A) $150

B) $180

C) $250

D) $300

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A tax levied on buyers will never be partially paid by sellers.

B) Who actually pays a tax depends on the price elasticities of supply and demand.

C) Government can decide who actually pays a tax.

D) A tax levied on sellers always will be passed on completely to buyers.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Taxes levied on sellers and taxes levied on buyers are not equivalent.

B) A tax places a wedge between the price that buyers pay and the price that sellers receive.

C) The wedge between the buyers' price and the sellers' price is the same,regardless of whether the tax is levied on buyers or sellers.

D) In the new after-tax equilibrium,buyers and sellers share the burden of the tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

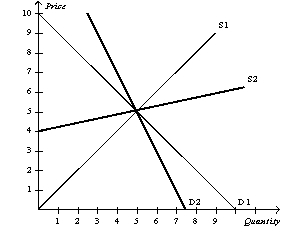

Figure 6-24

Suppose the government imposes a $2 on this market.  -Refer to Figure 6-24.Suppose D1 represents the demand curve for paperback novels,D2 represents the demand curve for gasoline,and S1 represents the supply curve for paperback novels and gasoline.After the imposition of the $2 on paperback novels and on gasoline,the

-Refer to Figure 6-24.Suppose D1 represents the demand curve for paperback novels,D2 represents the demand curve for gasoline,and S1 represents the supply curve for paperback novels and gasoline.After the imposition of the $2 on paperback novels and on gasoline,the

A) buyers of gasoline bear a higher burden of the $2 tax than buyers of paperback novels.

B) sellers of gasoline bear a higher burden of the $2 tax than sellers of paperback novels.

C) buyers of gasoline bear an equal burden of the $2 tax as buyers of paperback novels.

D) Both a and b are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After a binding price floor becomes effective,a

A) smaller quantity of the good is bought and sold.

B) a larger quantity of the good is demanded.

C) a smaller quantity of the good is supplied.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum wage laws

A) may encourage some teenagers to drop out and take jobs.

B) create labor shortages.

C) have the greatest impact in the market for skilled labor.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a binding price floor is imposed on the market for eBooks,then

A) the demand for eBooks will decrease.

B) the supply of eBooks will increase.

C) a surplus of eBooks will develop.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the equilibrium price of a physical examination ("physical") by a doctor is $200,and the government imposes a price ceiling of $150 per physical.As a result of the price ceiling,the

A) demand curve for physicals shifts to the right.

B) supply curve for physicals shifts to the left.

C) quantity demanded of physicals increases,and the quantity supplied of physicals decreases.

D) number of physicals performed stays the same.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be the least likely result of a binding price ceiling imposed on the market for rental cars?

A) an accumulation of dirt in the interior of rental cars

B) poor engine maintenance in rental cars

C) free gasoline given to people as an incentive to a rent a car

D) slow replacement of old rental cars with newer ones

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is a binding constraint on a market,then

A) the equilibrium price must be below the price ceiling.

B) the quantity supplied must exceed the quantity demanded.

C) sellers cannot sell all they want to sell at the price ceiling.

D) buyers cannot buy all they want to buy at the price ceiling.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a good or service is sold in a competitive market free of government regulation,then the price of the good or service adjusts to balance supply and demand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

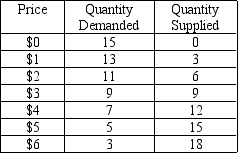

Table 6-3

The following table contains the demand schedule and supply schedule for a market for a particular good.Suppose sellers of the good successfully lobby Congress to impose a price floor $2 above the equilibrium price in this market.

-Refer to Table 6-3.How many units of the good are sold after the imposition of the price floor?

-Refer to Table 6-3.How many units of the good are sold after the imposition of the price floor?

A) 5

B) 9

C) 10

D) 15

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is not binding,then

A) there will be a surplus in the market.

B) there will be a shortage in the market.

C) the market will be less efficient than it would be without the price ceiling.

D) there will be no effect on the market price or quantity sold.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is imposed on a market with inelastic supply and elastic demand,then

A) buyers will bear most of the burden of the tax.

B) sellers will bear most of the burden of the tax.

C) the burden of the tax will be shared equally between buyers and sellers.

D) it is impossible to determine how the burden of the tax will be shared.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Not all sellers benefit from a binding price floor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government passes a law requiring buyers of college textbooks to send $5 to the government for every textbook they buy,then

A) the demand curve for textbooks shifts downward by $5.

B) buyers of textbooks pay $5 more per textbook than they were paying before the tax.

C) sellers of textbooks are unaffected by the tax.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A key lesson from the payroll tax is that the

A) tax is a tax solely on workers.

B) tax is a tax solely on firms that hire workers.

C) tax eliminates any wedge that might exist between the wage that firms pay and the wage that workers receive.

D) true burden of a tax cannot be legislated.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets.Buyers of airline tickets are required to pay the tax to the government.If the tax is reduced from $50 per ticket to $30 per ticket,then the

A) demand curve will shift upward by $20,and the effective price received by sellers will increase by $20.

B) demand curve will shift upward by $20,and the effective price received by sellers will increase by less than $20.

C) supply curve will shift downward by $20,and the price paid by buyers will decrease by $20.

D) supply curve will shift downward by $20,and the price paid by buyers will decrease by less than $20.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

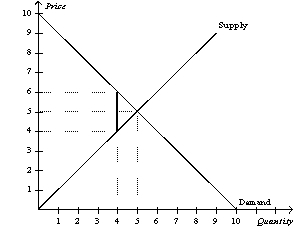

Figure 6-27  -Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer pays $6.

-Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer pays $6.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The wedge between the buyers' price and the sellers' price is the same,regardless of whether the tax is levied on buyers or sellers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 593

Related Exams