A) demand curve for toothpaste shifts to the left.

B) supply curve for toothpaste shifts to the right.

C) quantity demanded of toothpaste decreases, and the quantity of toothpaste that firms want to supply increases.

D) quantity supplied of toothpaste stays the same.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

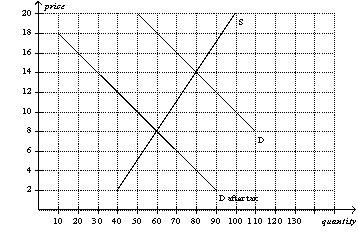

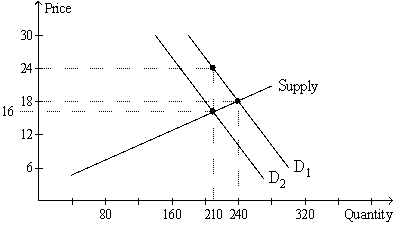

Figure 6-23

-Refer to Figure 6-23.The amount of the tax per unit is

-Refer to Figure 6-23.The amount of the tax per unit is

A) $4.

B) $5.

C) $6.

D) $10.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

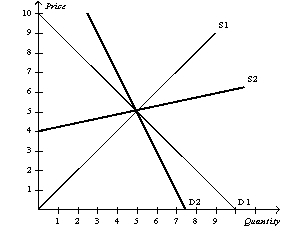

Figure 6-24

Suppose the government imposes a $2 on this market.

-Refer to Figure 6-24.The buyers will bear a higher share of the tax burden than sellers if the demand is

-Refer to Figure 6-24.The buyers will bear a higher share of the tax burden than sellers if the demand is

A) D1, and the supply is S1.

B) D2, and the supply is S1.

C) D1, and the supply is S2.

D) D2, and the supply is S2.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

To be binding,a price floor must be set above the equilibrium price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of coffee will increase the price of coffee paid by buyers,

A) increase the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee.

B) increase the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

C) decrease the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee.

D) decrease the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $500 tax per car on sellers of cars,then the price received by sellers of cars would

A) decrease by less than $500.

B) decrease by exactly $500.

C) decrease by more than $500.

D) increase by an indeterminate amount.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets.Buyers of airline tickets are required to pay the tax to the government.If the tax is reduced from $50 per ticket to $30 per ticket,then the

A) demand curve will shift upward by $20, and the effective price received by sellers will increase by $20.

B) demand curve will shift upward by $20, and the effective price received by sellers will increase by less than $20.

C) supply curve will shift downward by $20, and the price paid by buyers will decrease by $20.

D) supply curve will shift downward by $20, and the price paid by buyers will decrease by less than $20.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a binding price ceiling is imposed on the baby formula market,then

A) the quantity of baby formula demanded will increase.

B) the quantity of baby formula supplied will decrease.

C) a shortage of baby formula will develop.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set below the equilibrium price is nonbinding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a binding price ceiling from a market,then the price paid by buyers will

A) increase, and the quantity sold in the market will increase.

B) increase, and the quantity sold in the market will decrease.

C) decrease, and the quantity sold in the market will increase.

D) decrease, and the quantity sold in the market will decrease.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

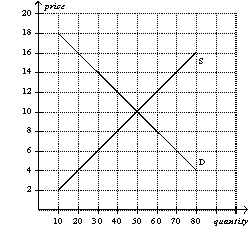

Figure 6-6

-Refer to Figure 6-6.Which of the following price ceilings would be binding in this market?

-Refer to Figure 6-6.Which of the following price ceilings would be binding in this market?

A) $8

B) $10

C) $12

D) $14

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 50-cent tax on the sellers of packets of chewing gum.The tax would

A) shift the supply curve upward by less than 50 cents.

B) raise the equilibrium price by 50 cents.

C) create a 50-cent tax burden each for buyers and sellers.

D) discourage market activity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers increases the quantity of the good sold in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding price floor will reduce a firm's total revenue

A) always.

B) when demand is elastic.

C) when demand is inelastic.

D) never.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

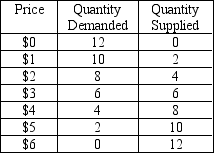

Table 6-1

-Refer to Table 6-1.Suppose the government imposes a price floor of $5 on this market.What will be the size of the surplus in this market?

-Refer to Table 6-1.Suppose the government imposes a price floor of $5 on this market.What will be the size of the surplus in this market?

A) 0 units

B) 2 units

C) 8 units

D) 10 units

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A tax of $1 on sellers always increases the equilibrium price by $1.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Price controls can generate inequities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You receive a paycheck from your employer,and your pay stub indicates that $400 was deducted to pay the FICA (Social Security/Medicare) tax.Which of the following statements is correct?

A) This type of tax is an example of a payback tax.

B) Your employer is required by law to pay $400 to match the $400 deducted from your check.

C) The $400 that you paid is the true burden of the tax that falls on you, the employee.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A price floor set above the equilibrium price is binding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-20

-Refer to Figure 6-20.Andrew is a buyer of the good.Taking the tax into account,how much does Andrew effectively pay to acquire one unit of the good?

-Refer to Figure 6-20.Andrew is a buyer of the good.Taking the tax into account,how much does Andrew effectively pay to acquire one unit of the good?

A) $16

B) $18

C) $24

D) $26

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 557

Related Exams