B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a U.S.person?

A) Domestic corporation.

B) Citizen of Turkey with U.S.permanent residence status (i.e., green card) .

C) U.S.corporation 100% owned by a foreign corporation.

D) Foreign corporation 100% owned by a domestic corporation.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olaf, a citizen of Norway with no trade or business activities in the United States, sells at a gain 200 shares of MicroShift, Inc., a U.S.company.The sale takes place through Olaf's broker in Oslo.How is this gain treated for U.S.tax purposes?

A) It is foreign-source income subject to U.S.taxation.

B) It is foreign-source income not subject to U.S.taxation.

C) It is U.S.-source income subject to U.S.taxation.

D) It is U.S.-source income exempt from U.S.taxation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A service engineer spends 80% of her time maintaining the employer's productive business property and 20% maintaining the employer's nonbusiness rental properties.This year, her compensation totaled $90,000.The payroll factor assigns $90,000 to the state in which the employer is based.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

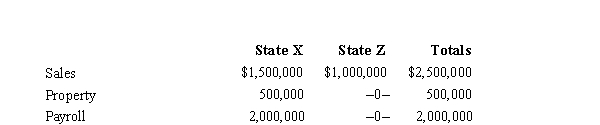

José Corporation realized $900,000 taxable income from the sales of its products in States X and Z.José's activities in both states establish nexus for income tax purposes.José's sales, payroll, and property among the states include the following:  Z utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of José's taxable income is apportioned to Z?

Z utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of José's taxable income is apportioned to Z?

A) $1,000,000

B) $900,000

C) $180,000

D) $0

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

ForCo, a subsidiary of a U.S.corporation incorporated in Belgium, manufactures widgets in Belgium and sells the widgets to its 100%-owned subsidiary in Germany.The income from the sale of widgets is not Subpart F foreign base company sales income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mitch, an NRA, sells a building in Omaha for $1 million.His basis in the building is zero for both regular tax and AMT purposes.Mitch has no other contact with the United States other than the ownership of the building.How much Federal income tax is due from Mitch on the sale?

A) $0, because Mitch is an NRA.

B) The amount realized times the top individual tax rate.

C) The net gain times the top capital gains tax rate.

D) The net gain taxed at the lesser of the applicable regular or AMT rates.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Waltz, Inc., a U.S.taxpayer, pays foreign taxes of $50,000 on foreign-source general basket income of $90,000. Waltz's worldwide taxable income is $450,000, on which it owes U.S.taxes of $94,500 before FTC.Waltz's FTC is $50,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following income of a foreign corporation is not subject to the regular U.S.corporate income tax rates.

A) FIRPTA gains.

B) Capital gains effectively connected with a U.S.trade or business.

C) Net long-term capital gains for which no U.S.trade or business exists.

D) Interest income effectively connected with a U.S.trade or business.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In allocating interest expense between U.S.and foreign sources, a taxpayer elects to use either the tax basis of the income-producing assets or their fair market values.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not immune from state income taxation even if P.L.86-272 is in effect?

A) Sale of office equipment that is used in the taxpayer's business.

B) Sale of office equipment that constitutes inventory to the purchaser.

C) Sale of a warehouse used in the taxpayer's business.

D) All of these are protected by P.L.86-272 immunity provisions.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 91 of 91

Related Exams