A) $23,000

B) $35,000

C) $44,000

D) $55,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which two of the Ten Principles of Economics are illustrated in this chapter?

A) A country's standard of living depends on its ability to produce goods & People face tradeoffs.

B) Prices rise when the government prints too much money & Governments can sometimes improve market outcomes.

C) Governments can sometimes improve market outcomes & People face tradeoffs.

D) People face tradeoffs & Prices rise when the government prints too much money .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When the government enacts policies to make the distribution of income more equitable, it distorts incentives, alters behavior, and makes the allocation of resources less efficient.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whether or not policymakers should try to make our society more egalitarian is largely a matter of

A) economic efficiency.

B) political philosophy.

C) egalitarian principles.

D) enhanced opportunity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

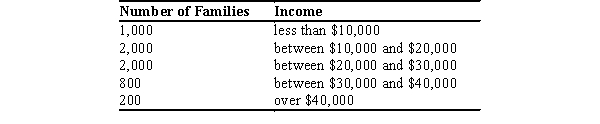

The distribution of income for Dismal is as follows:  If the poverty rate in Dismal is about 17 percent, what is the poverty line in Dismal?

If the poverty rate in Dismal is about 17 percent, what is the poverty line in Dismal?

A) $10,000.

B) $20,000.

C) $30,000.

D) $40,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If society chose to maximize total utility rather than minimum utility,

A) society would achieve perfect income equality.

B) society would achieve the maximin objective.

C) its justice would be more utilitarian than Rawlsian.

D) its justice would be more Rawlsian than utilitarian.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage associated with in-kind transfers to reduce poverty is that they

A) alter peoples' incentives, whereas a negative income tax does not alter peoples' incentives.

B) do not allow poor families to make purchases based on their preferences.

C) can only be distributed by the federal government.

D) cannot restrict the group of recipients and some middle-class families may benefit from them.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

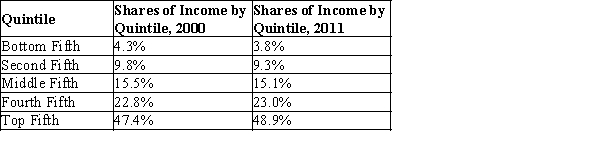

Table 20-8  Source: U.S. Bureau of Census

-Refer to Table 20-8. Comparing data from 2000 and 2011, which of the following statements is correct?

Source: U.S. Bureau of Census

-Refer to Table 20-8. Comparing data from 2000 and 2011, which of the following statements is correct?

A) The bottom 40% of the population had a greater share of the income in 2011 than it did in 2001.

B) The top 40% of the population had a greater share of the income in 2011 than it did in 2001.

C) The middle 60% of the population had a greater share of the income in 2011 than it did in 2001.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-3 Suppose that a society is made up of five families whose incomes are as follows: $120,000; $90,000; $30,000; $30,000; and $18,000. The federal government is considering two potential income tax plans: Plan A is a negative income tax plan where the taxes owed equal 1/3 of income minus $20,000. Plan B is a two-tiered plan where families earning less than $35,000 pay no income tax and families earning more than $35,000 pay 10% of their income in taxes. The income tax revenue collected from those families earning over $35,000 is then redistributed equally to those families earning less than $35,000. -Refer to Scenario 20-3. Assuming that utility is directly proportional to the cash value of after-tax income, which government policy would an advocate of utilitarianism prefer?

A) Plan A

B) Plan B

C) either Plan A or Plan B

D) neither Plan A nor Plan B because any plan that forcibly redistributes income is against the philosophy

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the value of in-kind transfers are taken into account, the number of families living in poverty in the United States would

A) increase by about 1 percent.

B) decrease by about 1 percent.

C) decrease by about 5 percent.

D) decrease by about 10 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-4 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/5 of income) - $15,000 -Refer to Scenario 20-4. Below what level of income would families start to receive a subsidy from this negative income tax?

A) $5,000

B) $15,000

C) $50,000

D) $75,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-6 Zooey is a single mother of two young children whose husband died in a tragic car accident. She earns $20,000 per year working as a cashier at a grocery store. The government uses a negative income tax system in which Taxes owed = (1/4 of income) - $15,000. -Refer to Scenario 20-6. How much does Zooey owe or receive from the government?

A) She receives $10,000.

B) She owes $10,000.

C) She receives $15,000.

D) She owes $5,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty rate is based on a family's

A) income, in-kind transfers, and other government aid.

B) income and in-kind transfers.

C) in-kind transfers only.

D) income only.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The utilitarian case for redistributing income is based on the assumption of

A) collective consensus.

B) a notion of fairness engendered by equality.

C) diminishing marginal utility.

D) rising marginal utility.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

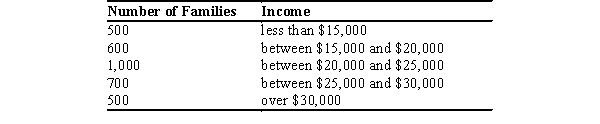

The distribution of income for Danville is as follows:  If the poverty rate in Danville is 33.3 percent, what is the poverty line in Danville?

If the poverty rate in Danville is 33.3 percent, what is the poverty line in Danville?

A) $15,000.

B) $20,000.

C) $25,000.

D) $30,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a family saves and borrows to buffer itself against changes in income. These actions relate to which problem in measuring inequality?

A) in-kind transfers

B) negative income tax

C) transitory versus permanent income

D) economic mobility

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

The percentage of the population whose family income falls below an absolute level is call the

Correct Answer

verified

Correct Answer

verified

Short Answer

In 2011, the top 20% of US families had more than times as much income as the bottom 20%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does not explain the rise in income inequality in the United States from 1970 to 2011?

A) Changes in technology.

B) An increase in minimum wages.

C) A reduction in the demand for unskilled labor.

D) Increased international trade with low-wage countries.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Of the following groups, which group is least likely to live in poverty - whites, blacks, Hispanics, Asians?

Correct Answer

verified

Correct Answer

verified

Showing 421 - 440 of 478

Related Exams