A) $0

B) $6,000

C) $9,000

D) $15,000

E) None of these

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Grace's sole source of income is from a restaurant that she owns and operates as a proprietorship.Any state income tax Grace pays on the business net income must be deducted as a business expense rather than as an itemized deduction.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

Shirley pays FICA (employer's share) on the wages she pays her housekeeper to clean and maintain Shirley's personal residence.The FICA payment is not deductible as an itemized deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Chad pays the medical expenses of his son, James.James would qualify as Chad's dependent except that he earns $7,500 during the year.Chad may claim James' medical expenses even if he is not a dependent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The alimony rules applicable to divorces entered into before 2019:

A) Are based on the principle that the person who earns the income should pay the tax.

B) Permit tax deductions for property divisions.

C) Look to state law to determine the definition of alimony.

D) Treat child support payments and alimony differently.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year, Khalid was in an automobile accident and suffered physical injuries.The accident was caused by Rashad's negligence.Khalid threatened to file a lawsuit against Amber Trucking Company, Rashad's employer, claiming $50,000 for pain and suffering, $90,000 for loss of income, and $70,000 in punitive damages.Amber's insurance company will not pay punitive damages; therefore, Amber has offered to settle the case for $100,000 for pain and suffering, $90,000 for loss of income, and nothing for punitive damages.Khalid is in the 35% marginal tax bracket.What is the after-tax difference to Khalid between Khalid's original claim and Amber's offer?

A) Amber's offer is $20,000 less.($50,000 + $90,000 + $70,000 - $100,000 - $90,000) .

B) Amber's offer is $7,000 less.[($50,000 + $90,000 + $70,000 - $100,000 - $90,000) × 0.35) ].

C) Amber's offer is $4,500 more.{$190,000 - ($50,000 + $90,000) + [$70,000 × (1.00 - 0.35) ]}.

D) Amber's offer is $22,000 more.[($190,000 - $210,000) + ($120,000 × 0.35) ].

E) None of these.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the terms of a divorce agreement entered into in 2017, Ron is to pay his former wife Jill $10,000 per month. The payments are to be reduced to $7,000 per month when their 15-year old child reaches age 18.During the current year, Ron paid $120,000 under the agreement.Assuming all of the other conditions for alimony are satisfied, Ron can deduct from gross income (and Jill must include in gross income) as alimony:

A) $120,000.

B) $84,000.

C) $36,000.

D) $0.

E) None of these is correct.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Paula transfers stock to her former spouse, Fred.The transfer is pursuant to a divorce agreement.Paula's cost of the stock was $75,000 and its fair market value on the date of the transfer is $95,000.Fred later sells the stock for $100,000.Fred's recognized gain from the sale of the stock is $5,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Jacob and Emily were co-owners of a personal residence.As part of their divorce agreement entered into in 2017, Emily paid Jacob cash for his interest in the personal residence.This cash payment results in a taxable gain to Jacob if he receives more cash than his share of the cost of the residence.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Excess charitable contributions that come under the 30%-of-AGI ceiling are always subject to the 30%-of-AGI ceiling in the carryover year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For all of the current year, Randy (a calendar year taxpayer) allowed the Salvation Army to use rent-free a building he owns.The building normally rents for $24,000 a year.Randy will be allowed a charitable contribution deduction this year of $24,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

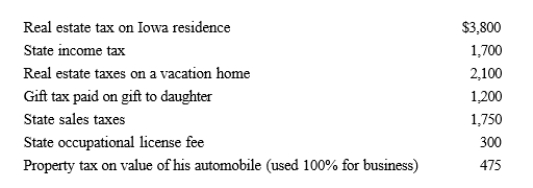

Hugh, a self-employed individual, paid the following amounts during the year:  What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

A) $7,650

B) $8,850

C) $9,625

D) $10,000

E) None of these

G) B) and E)

Correct Answer

verified

A

Correct Answer

verified

True/False

Ronaldo contributed stock worth $12,000 to the Children's Protective Agency, a qualified charity.He acquired the stock 20 months ago for $7,000.He may deduct $7,000 as a charitable contribution deduction (subject to percentage limitations).

B) False

Correct Answer

verified

Correct Answer

verified

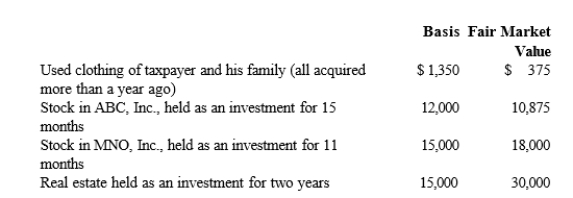

Multiple Choice

Zeke made the following donations to qualified charitable organizations during the year:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In 2019, Rhonda received an insurance reimbursement for medical expenses incurred in 2018.She is not required to include the reimbursement in gross income in 2019 if she claimed the standard deduction in 2018.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a scholarship does not satisfy the requirements for a gift, the scholarship must be included in gross income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the terms of a divorce agreement entered into in 2017, Lanny was to pay his wife Joyce $2,000 per month in alimony and $500 per month in child support.For a 12-month period, Lanny can deduct from gross income (and Joyce must include in gross income) :

A) $0.

B) $6,000.

C) $24,000.

D) $30,000.

E) None of these.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Christie sued her former employer for a back injury she suffered on the job in 2019.As a result of the injury, she was partially disabled.In 2020, she received $240,000 for her loss of future income, $160,000 in punitive damages because of the employer's flagrant disregard for the employee's safety, and $15,000 for medical expenses.The medical expenses were deducted on her 2019 return, reducing her taxable income by $12,000.Christie's 2020 gross income from the above is:

A) $415,000.

B) $412,000.

C) $255,000.

D) $175,000.

E) $172,000.

G) None of the above

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Harry and Wei are married and file a joint income tax return.On their tax return, they report $44,000 of adjusted gross income ($20,000 salary earned by Harry and $24,000 salary earned by Wei) and report two dependent children.During the year, they pay the following amounts to care for their four-year old son and six-year old daughter while they work.  Harry and Wei may claim a credit for child and dependent care expenses of:

Harry and Wei may claim a credit for child and dependent care expenses of:

A) $840.

B) $1,040.

C) $1,200.

D) $1,240.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As an executive of Cherry, Inc., Ollie receives a fringe benefit in the form of annual tuition scholarships of $10,000 to each of his three children.The scholarships are paid by the company on behalf of the children of key employees directly to each child's educational institution and are payable only if the student maintains a B average.

A) The tuition payments of $30,000 may be excluded from Ollie's gross income as a scholarship.

B) The tuition payments of $10,000 each must be included in each child's gross income.

C) The tuition payments of $30,000 may be excluded from Ollie's gross income because the payments are for the academic achievements of the children.

D) The tuition payments of $30,000 must be included in Ollie's gross income.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 129

Related Exams