A) the demand curve for textbooks shifts downward by $5.

B) buyers of textbooks pay $5 more per textbook than they were paying before the tax.

C) sellers of textbooks are unaffected by the tax.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the sellers of a product, then the demand curve will

A) shift down.

B) shift up.

C) become flatter.

D) not shift.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

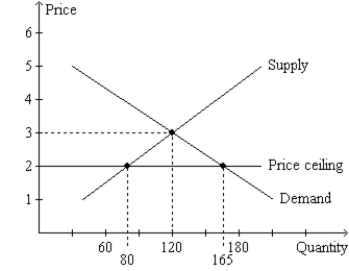

Figure 6-2  -Refer to Figure 6-2. The price ceiling causes quantity

-Refer to Figure 6-2. The price ceiling causes quantity

A) supplied to exceed quantity demanded by 45 units.

B) supplied to exceed quantity demanded by 85 units.

C) demanded to exceed quantity supplied by 45 units.

D) demanded to exceed quantity supplied by 85 units.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

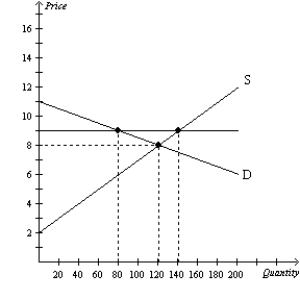

Figure 6-5  -Refer to Figure 6-5. If the solid horizontal line on the graph represents a price ceiling, then the price ceiling is

-Refer to Figure 6-5. If the solid horizontal line on the graph represents a price ceiling, then the price ceiling is

A) binding and creates a surplus of 60 units of the good.

B) binding and creates a surplus of 20 units of the good.

C) not binding but creates a surplus of 40 units of the good.

D) not binding, and there will be no surplus or shortage of the good.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Since a tax imposed on buyers of a product only affects demand, such a tax has no impact on sellers in that market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government wants to encourage Americans to exercise more, so it imposes a binding price ceiling on the market for in-home treadmills. As a result,

A) the demand for treadmills will increase.

B) the supply of treadmills will decrease.

C) a shortage of treadmills will develop.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set below the equilibrium price causes a shortage in the market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set below the equilibrium price is nonbinding.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a good or service is sold in a competitive market free of government regulation, then the price of the good or service adjusts to balance supply and demand.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The burden of a luxury tax most likely falls more heavily on sellers because demand is more elastic and supply is more inelastic.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price floor is imposed on a market to benefit sellers,

A) every seller in the market benefits.

B) all buyers and sellers benefit.

C) every seller who wants to sell the good will be able to do so, but only if he appeals to the personal biases of the buyers.

D) some sellers will not be able to sell any amount of the good.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price floor is imposed on a market,

A) price no longer serves as a rationing device.

B) the quantity supplied at the price floor exceeds the quantity that would have been supplied without the price floor.

C) only some sellers benefit.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a free market for a good reaches equilibrium, anyone who is willing and able to sell at the market price can sell the good.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over time, housing shortages caused by rent control

A) increase, because the demand for and supply of housing are less elastic in the long run.

B) increase, because the demand for and supply of housing are more elastic in the long run.

C) decrease, because the demand for and supply of housing are less elastic in the long run.

D) decrease, because the demand for and supply of housing are more elastic in the long run.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a price ceiling of $1.50 per gallon is imposed on gasoline, and the market equilibrium price is $2, then the price ceiling is a binding constraint on the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a tax on a good, then the quantity of the good sold will

A) increase.

B) decrease.

C) not change.

D) All of the above are possible.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the sellers of a good will

A) raise both the price buyers pay and the effective price sellers receive.

B) raise the price buyers pay and lower the effective price sellers receive.

C) lower the price buyers pay and raise the effective price sellers receive.

D) lower both the price buyers pay and the effective price sellers receive.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage causes the quantity of labor demanded to exceed the quantity of labor supplied.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of coffee will increase the price of coffee paid by buyers,

A) increase the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee.

B) increase the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

C) decrease the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee.

D) decrease the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a tax is placed on books. If the sellers pay the majority of the tax, then we know that the

A) demand is more inelastic than the supply.

B) supply is more inelastic than the demand.

C) government has required that buyers remit the tax payments.

D) government has required that sellers remit the tax payments.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 461 - 480 of 668

Related Exams