A) A wealthy individual should pay more taxes than a lower-income individual

B) A wealthy individual should have a greater average tax rate than a middle-income individual

C) Two persons with identical incomes should pay the same taxes

D) A local government decides to impose taxes based on the benefits principle

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an administrative burden of our tax system?

A) government resources used to enforce tax laws

B) keeping tax records throughout the year

C) paying the taxes owed

D) time spent in April filling out forms

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's tax obligation divided by her income is called her

A) marginal social tax rate.

B) marginal private tax rate.

C) marginal tax rate.

D) average tax rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

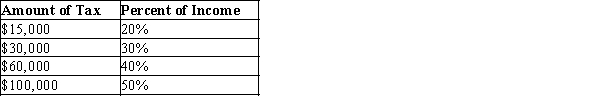

Table 12-3  -Refer to Table 12-3. What is the marginal tax rate for a person who makes $35,000?

-Refer to Table 12-3. What is the marginal tax rate for a person who makes $35,000?

A) 20%

B) 30%

C) 40%

D) 50%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal equity in taxation refers to the idea that people

A) in unequal conditions should be treated differently.

B) in equal conditions should pay equal taxes.

C) should be taxed according to their ability to pay.

D) should receive government benefits according to how much they have been taxed.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-15  -Refer to Table 12-15. The tax system is

-Refer to Table 12-15. The tax system is

A) proportional.

B) regressive.

C) progressive.

D) lump sum.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of horizontal equity?

A) A wealthy individual should pay more taxes than a lower-income individual

B) A wealthy individual should have a greater average tax rate than a middle-income individual

C) Two persons with identical incomes should pay the same taxes

D) A local government decides to impose taxes based on the benefits principle

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Revenues from social insurance taxes are earmarked to pay for Social Security and Medicare.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a state has the following individual income tax structure. The first $20,000 that an individual earns is taxed at 5%. The next $30,000 is taxed at 10%. Any income exceeding $50,000 is taxed at 20%. Based on this tax structure, if a person's income rises from $45,000 to $55,000, his marginal tax rate is:

A) 25%

B) 20%

C) 10%

D) 15%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The argument that each person should pay taxes according to how well the individual can shoulder the burden is called

A) the ability-to-pay principle.

B) the equity principle.

C) the benefits principle.

D) regressive.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal equity in taxation refers to the idea that people

A) in unequal conditions should be treated differently.

B) in equal conditions should pay equal taxes.

C) should be taxed according to their ability to pay.

D) should receive government benefits according to how much they have been taxed.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

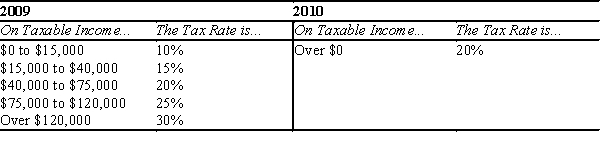

Table 12-17

The following table shows the marginal tax rates for unmarried individuals for two years.  -Refer to Table 12-17. Which of the following best describes the tax schedule in 2009?

-Refer to Table 12-17. Which of the following best describes the tax schedule in 2009?

A) proportional tax

B) progressive tax

C) regressive tax

D) vertical tax

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

One reason for the projected increase, over the next several decades, in government spending as a percentage of GDP is the projected increase in the size of the elderly population.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The resources that a taxpayer devotes to complying with the tax laws are a type of

A) marginal tax.

B) administrative burden.

C) deadweight loss.

D) Both b and c are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight losses represent the

A) inefficiency that taxes create.

B) shift in benefit from producers to consumers.

C) part of consumer and producer surplus that is now revenue to the government.

D) increase in revenue to the government.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Hillary values a large order of French fries at $4. Bill values a large order of French fries at $7. The pre-tax price of a large order of French fries is $2. The government imposes a "fat tax" of $3 on each large order of French fries, and the price rises to $5. The deadweight loss from the tax is

A) $4, and the deadweight loss comes from both Hillary and Bill.

B) $4, and the deadweight loss comes only from Hillary because she does not buy a large French fries after the tax.

C) $2, and the deadweight loss comes from both Hillary and Bill.

D) $2, and the deadweight loss comes only from Hillary because she does not buy a large French fries after the tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a poor family has three children in public school and a rich family has two children in private school, the benefits principle would suggest that

A) the poor family should pay more in taxes to pay for public education than the rich family.

B) the rich family should pay more in taxes to pay for public education than the poor family.

C) the benefits of private school exceed those of public school.

D) public schools should be financed by property taxes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Individual Retirement Accounts and 401(k) plans make the current U.S. tax system

A) more like a consumption tax and so more like the tax system of many European countries.

B) more like a consumption tax and so less like the tax system of many European countries.

C) less like a consumption tax and so more like the tax system of many European countries.

D) less like a consumption tax and so less like the tax system of many European countries.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-4 A taxpayer faces the following tax rates on her income: 20 percent of the first $40,000 of her income; 30 percent of all her income above $40,000. -Refer to Scenario 12-4. The taxpayer faces a marginal tax rate of

A) 20 percent when her income rises from $40,000 to $40,001.

B) 20 percent when her income rises from $30,000 to $30,001.

C) 0 percent when her income rises from $30,000 to $30,001.

D) 10 percent when her income rises from $40,000 to $40,001.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

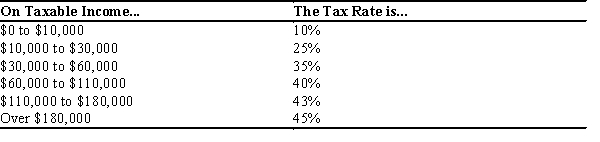

Table 12-6

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.  -Refer to Table 12-6. For this tax schedule, what is the marginal tax rate for an individual with taxable income of $49,000?

-Refer to Table 12-6. For this tax schedule, what is the marginal tax rate for an individual with taxable income of $49,000?

A) 0%

B) 10%

C) 25%

D) 35%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 541 - 560 of 563

Related Exams