A) $11,581.

B) $16,181.

C) $20,000.

D) $24,881.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the ability-to-pay principle,it is fair for people to pay taxes based on the amount of government services that they receive.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Most people in the United States believe that our tax system should be both __________ and __________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Public schools,which educate most students through high school,are paid for primarily by

A) state governments.

B) local governments.

C) the federal government.

D) taxpayers directly.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past 100 years,as the U.S.economy's income has grown,

A) tax rates have decreased,while tax revenues have increased.

B) tax rates have increased,while tax revenues have decreased.

C) both tax rates and tax revenues have increased.

D) both tax rates and tax revenues have decreased.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The government raises revenue through taxation to pay for the services it provides.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept that people should pay taxes based on the benefits they receive from government services is called

A) the ability-to-pay principle.

B) the benefits principle.

C) horizontal equity.

D) vertical equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government finances the budget deficit by

A) borrowing from the public.

B) borrowing solely from the Federal Reserve Bank.

C) printing currency in the amount of the budget deficit.

D) requiring that budget surpluses occur every other year to pay off the deficits.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two types of taxes that are most important to state and local governments as sources of revenue are

A) individual income taxes and corporate income taxes.

B) sales taxes and individual income taxes.

C) sales taxes and property taxes.

D) social insurance taxes and property taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The U.S.tax burden is high compared to many European countries,but is low compared to many other nations in the world.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

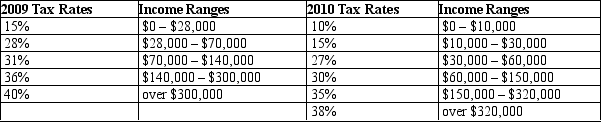

Table 12-12

United States Income Tax Rates for a Single Individual,2009 and 2010.

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What is his average tax rate in 2010?

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What is his average tax rate in 2010?

A) 15.3%

B) 17.6%

C) 21.3%

D) 24.8%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Tyler values a basketball at $20.Jacqui values a basketball at $16.The pre-tax price of a basketball $15.The government imposes a tax of $2 on each basketball,and the price rises to $17.The deadweight loss from the tax is

A) $1.

B) $2.

C) $3.

D) $6.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a poor family has three children in public school and a rich family has two children in private school,the ability-to-pay principle would suggest that

A) the poor family should pay more in taxes to pay for public education than the rich family.

B) the rich family should pay more in taxes to pay for public education than the poor family.

C) the benefits of private school exceed those of public school.

D) public schools should be financed by property taxes.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local governments generate revenue from all of the following sources except

A) sales taxes.

B) the federal government.

C) corporate income taxes.

D) customs duties.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The projected government spending on Social Security,Medicare,and Medicaid as a percentage of GDP is expected to increase from

A) less than one percent in 1950 to over 50 percent in 2070.

B) less than one percent in 1950 to almost 20 percent in 2070.

C) 10 percent in 1950 to over 50 percent in 2070.

D) 20 percent in 1950 to almost 40 percent in 2070.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

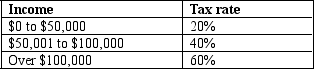

Table 12-7

-Refer to Table 12-7.What is the average tax rate for a person who makes $120,000?

-Refer to Table 12-7.What is the average tax rate for a person who makes $120,000?

A) 25%

B) 35%

C) 45%

D) 60%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following countries,which country's government collects the least amount of tax revenue as a percentage of that country's total income?

A) France

B) United States

C) Canada

D) Sweden

F) A) and C)

Correct Answer

verified

Correct Answer

verified

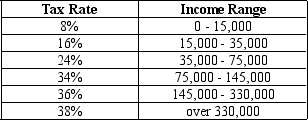

Multiple Choice

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Livi has taxable income of $78,000,her tax liability is

-Refer to Table 12-2.If Livi has taxable income of $78,000,her tax liability is

A) $7,800.

B) $9,900.

C) $10,200.

D) $15,020.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed at every stage of production is a

A) value-added tax.

B) lump sum tax.

C) corrective tax.

D) regressive tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

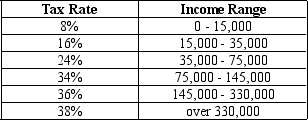

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Mateo has taxable income of $165,000,his average tax rate is

-Refer to Table 12-2.If Mateo has taxable income of $165,000,his average tax rate is

A) 26.6%.

B) 26.9%.

C) 27.3%.

D) 28.5%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 499

Related Exams