A) Establish a poverty threshold based on expenditures for a bundle of necessities including food,shelter,clothing,and utilities.

B) Allow variations in the poverty line based on differences in housing costs.

C) Include tax payments (or credits) and the value of in-kind transfers when computing a family's "income."

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose society consists of four individuals: Andy,Bill,Carl,and David.Andy has $20,000 of income,Bill has $40,000 of income,Carl has $60,000 of income,and David has $80,000 of income.A utilitarian would argue that

A) taking $1 from Bill and giving it to Carl would increase society's total utility.

B) taking $1 from Carl and giving it to Andy would increase society's total utility.

C) taking $1 from Carl and giving it to David would increase society's total utility.

D) taking $1 from Bill and giving it to David would increase society's total utility.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The only qualification to receive government assistance under a negative income tax is

A) pre-school children.

B) to be enrolled in job training.

C) a working head-of-household.

D) a low income.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Only individual members of society earn income,not society itself." This statement is most closely associated with the political philosophy of a

A) utilitarian.

B) liberal.

C) libertarian.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

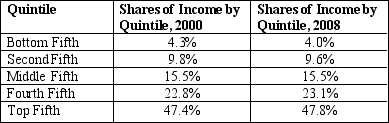

Table 20-8

Source: U.S.Bureau of Census

-Refer to Table 20-8.In 2008,the top fifth of families has

Source: U.S.Bureau of Census

-Refer to Table 20-8.In 2008,the top fifth of families has

A) about 12 times as much income as the bottom fifth of families.

B) 6.8% more income than the bottom fifth of families.

C) 47.8% more income than the bottom fifth of families.

D) 96.6% more income than the bottom fifth of families.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following programs would be opposed by philosopher John Rawls?

A) a negative income tax

B) the Supplemental Security Income (SSI) program

C) a tax plan creating a perfectly egalitarian income distribution

D) Rawls would oppose all of the programs.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the average value of in-kind transfers increases by $2,000 from 2010 to 2011.The poverty rate

A) is more likely to understate the true level of poverty.

B) is more likely to overstate the true level of poverty.

C) will increase by $2,000 divided by the poverty level.

D) Both b and c are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In general,which of the following would libertarians argue is more important than equal outcomes?

A) equal opportunities

B) equal incomes

C) providing a social safety net

D) offering the opportunity to purchase social insurance

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty line is adjusted each year to reflect changes in the

A) number of people currently on public assistance.

B) level of prices.

C) nutritional content of an "adequate" diet.

D) size of a family.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The percentage of the population whose family income falls below an absolute level is call the

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Libertarians are opposed to redistributing income.

B) Critics of the welfare system argue that it breaks up families.

C) One of the problems with measuring income inequality is valuing in-kind transfers.

D) Utilitarians believe that the government should punish crimes but should not redistribute income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is characteristic of utilitarianism?

A) An extra dollar of income provides higher marginal utility to a poor person than to a rich person.

B) Social policies should be created behind a "veil of ignorance."

C) Society should strive to maximize the utility of its wealthiest member.

D) Equality of opportunity is more important than equality of incomes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robert Nozick criticizes Rawls's concept of justice by using an example of

A) minimum wage laws.

B) the grade distribution in a class.

C) a leaky bucket.

D) the price of tea in China.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following programs to alleviate poverty would be most favored by philosopher Robert Nozick?

A) a negative income tax

B) an Earned Income Tax Credit (EITC)

C) an in-kind transfer program

D) None of the programs would be favored by Nozick.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements illustrates diminishing marginal utility?

A) An extra dollar of income to a poor person provides that person with more additional utility than does an extra dollar to a rich person.

B) An extra dollar of income to a poor person provides that person with less additional utility than does an extra dollar to a rich person.

C) An extra dollar of income to a poor person provides that person with the same additional utility as does an extra dollar to a rich person.

D) An extra dollar of income to a poor person provides that person with the same total utility as does an extra dollar to a rich person.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When the government enacts policies to make the distribution of income more equitable,it distorts incentives,alters behavior,and makes the allocation of resources less efficient.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.welfare system was revised by a 1996 law that

A) consolidated all of the previous assistance programs into a single program.

B) limited the amount of time that people could receive assistance.

C) said it was no longer necessary for poor people to demonstrate an additional "need," such as small children or a disability,to qualify for assistance.

D) turned all federally-run welfare programs over to the states.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2008,the poverty line for a family of four in the U.S.was

A) $56,194.

B) $22,025.

C) $19,971.

D) $12,603.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

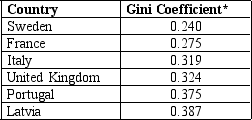

Table 20-5

*A Gini coefficient is a commonly used measure of income inequality,with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income,and 1 corresponds to perfect inequality where one person has all the income,while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-5.Which of the following statements is correct?

*A Gini coefficient is a commonly used measure of income inequality,with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income,and 1 corresponds to perfect inequality where one person has all the income,while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-5.Which of the following statements is correct?

A) Latvia has the most unequal distribution of income.

B) France has a more equal distribution of income than Italy.

C) Sweden has the most equal distribution of income.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Of the following countries,which has the most equal distribution of income? United States,Brazil,Mexico,China,Japan,Germany,Canada,Russia

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 399

Related Exams