A) permanent income.

B) life-cycle income.

C) transitory income.

D) an in-kind transfer.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic mobility in the United States is so great that fewer than

A) 3 percent of families are poor for 8 or more years.

B) 5 percent of families are poor for 8 or more years.

C) 8 percent of families are poor for 8 or more years.

D) 10 percent of families are poor for 8 or more years.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The 2011 U.S. distribution of income shows that the top 5 percent of families earn approximately how much income per year?

A) $170,000 and over

B) $205,000 and over

C) $250,000 and over

D) $325,000 and over

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The utilitarian justification for redistributing income is based on the assumption of diminishing marginal utility.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What percentage of millionaires in the United States are self-made?

A) about 20 percent

B) about 40 percent

C) about 60 percent

D) about 80 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pietro is 40 years old and is laid off from his job at the paper plant and borrows from his savings for 8 months until he finds a new job. Pietro's

A) transitory income likely exceeds his permanent income for that year.

B) borrowing is representative of a normal economic life cycle.

C) permanent income is largely unaffected by this one time change to his income.

D) economic mobility during this year is highly unusual, as US workers tend to stay in a particular income class.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

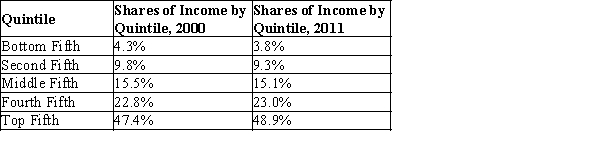

Table 20-8  Source: U.S. Bureau of Census

-Refer to Table 20-8. In 2011, the bottom 40% of families has

Source: U.S. Bureau of Census

-Refer to Table 20-8. In 2011, the bottom 40% of families has

A) about 13% of total income in the U.S.

B) about 28% of total income in the U.S.

C) about 51% of total income in the U.S.

D) about 72% of total income in the U.S.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The normal life cycle pattern of income

A) contributes to more inequality in the distribution of annual income and to more inequality in living standards.

B) contributes to more inequality in the distribution of annual income, but it does not necessarily contribute to more inequality in living standards.

C) contributes to less inequality in the distribution of annual income and to less inequality in living standards.

D) has no effect on either the distribution of annual income or on living standards.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists study poverty and income inequality to answer which of the following questions?

A) What are people's wages?

B) How does labor-force experience affect wages?

C) How much inequality is there in society?

D) How do people adjust their behavior due to taxation?

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

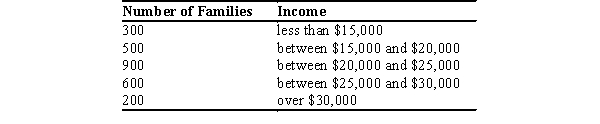

The poverty line in the country of Abbyville is $15,000. The distribution of income for Abbyville is as follows:  The poverty rate in Abbyville is

The poverty rate in Abbyville is

A) 12 percent.

B) 32 percent.

C) 50 percent.

D) 68 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An advantage of a negative income tax is that it does not encourage the breakup of families because the only criterion for assistance is family income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on U.S. income data from 2011, the bottom fifth of all families received approximately what percent of all income?

A) 48.9 percent

B) 21.3 percent

C) 8.6 percent

D) 3.8 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

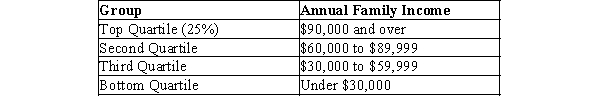

Table 20-1

The following table shows the distribution of income in Marysville.  -Refer to Table 20-1. If the poverty line were $23,021, what would be the poverty rate?

-Refer to Table 20-1. If the poverty line were $23,021, what would be the poverty rate?

A) less than 25%

B) between 25% and 50%

C) between 50% and 75%

D) There is insufficient information to answer this question.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Supplemental Security Income (SSI) program focuses on the poor who are sick or disabled.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A disadvantage of a minimum-wage law is that it may benefit unskilled workers who are not low-income workers.

B) A disadvantage of a negative income tax program is that a poor person who chooses not to work many hours would receive a cash benefit.

C) A disadvantage of an Earned Income Tax Credit (EITC) is that a person who is unable to work due to a disability does not benefit from the program.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the government proposes a negative income tax that calculates the taxes owed as follows: taxes owed equal 30% of income less $12,000. A family that earns an income of $40,000 will

A) neither pay taxes nor receive an income subsidy.

B) receive an income subsidy of $3,600.

C) pay $3,600 in taxes.

D) pay $12,000 in taxes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What percent of families are poor for eight or more years?

A) more than 20 percent

B) between 15 and 20 percent

C) approximately 10 percent

D) less than 3 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage associated with an Earned Income Tax Credit (EITC) program to reduce poverty is that it

A) encourages illegitimate births because single women with children receive higher payments.

B) rewards laziness because it provides payments to those with low incomes regardless of their work effort.

C) does not help the poor who are unemployed.

D) creates unemployment by increasing the wage paid to unskilled workers above the equilibrium wage.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commonly-used gauge of poverty is the

A) income inequality rate.

B) average income rate.

C) poverty rate.

D) social inequality rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The United States has a more equal income distribution than many developing economies such as Mexico, South Africa, and Brazil.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 401 - 420 of 478

Related Exams