B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

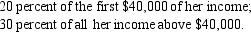

Scenario 12-4.A taxpayer faces the following tax rates on her income:

-Refer to Scenario 12-4.The taxpayer faces

-Refer to Scenario 12-4.The taxpayer faces

A) an average tax rate of 22.5 percent when her income is $30,000.

B) an average tax rate of 22.0 percent when her income is $50,000.

C) a marginal tax rate of 10 percent when her income rises from $40,000 to $40,001.

D) a marginal tax rate of 50 percent when her income rises from $60,000 to $60,001.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three largest categories of spending by the Federal government in order from first to third would be

A) Social Security,Medicare,and national defense

B) national defense,net interest,and Social Security

C) Social Security,national defense,and income security

D) income security,Social Security,and national defense

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's average tax rate equals her

A) tax obligation divided by her marginal tax rate.

B) increase in taxes if her income were to rise by $1.

C) tax obligation divided by her income.

D) increase in taxes if her marginal tax rate were to rise 1%.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sue earns income of $80,000 per year.Her average tax rate is 40 percent.Sue paid $4,500 in taxes on the first $30,000 she earned.What was the marginal tax rate on the rest of her income?

A) 15 percent

B) 32 percent

C) 40 percent

D) 55 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009 the largest percentage of federal government spending was on

A) national defense.The largest source of federal revenues was from corporate income taxes.

B) national defense.The largest source of federal revenues was from individual income taxes.

C) Social Security.The largest source of federal revenues was from corporate income taxes.

D) Social Security.The largest source of federal revenues was from individual income taxes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.tax code gives preferential treatment to investors in municipal bonds.This is an example of

A) a tax loophole.

B) tax evasion.

C) an administrative burden.

D) tax enforcement.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

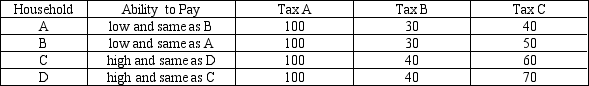

Table 12-16

The table below provides information on the 4 households that make up a small economy and how much they would pay in taxes under 3 types of taxes.

-Refer to Table 12-16.In this economy Tax C exhibits

-Refer to Table 12-16.In this economy Tax C exhibits

A) horizontal and vertical equity.

B) horizontal equity but not vertical equity.

C) vertical equity but not horizontal equity.

D) neither horizontal nor vertical equity.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to determine tax incidence,one must

A) consider issues of equity.

B) also determine the legal liability of the tax.

C) evaluate where the tax burden eventually falls.

D) use the "flypaper theory" of taxation.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The flypaper theory of tax incidence

A) ignores the indirect effects of taxes.

B) assumes that most taxes should be "stuck on " the rich.

C) says that once a tax has been imposed,there is little chance of it changing,so in essence people are stuck with it.

D) suggests that taxes are like flies because they are everywhere and will never go away.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The public welfare spending category for state and local governments includes

A) many programs that are initiated by private foundations.

B) contributions in support of public universities.

C) some federal programs that are administered by state and local governments.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rank the following state and local government expenditure categories from largest to smallest.

A) education,public welfare,highways

B) education,highways,public welfare

C) highways,education,public welfare

D) public welfare,education,highways

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Part of the administrative burden of a tax is

A) the money people pay to the government in taxes.

B) reducing the size of the market because of the tax.

C) the hassle of filling out tax forms that is imposed on taxpayers who comply with the tax.

D) the cost of administering programs that use tax revenue.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following countries has the largest tax burden?

A) Brazil

B) Germany

C) United States

D) Sweden

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When government receipts exceed total government spending during a fiscal year,the difference is

A) a budget surplus.

B) a budget deficit.

C) the national debt.

D) automatically refunded.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If transfer payments are included when evaluating tax burdens,then the average tax rate of the poorest quintile of taxpayers would be approximately

A) negative 30 percent.

B) negative 10 percent.

C) positive 1 percent.

D) positive 8 percent.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Most economists believe that a corporate income tax affects the stockholders of a corporation but not its employees or customers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are transfer payments except

A) Medicaid.

B) unemployment compensation.

C) personal income taxes.

D) Food Stamps.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

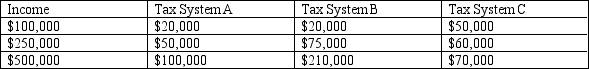

Table 12-17

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-Refer to Table 12-17.Which of the three tax systems is progressive?

-Refer to Table 12-17.Which of the three tax systems is progressive?

A) Tax System A

B) Tax System B

C) Tax System C

D) None of the systems are progressive.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

European countries tend to rely on which type of tax more so than the United States does?

A) an income tax

B) a lump-sum tax

C) a value-added tax

D) a corrective tax

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 499

Related Exams