of the affiliates.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A capital stock tax usually is structured as an excise tax imposed on a corporation's "net worth," using financial statement data to compute the tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the broadest application of the unitary theory, the U.S. unitary business files a combined tax return using factors and income amounts for all affiliates:

A) Organized in the U.S.

B) Organized in NAFTA countries.

C) Organized anywhere in the world.

D) As dictated by the tax treaties between the U.S. and the other countries.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In most states, Federal S corporations must make a separate state-level election of the flow-through status.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

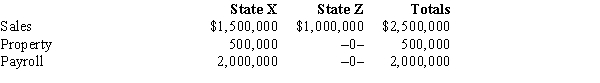

José Corporation realized $900,000 taxable income from the sales of its products in States X and Z. José's activities in both states establish nexus for income tax purposes. José's sales, payroll, and property among the states include the following.

X utilizes an equally weighted three-factor apportionment formula. How much of José's taxable income is apportioned to X?

X utilizes an equally weighted three-factor apportionment formula. How much of José's taxable income is apportioned to X?

A) $120,000

B) $450,000

C) $780,000

D) $900,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Most states' consumer sales taxes are paid by the final purchaser of the taxable asset.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

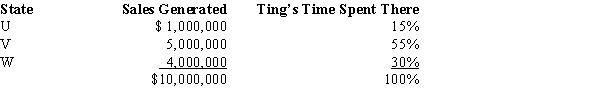

Ting, a regional sales manager, works from her office in State W. Her region includes several states, as indicated in the sales report below. Determine how much of Ting's $300,000 compensation is assigned to the payroll factor of State W.

A) $0.

B) $90,000.

C) $120,000.

D) $300,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -Computer software, in the form of a disk purchased by an individual at a rummage sale.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under P.L. 86-272, which of the following transactions by itself would create nexus with a state?

A) Inspection by a sales employee of the customer's inventory for specific product lines.

B) Using an independent contractor who acts as a manufacturer's representative for the taxpayer through a sales office in the state.

C) Executing a sales campaign, using an advertising agency acting as an independent contractor for the taxpayer.

D) Maintenance of inventory in the state by an independent contractor under a consignment plan.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses -Deduction for advertising expenditures.

A) Addition modification

B) Subtraction modification

C) No modification

E) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following events, considered independently, to its likely effect on WillCo's various apportionment factors. WillCo is based in Q and has customers in Q, R, and S. To this point, WillCo has not established nexus with S. More than one choice may be correct -WillCo completes the construction of production facilities in S.

A) No change in apportionment factors

B) Q apportionment factor increases

C) Q apportionment factor decreases

D) R apportionment factor increases

E) R apportionment factor decreases

F) S apportionment factor increases

G) S apportionment factor decreases

I) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Typically exempt from the sales/use tax base is the purchase of clothing from a neighbor's "garage sale."

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The throwback rule requires that:

A) Sales of tangible personal property are attributed to the state where they originated, if the taxpayer is not taxable in the state of destination.

B) Sales of tangible personal property are attributed to the seller's state, even if the taxpayer is not taxable in the state of destination.

C) Sales of services are attributed to the state of commercial domicile.

D) Capital gain/loss is attributed to the state of commercial domicile.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In most states, a taxpayer's income is apportioned on the basis of a formula measuring the extent of business contact, and allocated according to the location of property owned or used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A state sales tax usually falls upon:

A) The sale of a used dinette set sold at a rummage sale.

B) The sale of a dinette set by the manufacturer to a furniture retailer.

C) The sale of a case of Bibles by the publisher to a church bookstore.

D) The sale of a Bible to a member of the church.

E) All of the above are exempt transactions.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under P.L. 86-272, which of the following transactions by itself would create nexus with a state?

A) Order solicitation for a plot of real estate, approved and filled from another state.

B) Order solicitation for a computer, approved and filled from another state.

C) Order solicitation for a machine, with credit approval from another state.

D) The conduct of a training seminar for sales personnel as to how to install and operate a new software product.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the taxpayer operates in one or more unitary states:

A) Apportionment factors are computed on a group-wide basis.

B) The tax incentive of creating nexus in a low-tax state is enhanced.

C) The tax benefit of a passive investment subsidiary holding company is neutralized.

D) The use of a water's edge election should be considered.

E) All of the above are true.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In determining state taxable income, all of the following are adjustments to Federal income except:

A) Federal net operating loss.

B) Federal income tax expense.

C) Fringe benefits paid to officers and executives.

D) Dividends received from other U.S. corporations.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Most of the U.S. states have adopted an alternative minimum tax, similar to the Federal system, in taxing the income of corporations.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 123

Related Exams