B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Christie sued her former employer for a back injury she suffered on the job in 2018.As a result of the injury, she was partially disabled.In 2019, she received $240,000 for her loss of future income, $160,000 in punitive damages because of the employer's flagrant disregard for the employee's safety, and $15,000 for medical expenses.The medical expenses were deducted on her 2018 return, reducing her taxable income by $12,000.Christie's 2019 gross income from the above is:

A) $415,000.

B) $412,000.

C) $255,000.

D) $175,000.

E) $172,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a requirement for an alimony deduction?

A) The payments must be in cash.

B) The payments must cease upon the death of the payee.

C) The payments must extend over at least three years.

D) The payor and payee must not live in the same household at the time of the payments.

E) All of these are requirements for an alimony deduction.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

For purposes of computing the deduction for qualified residence interest, a qualified residence includes the taxpayer's principal residence and two other residences of the taxpayer or spouse.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer pays points to obtain financing to purchase a second residence.At the election of the taxpayer, the points can be deducted as interest expense for the year paid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

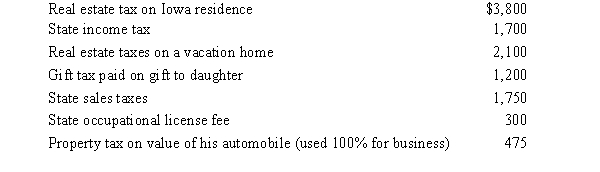

Hugh, a self-employed individual, paid the following amounts during the year:  What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

A) $7,650

B) $8,850

C) $9,625

D) $10,000

E) None of the above

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Brooke works part-time as a waitress in a restaurant.For groups of 7 or more customers, the customer is charged 15% of the bill for Brooke's services.For parties of less than 7, the tips are voluntary.Brooke received $11,000 from the groups of 7 or more and $7,000 in voluntary tips from all other customers.Using the customary 15% rate, her voluntary tips would have been only $6,000.Brooke must include $18,000 $11,000 + $7,000) in gross income.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

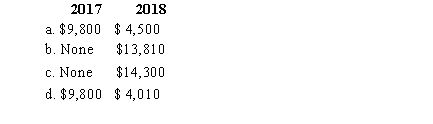

In 2017, Juan and Juanita incur $9,800 in legal and adoption fees directly related to the adoption of an infant son born in a nearby state.Over the next year, they incur another $4,500 of adoption expenses.The adoption becomes final in 2018.Which of the following choices properly reflects the amounts and years in which the adoption expenses credit is available.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edna had an accident while competing in a rodeo.She sustained facial injuries that required cosmetic surgery.While having the surgery done to restore her appearance, she had additional surgery done to reshape her chin, which was not injured in the accident.The surgery to restore her appearance cost $9,000 and the surgery to reshape her chin cost $6,000.How much of Edna's surgical fees will qualify as a deductible medical expense before application of the 10%-of-AGI floor) ?

A) $0

B) $6,000

C) $9,000

D) $15,000

E) None of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In January 2019, Pam, a calendar year cash basis taxpayer, made an estimated state income tax payment for 2018.The payment is deductible in 2018.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Joe, a cash basis taxpayer, took out a 12-month business loan on December 1, 2018.He prepaid all $3,600 of the interest on the loan on December 1, 2018.Joe can deduct only $300 of the prepaid interest in 2018.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Theresa sued her former employer for age, race, and gender discrimination.She claimed $200,000 in damages for loss of income, $300,000 for emotional harm, and $500,000 in punitive damages.She settled the claim for $700,000.As a result of the settlement, Theresa must include in gross income:

A) $700,000.

B) $500,000.

C) $490,000 [$700,000/$1,000,000) × $700,000].

D) $0.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The maximum child tax credit under current law is $1,500 per qualifying child.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Al contributed a painting to the Metropolitan Art Museum of St.Louis, Missouri.The painting, purchased six years ago, was worth $40,000 when donated, and Al's basis was $25,000.If this painting is immediately sold by the museum and the proceeds are placed in the general fund, Al's charitable contribution deduction is $25,000 subject to percentage limitations).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Grace's sole source of income is from a restaurant that she owns and operates as a proprietorship.Any state income tax Grace pays on the business net income must be deducted as a business expense rather than as an itemized deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

On December 31, Lynette used her credit card to make a $500 contribution to the United Way, a qualified charitable organization.She will pay her credit card balance in January of the following year.If Lynette itemizes, she can deduct the $500 in the year she used the card.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The taxpayer is a Ph.D.student in accounting at City University.The student is paid $1,500 per month for teaching two classes.The total amount received for the year is $13,500.

A) The $13,500 is excludible if the money is used to pay for tuition and books.

B) The $13,500 is taxable compensation.

C) The $13,500 is considered a scholarship and, therefore, is excluded.

D) The $13,500 is excluded because the total amount received for the year is less than her standard deduction and personal exemption.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

This year, Carol, a single taxpayer, purchased a vacation home for $400,000 using an equity debt of $350,000 on her principal residence.Carol has no other debt on her principal residence.Carol paid $16,000 of interest on the debt this year.How much of this interest is deductible assuming Carol itemizes her deductions?

A) $0

B) $10,000

C) $16,000

D) $125,000

E) None of the above

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In April 2018, Bertie, a calendar year cash basis taxpayer, had to pay the state of Michigan additional income tax for 2017.Even though it relates to 2017, for Federal income tax purposes the payment qualifies as a tax deduction for tax year 2018.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 119 of 119

Related Exams