A) under $28,000

B) between $28,000 and $43,999

C) between $44,000 and $75,999

D) between $76,000 and $87,999

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a typical worker, her income will be lower when she is younger, peak around age 50, and decrease drastically when she retires. This pattern of changes in income for a typical worker is called

A) the life cycle.

B) permanent income.

C) transitory income.

D) in-kind transfers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Utilitarians believe

A) that the government should choose just policies as evaluated by an impartial observer behind a "veil of ignorance."

B) in the assumption of diminishing marginal utility.

C) that everyone in society should have equal utility.

D) that the government should not redistribute income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative income tax system is designed to

A) provide in-kind benefits to the poor.

B) provide a minimum income to the poor.

C) reduce taxes on the rich when their incomes surpass the maximum income tax bracket.

D) subsidize food consumption in poor families.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Measuring poverty using an absolute income scale like the poverty line can be misleading because

A) income measures do not include the value of in-kind transfers.

B) money is more highly valued by the rich than by the poor.

C) the poor are not likely to participate in the labor market.

D) income measures are not adjusted for the effects of labor-market discrimination.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following explains the rise in income inequality in the United States from 1970 to 2011?

A) An increase in minimum wages.

B) An increase in the demand for skilled labor.

C) An increase in the demand for unskilled labor.

D) Reduced international trade with low-wage countries.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When John F. Kennedy said, "A rising tide lifts all boats," to what was he referring?

A) With government intervention, all citizens receive a greater allocation of resources.

B) With market forces working independently, everyone receives an equitable share of resources.

C) With economic growth, more families are pushed above the poverty line.

D) None of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to utilitarians, the ultimate objective of public actions should be to

A) ensure the poor can afford an adequate diet.

B) distribute income uniformly.

C) maximize the sum of individual utility.

D) prevent all people from experiencing diminishing marginal utility.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the maximin criterion, income should be transferred from the rich to the poor as long as it

A) raises the well-being of the least fortunate.

B) does not alter incentives to work and save.

C) promotes an equal distribution of income.

D) does not lower the welfare of the elderly.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of an in-kind transfer to the poor is

A) the negative income tax.

B) the Earned Income Tax Credit (EITC) .

C) Medicaid.

D) Temporary Assistance for Needy Families (TANF) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

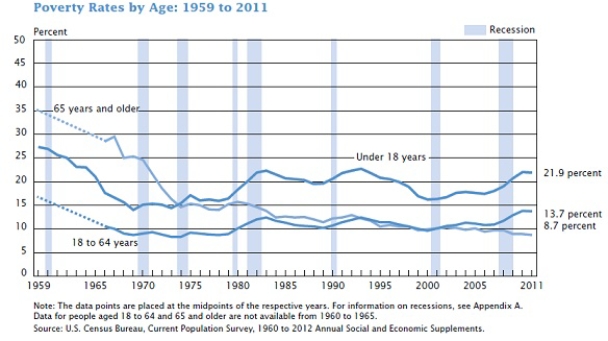

Figure 20-3  -Refer to Figure 20-3. In 1968, the percent of adults aged 18 to 64 years in poverty is

-Refer to Figure 20-3. In 1968, the percent of adults aged 18 to 64 years in poverty is

A) higher than both the percentage of children under age 18 and the percentage of elderly aged 65 and over in poverty.

B) higher than the percentage of children under age 18 but is lower than the percentage of elderly aged 65 and over in poverty.

C) lower than both the percentage of children under age 18 and the percentage of elderly aged 65 and over in poverty.

D) lower than the percentage of children under age 18 but is higher than the percentage of elderly aged 65 and over in poverty.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Poverty is long-term problem for relatively few families.

B) Measurements of income inequality usually do not include in-kind transfers.

C) Measurements of income inequality use lifetime incomes rather than annual incomes.

D) Measurements of income inequality would be more meaningful if they reflected permanent rather than current income.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on U.S. income data from 2011, the top fifth of all families received

A) about 3.8 percent more than the bottom fifth.

B) about 49 percent more than the bottom fifth.

C) approximately 5 times more income than the bottom fifth.

D) more than 12 times more income than the bottom fifth.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government provides poor families with antipoverty programs such as welfare, Medicaid, food stamps, and the Earned Income Tax Credit which are all tied to income,

A) the government creates an egalitarian distribution of income.

B) the recipients can usually receive benefits for an unlimited amount of time.

C) it is common for families to face very high effective marginal tax rates.

D) the incentive to work and earn more income remains unchanged.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Since the early 1970s, average incomes have

A) increased, which has reduced the poverty rate.

B) increased, while the poverty rate increased slightly.

C) decreased, while the poverty rate has remained unchanged.

D) remained unchanged, while the poverty rate has decreased.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

A government policy aimed at protecting people against the risk of adverse events is called .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is characteristic of utilitarianism?

A) An extra dollar of income provides higher marginal utility to a poor person than to a rich person.

B) Social policies should be created behind a "veil of ignorance."

C) Society should strive to maximize the utility of its wealthiest member.

D) Equality of opportunity is more important than equality of incomes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

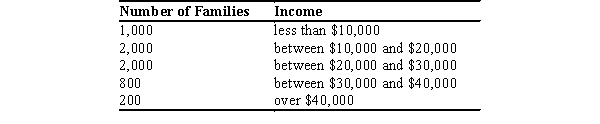

The poverty line in the country of Dismal is $20,000. The distribution of income for Dismal is as follows:  The poverty rate in Dismal is

The poverty rate in Dismal is

A) 16.7 percent.

B) 33.3 percent.

C) 50 percent.

D) 83.3 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government taxes income as part of a redistribution program,

A) the poor pay higher taxes.

B) the rich always benefit more than the poor.

C) the poor are encouraged to work.

D) incentives to earn income are diminished.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the government proposes a negative income tax that calculates the taxes owed as follows: taxes owed equal 30% of income less 12,000. A family that earns an income of $60,000 will

A) pay $6,000 in taxes.

B) receive an income subsidy of $6,000.

C) receive an income subsidy of $12,000.

D) have an after-tax income of $48,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 478

Related Exams