B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its A headquarters to a customer in B. This activity is not sufficient for General to create nexus with B. State B applies a throwback rule, but State A does not. In which state(s) will the sale be included in the sales factor numerator?

A) $0 in both A and B.

B) $100,000 in A.

C) $100,000 in B.

D) In both A and B, according to the apportionment formulas of each.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its A headquarters to a customer in B. This activity is not sufficient for General to create nexus with B. State A applies a throwback rule, but State B does not. In which state(s) will the sale be included in the sales factor numerator?

A) $0 in both A and B.

B) $100,000 in A.

C) $100,000 in B.

D) In both A and B, according to the apportionment formulas of each.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses -Federal general business credit.

A) Addition modification

B) Subtraction modification

C) No modification

E) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Typically exempt from the sales/use tax base is the purchase of prescription medicines by an individual.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses -State income tax expense.

A) Addition modification

B) Subtraction modification

C) No modification

E) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer has nexus with a state for sales and use tax purposes if it has a physical presence in the state.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For most taxpayers, which of the traditional apportionment factors yields the greatest opportunities for tax reduction?

A) Payroll.

B) Property.

C) Sales (gross receipts) .

D) Unitary.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A city might assess a recording tax when a business takes out a mortgage on its real estate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

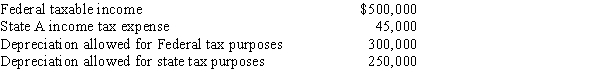

Ramirez Corporation is subject to tax only in State A. Ramirez generated the following income and deductions.

Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Ramirez's A taxable income is:

Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Ramirez's A taxable income is:

A) $495,000.

B) $500,000.

C) $545,000.

D) $595,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -Earthmoving equipment used by the purchaser in construction business.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Parent Corporation owns all of the stock of Junior Corporation, a Delaware passive investment company. Parent operates strictly in nonunitary State B, which levies a 9% income tax. This year, Junior earned $200,000 of portfolio interest income and paid a $150,000 dividend to Parent. In which state(s) will the interest income create an income tax liability?

A) Only in B.

B) Only in Delaware.

C) In neither state.

D) In both B and Delaware, according to the apportionment formulas of each.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

All of the U.S. states use an apportionment formula based on the sales, property, and payroll factors.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A state can levy an income tax on a business only if the business was incorporated in the state.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under P.L. 86-272, the taxpayer is exempt from state taxes on income resulting from the mere solicitation of orders for the sale of stocks and bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its A headquarters to an agency of the U.S. government. State A applies a throwback rule. In which state(s) will the sale be included in the sales factor numerator?

A) $0 in A.

B) $50,000 in A, with the balance exempted from other states' sales factors under the Colgate doctrine.

C) $100,000 in A.

D) In all of the states, according to the apportionment formulas of each, as the U.S. government is present in all states.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -A textbook purchased by a State University student.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

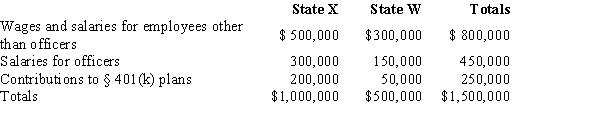

Multiple Choice

Trayne Corporation's sales office and manufacturing plant are located in State X. Trayne also maintains a manufacturing plant and sales office in State W. For purposes of apportionment, X defines payroll as all compensation paid to employees, including elective contributions to § 401(k) deferred compensation plans. Under the statutes of W, neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor. Trayne incurred the following personnel costs.  Trayne's payroll factor for State X is:

Trayne's payroll factor for State X is:

A) 100.00%.

B) 66.67%.

C) 62.50%.

D) 50.00%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A typical state taxable income subtraction modification is the interest income earned from another state's bonds.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a state follows Federal income tax rules, the state's tax compliance and enforcement become easier to accomplish.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 123

Related Exams