A) Three years from date return is filed

B) Three years from due date of return

C) 20% of underpayment

D) 5% per month (25% limit)

E) 0.5% per month (25% limit)

F) Conducted at IRS office

G) Conducted at taxpayer's office

H) Six years

I) 45-day grace period allowed to IRS

J) No statute of limitations (period remains open)

K) 75% of underpayment

L) No correct match provided

N) C) and I)

Correct Answer

verified

Correct Answer

verified

True/False

To lessen or eliminate the effect of multiple taxation, a taxpayer who is subject to both foreign and U.S.income taxes on the same income is allowed either a deduction or a credit for the foreign tax paid.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A fixture will be subject to the ad valorem tax on personalty rather than the ad valorem tax on realty.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following choices, show the justification for each provision of the tax law listed. a. Economic considerations b. Social considerations c. Equity considerations d. Both a. and b. -A Federal deduction for state and local sales taxes paid.

A) Deferral of gains from involuntary conversions

B) Carryforward of net operating losses

C) "No change" is a possible result

D) State income tax applied to a visiting nonresident

E) IRS special agent

F) Undoing the "piggyback" result

G) Ideal budget goal as to new tax legislation

H) Every state that has a general sales tax has one

I) Imposed by all states and the Federal government

J) Imposed by some states but not the Federal government

K) Imposed only by the Federal government

L) No correct match provided

N) E) and K)

Correct Answer

verified

Correct Answer

verified

True/False

If a taxpayer files early (i.e., before the due date of the return), the statute of limitations on assessments begins on the date the return is filed.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For the negligence penalty to apply, the underpayment must be caused by intentional disregard of rules and regulations without intent to defraud.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following choices, show the justification for each provision of the tax law listed. a. Economic considerations b. Social considerations c. Equity considerations d. Both a. and b. -More rapid expensing for tax purposes of the costs of installing pollution control devices.

A) Deferral of gains from involuntary conversions

B) Carryforward of net operating losses

C) "No change" is a possible result

D) State income tax applied to a visiting nonresident

E) IRS special agent

F) Undoing the "piggyback" result

G) Ideal budget goal as to new tax legislation

H) Every state that has a general sales tax has one

I) Imposed by all states and the Federal government

J) Imposed by some states but not the Federal government

K) Imposed only by the Federal government

L) No correct match provided

N) E) and L)

Correct Answer

verified

Correct Answer

verified

True/False

Ultimately, most taxes are paid by individuals.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following choices, show the justification for each provision of the tax law listed. a. Economic considerations b. Social considerations c. Equity considerations d. Both a. and b. -Wherewithal to pay concept

A) Deferral of gains from involuntary conversions

B) Carryforward of net operating losses

C) "No change" is a possible result

D) State income tax applied to a visiting nonresident

E) IRS special agent

F) Undoing the "piggyback" result

G) Ideal budget goal as to new tax legislation

H) Every state that has a general sales tax has one

I) Imposed by all states and the Federal government

J) Imposed by some states but not the Federal government

K) Imposed only by the Federal government

L) No correct match provided

N) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following choices, show the justification for each provision of the tax law listed. a. Economic considerations b. Social considerations c. Equity considerations d. Both a. and b. -A deduction for contributions by an employee to certain retirement plans.

A) Deferral of gains from involuntary conversions

B) Carryforward of net operating losses

C) "No change" is a possible result

D) State income tax applied to a visiting nonresident

E) IRS special agent

F) Undoing the "piggyback" result

G) Ideal budget goal as to new tax legislation

H) Every state that has a general sales tax has one

I) Imposed by all states and the Federal government

J) Imposed by some states but not the Federal government

K) Imposed only by the Federal government

L) No correct match provided

N) D) and F)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following choices, show the justification for each provision of the tax law listed. a. Economic considerations b. Social considerations c. Equity considerations d. Both a. and b. -A small business corporation can elect to avoid the corporate income tax.

A) Deferral of gains from involuntary conversions

B) Carryforward of net operating losses

C) "No change" is a possible result

D) State income tax applied to a visiting nonresident

E) IRS special agent

F) Undoing the "piggyback" result

G) Ideal budget goal as to new tax legislation

H) Every state that has a general sales tax has one

I) Imposed by all states and the Federal government

J) Imposed by some states but not the Federal government

K) Imposed only by the Federal government

L) No correct match provided

N) E) and L)

Correct Answer

verified

Correct Answer

verified

True/False

On occasion, Congress has to enact legislation that clarifies the tax law in order to change a result reached by the U.S.Supreme Court.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Both economic and social considerations can be used to justify:

A) Favorable tax treatment for accident and health plans provided for employees and financed by employers.

B) Disallowance of any deduction for expenditures deemed to be contrary to public policy (e.g., fines, penalties, illegal kickbacks, bribes to government officials) .

C) Various tax credits, deductions, and exclusions that are designed to encourage taxpayers to obtain additional education.

D) Allowance of a deduction for state and local income taxes paid.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The ratification of the Sixteenth Amendment to the U.S.Constitution was necessary to validate the Federal income tax on corporations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For Federal income tax purposes, there never has been a general amnesty period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following choices, show the justification for each provision of the tax law listed. a. Economic considerations b. Social considerations c. Equity considerations d. Both a. and b. -Export taxes

A) Deferral of gains from involuntary conversions

B) Carryforward of net operating losses

C) "No change" is a possible result

D) State income tax applied to a visiting nonresident

E) IRS special agent

F) Undoing the "piggyback" result

G) Ideal budget goal as to new tax legislation

H) Every state that has a general sales tax has one

I) Imposed by all states and the Federal government

J) Imposed by some states but not the Federal government

K) Imposed only by the Federal government

L) No correct match provided

N) K) and L)

Correct Answer

verified

Correct Answer

verified

True/False

A provision in the law that compels accrual basis taxpayers to pay a tax on prepaid income in the year received and not when earned is consistent with generally accepted accounting principles.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Even though a client refuses to correct an error on a past return, it may be possible for a practitioner to continue to prepare returns for the client.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A state income tax can be imposed on nonresident taxpayers who earn income within the state on an itinerant basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

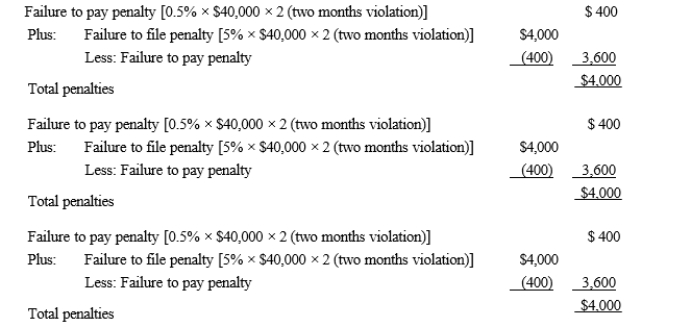

David files his tax return 45 days after the due date.Along with the return, David remits a check for $40,000.which is the balance of the tax owed.Disregarding the interest element, David's total failure to file and to pay penalties are:

A) $400.

B) $3,600.

C) $4,000.

D) $4,400.

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 171

Related Exams