B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The less freedom young mothers have to work outside the home, the

A) more elastic the supply of labor will be.

B) less elastic the supply of labor will be.

C) more horizontal the labor supply curve will be.

D) larger is the decrease in employment that will result from a tax on labor.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on the sellers of a good, the

A) supply curve shifts upward by the amount of the tax.

B) quantity demanded decreases for all conceivable prices of the good.

C) quantity supplied increases for all conceivable prices of the good.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the price of gasoline is $2.40 per gallon, and the equilibrium quantity of gasoline is 12 million gallons per day with no tax on gasoline. Starting from this initial situation, which of the following scenarios would result in the largest deadweight loss?

A) A 10 percent increase in the price of gasoline reduces the quantity of gasoline demanded by 2 percent and it increases the quantity of gasoline supplied by 5 percent; and the tax on gasoline amounts to $0.40 per gallon.

B) A 10 percent increase in the price of gasoline reduces the quantity of gasoline demanded by 2 percent and it increases the quantity of gasoline supplied by 7 percent; and the tax on gasoline amounts to $0.40 per gallon.

C) A 10 percent increase in the price of gasoline reduces the quantity of gasoline demanded by 1 percent and it increases the quantity of gasoline supplied by 8 percent; and the tax on gasoline amounts to $0.35 per gallon.

D) There is insufficient information to make this determination.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Taxes on labor tend to increase the number of hours that people choose to work.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The size of the deadweight loss generated from a tax is affected by the

A) elasticities of both supply and demand.

B) elasticity of demand only.

C) elasticity of supply only.

D) total revenue collected by the government.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

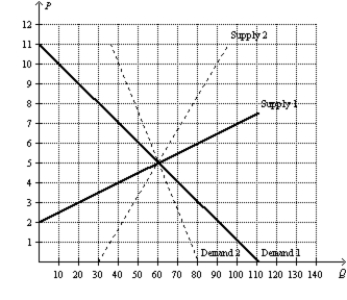

Figure 8-21  -Refer to Figure 8-21. Suppose the market is represented by Demand 1 and Supply 1. At first the government places a $3 per-unit tax on this good. Then the government decides to raise the tax to $6 per unit. How would you characterize the decision to raise the tax rate from $3 to $6 per unit? The decision is

-Refer to Figure 8-21. Suppose the market is represented by Demand 1 and Supply 1. At first the government places a $3 per-unit tax on this good. Then the government decides to raise the tax to $6 per unit. How would you characterize the decision to raise the tax rate from $3 to $6 per unit? The decision is

A) a good one because it increases tax revenue while decreasing the deadweight loss from the tax.

B) a bad one because it does not increase tax revenue yet increases the deadweight loss from the tax.

C) a bad one because it decreases tax revenue while increasing the deadweight loss from the tax.

D) unclear because it increases tax revenue yet also increases the deadweight loss from the tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 501 - 507 of 507

Related Exams