A) increase taxes or increase the money supply

B) increase taxes or decrease the money supply

C) decrease taxes or increase the money supply

D) decrease taxes or decrease the money supply

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

While a television news reporter might state that "Today the Fed raised the federal funds rate from 1 percent to 1.25 percent," a more precise account of the Fed's action would be as follows:

A) "Today the Fed told its bond traders to conduct open-market operations in such a way that the equilibrium federal funds rate would increase to 1.25 percent."

B) "Today the Fed raised the discount rate by a quarter of a percentage point, and this action will force the federal funds rate to rise by the same amount."

C) "Today the Fed took steps to increase the money supply by an amount that is sufficient to increase the federal funds rate to 1.25 percent."

D) "Today the Fed took a step toward expanding aggregate demand, and this was done by raising the federal funds rate to 1.25 percent."

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax cut shifts the aggregate demand curve the farthest if

A) the MPC is large and if the tax cut is permanent.

B) the MPC is large and if the tax cut is temporary.

C) the MPC is small and if the tax cut is permanent.

D) the MPC is small and if the tax cut is temporary.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The theory of liquidity preference was developed by Irving Fisher.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Suppose the Federal Reserve lowers the target on the interest rate in the Federal Funds market. The Federal Reserve will _____ the money supply and aggregate demand will _____.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the multiplier is 5 and that the crowding-out effect is $30 billion. An increase in government purchases of $20 billion will shift the aggregate-demand curve to the

A) right by $130 billion.

B) right by $70 billion.

C) right by $50 billion.

D) right by $10 billion.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following shifts aggregate demand to the right?

A) The price level rises.

B) The price level falls.

C) The money supply falls.

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is an increase in government spending. To stabilize output, the Federal Reserve would

A) increase government spending.

B) increase the money supply.

C) decrease government spending.

D) decrease the money supply.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

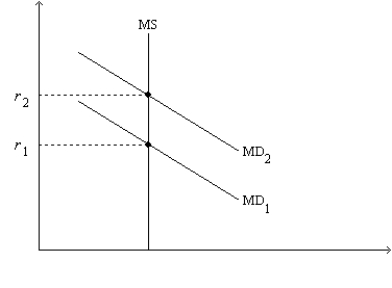

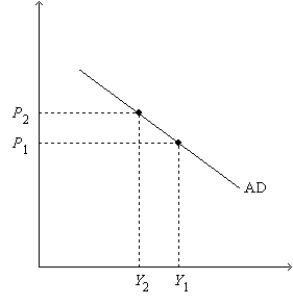

Figure 34-2. On the left-hand graph, MS represents the supply of money and MD represents the demand for money; on the right-hand graph, AD represents aggregate demand. The usual quantities are measured along the axes of both graphs.

.

-Refer to Figure 34-2. Which of the following quantities is held constant as we move from one point to another on either graph?

-Refer to Figure 34-2. Which of the following quantities is held constant as we move from one point to another on either graph?

A) the nominal interest rate

B) the quantity of money demanded

C) investment

D) the expected rate of inflation

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed increases the money supply,

A) the interest rate increases, which tends to raise stock prices.

B) the interest rate increases, which tends to reduce stock prices.

C) the interest rate decreases, which tends to raise stock prices.

D) the interest rate decreases, which tends to reduce stock prices.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

What is the value of the multiplier if the marginal propensity to consume is 0.5?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things equal, in the short run a lower price level leads households to

A) increase consumption and firms to buy more capital goods.

B) increase consumption and firms to buy fewer capital goods.

C) decrease consumption and firms to buy more capital goods.

D) decrease consumption and firms to buy fewer capital goods.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An decrease in taxes shifts aggregate demand

A) to the right. The larger the multiplier is, the farther it shifts.

B) to the right. The larger the multiplier is, the less it shifts.

C) to the left. The larger the multiplier is, the farther it shifts.

D) to the left. The larger the multiplier is, the less it shifts.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

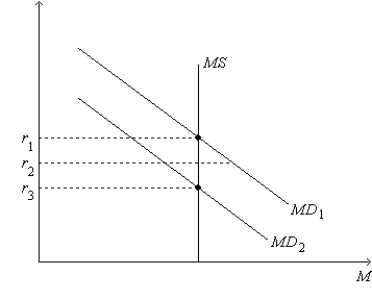

Figure 34-4. On the figure, MS represents money supply and MD represents money demand.  -Refer to Figure 34-4. Suppose the current equilibrium interest rate is r3. Let Y3 represent the corresponding quantity of goods and services demanded, and let P3 represent the corresponding price level. Starting from this situation, if the Federal Reserve decreases the money supply and if the price level remains at P3, then

-Refer to Figure 34-4. Suppose the current equilibrium interest rate is r3. Let Y3 represent the corresponding quantity of goods and services demanded, and let P3 represent the corresponding price level. Starting from this situation, if the Federal Reserve decreases the money supply and if the price level remains at P3, then

A) there will be an increase in the equilibrium quantity of goods and services demanded.

B) there will be a decrease in the equilibrium interest rate.

C) the aggregate-demand curve will shift to the right.

D) fewer firms will choose to borrow to build new factories and buy new equipment.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve increases the money supply, then initially there is a

A) shortage in the money market, so people will want to sell bonds.

B) shortage in the money market, so people will want to buy bonds.

C) surplus in the money market, so people will want to sell bonds.

D) surplus in the money market, so people will want to buy bonds.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate would fall and the quantity of money demanded would

A) increase if there were a surplus in the money market.

B) increase if there were a shortage in the money market.

C) decrease if there were a surplus in the money market.

D) decrease if there were a shortage in the money market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

For a country such as the U.S., the wealth effect exerts a very important influence on the slope of the aggregate-demand curve, since U.S. wealth is large relative to wealth in most other countries.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The theory of liquidity preference illustrates the principle that

A) monetary policy can be described either in terms of the money supply or in terms of the interest rate.

B) monetary policy can be described either in terms of the exchange rate or the interest rate.

C) monetary policy must be described in terms of the money supply.

D) monetary policy must be described in terms of the interest rate.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A reduction in U.S net exports would shift U.S. aggregate demand

A) rightward. In an attempt to stabilize the economy, the government could increase expenditures.

B) rightward. In an attempt to stabilize the economy, the government could decrease expenditures.

C) leftward. In an attempt to stabilize the economy, the government could increase expenditures.

D) leftward. In an attempt to stabilize the economy, the government could decrease expenditures.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following sequences best explains the negative slope of the aggregate-demand curve?

A) price level ↑ ⇒ demand for money ↑ ⇒ equilibrium interest rate ↑ ⇒ quantity of goods and services demanded ↓

B) price level ↑ ⇒ demand for money ↓ ⇒ equilibrium interest rate ↑ ⇒ quantity of goods and services demanded ↓

C) price level ↓ ⇒ demand for money ↓ ⇒ equilibrium interest rate ↑ ⇒ quantity of goods and services demanded ↓

D) price level ↑ ⇒ equilibrium interest rate ↑ ⇒ demand for money ↑ ⇒ quantity of goods and services demanded ↓

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 523

Related Exams