A) that all stocks are fairly valued all the time and that no stock is a better buy than any other.

B) that all stocks are fairly valued all the time,but that some stocks may be better buys than other.

C) that some stocks may be better buys than others and stock experts can determine which ones.

D) that no stock is efficiently valued.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $168.54 two years from today equal to $150 today?

A) 4 percent

B) 5 percent

C) 6 percent

D) None of the above would give a present value within a cent of $162.24.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In the 15 years ending June 2010,most active portfolio managers failed to beat the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When you were 10 years old,your grandparents put $500 into an account for you paying 7 percent interest.Now that you are 18 years old,your grandparents tell you that you can take the money out of the account.What is the balance to the nearest cent?

A) $1,200.00

B) $1,111.77

C) $983.58

D) $859.09

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the interest rate causes a decrease in the future value of $1,000 that you have in a bank account today.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock market fluctuations

A) often go hand in hand with fluctuations in the economy more broadly.

B) rarely have anything to do with fluctuations in the economy more broadly.

C) have few,if any,macroeconomic implications.

D) are attributable to the widespread belief that the efficient markets hypothesis is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are tearing down a building and find $1 in change that someone lost when working on the building 140 years ago.If,instead of being careless with the $1 in change,this person had deposited it into a bank and earned 2 percent interest every year for 140 years,how much would be in the account today according to the rule of 70?

A) $4

B) $8

C) $16

D) $32

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $183.60 two years from today equal to about $173.06 today?

A) 2 percent

B) 3 percent

C) 4 percent

D) 5 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yoyo's Frozen Yogurt,Inc.is thinking of building a new warehouse.They believe that this will give them $50,000 of additional revenue at the end of one year,$60,000 additional revenue at the end of two years,and $70,000 in additional revenue at the end of three years.If the interest rate is 5 percent,Yoyo would be willing to pay

A) $140,000,but not $150,000.

B) $150,000,but not $160,000.

C) $160,000,but not $170,000.

D) $170,000,but not $180,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best illustrates diversification?

A) A company that produces many different products decides to produce fewer.

B) After selling stock,corporate management spends funds on projects with greater risks than shareholders had anticipated.

C) Instead of holding only the stocks of companies engaged in the banking business,a person decides to hold stock in a number of different companies producing different goods and services.

D) A person decides to purchase only stocks that have paid high dividends in the past.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best illustrates moral hazard?

A) After a person obtains life insurance,she takes up skydiving.

B) A person obtains insurance knowing he is in poor health.

C) A person holds stock only in very risky corporations.

D) A person holds stocks from only a few corporations.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank might make mortgages to people in different regions of the country.By doing so

A) the bank reduces the risk it faces from falling house prices in its region and falling prices in all regions.

B) the bank reduces the risk it faces of falling house prices in its region but not from falling prices in all regions.

C) the bank reduces the risk it faces of falling house prices in all regions,but not the risk it faces from falling house prices in its regions.

D) the bank reduces neither the risk it faces from falling house prices in its region nor falling prices in all regions.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Historically,stocks have offered higher rates of return than bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the rule of 70,if the interest rate is 5 percent,how long will it take for the value of a savings account to double?

A) about 3.5 years

B) about 6.3 years

C) about 12 years

D) about 14 years

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The efficient markets hypothesis implies that

A) building a portfolio based on a published list of the "most respected" companies is likely to produce a better-than-average return.

B) if a stock rose in price last year,it is likely to rise in price this year.

C) managed mutual funds should generally outperform indexed mutual funds.

D) None of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

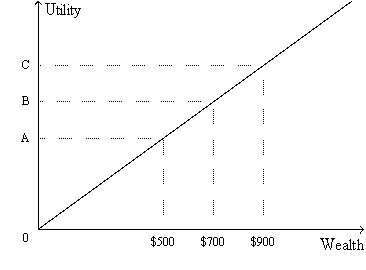

Figure 14-3.The figure shows a utility function for Rob.  -Refer to Figure 14-3.From the appearance of Rob's utility function,we know that

-Refer to Figure 14-3.From the appearance of Rob's utility function,we know that

A) the pain that Rob would experience if he lost $200 of his wealth would exceed the pleasure that he would experience if he added $200 to his wealth.

B) the pleasure that Rob would experience if he added $200 to his wealth would exceed the pain that he would experience if he lost $200 of his wealth.

C) the property of increasing utility does not apply to Rob.

D) the property of diminishing marginal utility does not apply to Rob.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the rule of 70,about how much would $100 be worth after 50 years if the interest rate were 7 percent?

A) $400

B) $800

C) $1,600

D) $3,200

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The efficient markets hypothesis says that beating the market consistently is

A) impossible.Many studies find that beating the market is,at best,extremely difficult.

B) impossible.Many studies find that beating the market is relatively easy.

C) relatively easy.Many studies find that beating the market is,at best,extremely difficult.

D) relatively easy.Many studies find that beating the market is relatively easy.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest reduction in a portfolio's risk is achieved when the number of stocks in the portfolio is increased from

A) 80 to 100.

B) 40 to 80.

C) 10 to 20.

D) 1 to 10.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sari puts $100 into an account with an interest rate of 10 percent.According to the rule of 70,about how much does she have at the end of 21 years?

A) $210

B) $300

C) $800

D) $1,010

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 461

Related Exams