B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income tax requires that taxpayers pay 10percent on the first $40,000 of income and 20 percent on all income over $40,000. Emily paid $9,000 in taxes. What were her marginal and average tax rates?

A) 20 percent and 13.8 percent, respectively

B) 20 percent and 15 percent, respectively

C) 10 percent and 13.8 percent respectively

D) 10 percent and 15 percent respectively

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

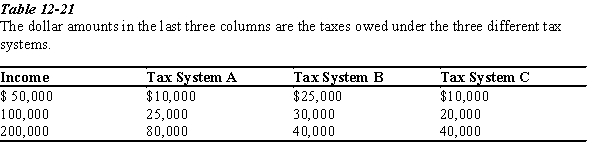

-Refer to Table 12-21. Which of the three tax systems is progressive?

-Refer to Table 12-21. Which of the three tax systems is progressive?

A) Tax System A

B) Tax System B

C) Tax System C

D) All of the tax systems are progressive.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Rob's income rises from $50,000 to $60,000 and his income tax increases from $6,000 to $7,500.His marginal tax rate is 12.5%.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A lump-sum tax does not produce a deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-3 Suppose Roger and Regina receive great satisfaction from their consumption of cheesecake. Regina would be willing to purchase only one slice and would pay up to $8 for it. Roger would be willing to pay $11 for his first slice, $9 for his second slice, and $5 for his third slice. The current market price is $5 per slice. -Refer to Scenario 12-3. Assume that the government places a $4 tax on each slice of cheesecake and that the new equilibrium price is $9. What is Regina's consumer surplus from cheesecake?

A) zero

B) $2

C) $3

D) $6

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax system requires all taxpayers to pay the same percentage of their income in taxes?

A) a regressive tax

B) a proportional tax

C) a progressive tax

D) a horizontal equity tax

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are trying to design a tax system that will simultaneously achieve both of the following goals: 1) a person with no income would pay no taxes, and 2) a high-income person would pay a higher fraction of income in taxes than a low-income person. Which of the following statements is correct?

A) A lump-sum tax would achieve the second goal but not the first.

B) A regressive tax would achieve the second goal but not the first.

C) A progressive tax could achieve both goals.

D) A proportional tax could achieve the second goal but not the first.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Today the typical American pays approximately what percent of income in taxes, including all federal, state, and local taxes?

A) 5 percent

B) 25 percent

C) 35 percent

D) 50 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your income is $40,000 and your income tax liability is $5,000, your marginal tax rate is

A) 8 percent.

B) 12.5 percent.

C) 20 percent.

D) unknown. We do not have enough information to answer this question.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is justified on the basis that the taxpayers who pay the tax receive specific government services from payment of the tax, the tax

A) is considered horizontally equitable.

B) burden is minimized.

C) satisfies the benefits principle.

D) is considered vertically equitable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The notion that similar taxpayers should pay similar amounts of taxes is known as

A) vertical equity.

B) the benefits principle.

C) horizontal equity.

D) taxpayer efficiency.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vertical equity in taxation refers to the idea that people

A) in unequal conditions should be treated differently.

B) in equal conditions should pay equal taxes.

C) should pay taxes based on the benefits they receive from the government.

D) should pay a proportional tax rather than a progressive tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

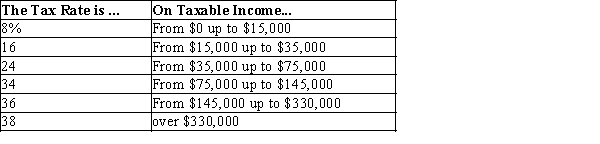

Table 12-11  -Refer to Table 12-11. If Peggy has taxable income of $43,000, her marginal tax rate is

-Refer to Table 12-11. If Peggy has taxable income of $43,000, her marginal tax rate is

A) 8%.

B) 16%.

C) 24%.

D) 34%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Leonard, Sheldon, Raj, and Penny each like to attend comic-book conventions. The price of a ticket to a convention is $50. Leonard values a ticket at $70, Sheldon at $65, Raj at $60, and Penny at $55. Suppose that if the government taxes tickets at $5 each, the price will rise to $55. A consequence of the tax is that consumer surplus shrinks by

A) $50 and tax revenues increase by $20, so there is a deadweight loss of $30.

B) $30 and tax revenues increase by $20, so there is a deadweight loss of $10.

C) $20 and tax revenues increase by $20, so there is no deadweight loss.

D) $50 and tax revenues increase by $20, so there is no deadweight loss.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket. In addition, suppose the price of a movie ticket is $5. -Refer to Scenario 12-2. Suppose the government levies a tax of $1 on each movie ticket and that, as a result, the price of a movie ticket increases to $6.00. If Bob and Lisa both purchase a movie ticket, what is total consumer surplus for Bob and Lisa?

A) $0.00

B) $0.50

C) $5.00

D) $6.00

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Darby values a certain smart phone at $400. Jake values the same smart phone at $300. The pre-tax price of this smart phone is $250. The government imposes a tax of $75 on each smart phone, and the price rises to $325. The deadweight loss from the tax is

A) $150.

B) $100.

C) $50.

D) $0.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The U.S. tax burden is high compared to many European countries..

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept that people should pay taxes based on the benefits they receive from government services is called

A) the ability-to-pay principle.

B) the benefits principle.

C) horizontal equity.

D) vertical equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goals of efficiency and equity in tax policy are

A) complementary in most countries.

B) necessary for application of the ability-to-pay principle.

C) often in conflict with each other.

D) easier to achieve when tax codes are complex.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 521 - 540 of 563

Related Exams