B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Taxes levied on sellers and taxes levied on buyers are not equivalent.

B) A tax places a wedge between the price that buyers pay and the price that sellers receive.

C) The wedge between the buyers' price and the sellers' price is the same, regardless of whether the tax is levied on buyers or sellers.

D) In the new after-tax equilibrium, buyers and sellers share the burden of the tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a $1 tax on sellers of gasoline and imposes the same $1 tax on buyers of gasoline,then the price paid by buyers will

A) increase, and the price received by sellers will increase.

B) increase, and the price received by sellers will not change.

C) not change, and the price received by sellers will increase.

D) not change, and the price received by sellers will not change.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When OPEC raised the price of crude oil in the 1970s,it caused the

A) demand for gasoline to increase.

B) demand for gasoline to decrease.

C) supply of gasoline to increase.

D) supply of gasoline to decrease.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage may not help all workers,but it does not hurt any workers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

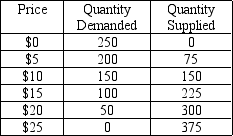

Table 6-2

-Refer to Table 6-2.A price floor set at $20 will

-Refer to Table 6-2.A price floor set at $20 will

A) be binding and will result in a surplus of 50 units.

B) be binding and will result in a surplus of 100 units.

C) be binding and will result in a surplus of 250 units.

D) not be binding.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A price floor set above the equilibrium price is not binding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

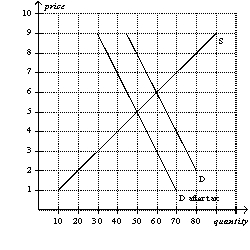

Figure 6-21

-Refer to Figure 6-22.The burden of the tax on sellers is

-Refer to Figure 6-22.The burden of the tax on sellers is

A) $1 per unit.

B) $1.50 per unit.

C) $2 per unit.

D) $3 per unit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The goal of the minimum wage is to ensure workers a minimally adequate standard of living.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

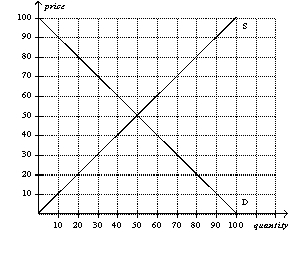

Figure 6-26

-Refer to Figure 6-26.A price floor set at $60 would create a surplus of 20 units.

-Refer to Figure 6-26.A price floor set at $60 would create a surplus of 20 units.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over time,housing shortages caused by rent control

A) increase, because the demand for and supply of housing are less elastic in the long run.

B) increase, because the demand for and supply of housing are more elastic in the long run.

C) decrease, because the demand for and supply of housing are less elastic in the long run.

D) decrease, because the demand for and supply of housing are more elastic in the long run.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the equilibrium wage is $4 per hour and the minimum wage is $5.15 per hour,then a shortage of labor will exist.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the minimum wage exceeds the equilibrium wage,then

A) the quantity demanded of labor will exceed the quantity supplied.

B) the quantity supplied of labor will exceed the quantity demanded.

C) the minimum wage will not be binding.

D) there will be no unemployment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a binding price floor from a market,then the price received by sellers will

A) decrease, and the quantity sold in the market will decrease.

B) decrease, and the quantity sold in the market will increase.

C) increase, and the quantity sold in the market will decrease.

D) increase, and the quantity sold in the market will increase.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of a product,the

A) size of the market decreases.

B) effective price received by sellers decreases, and the price paid by buyers increases.

C) demand for the product decreases.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $1,000 tax per boat on sellers of boats,then the price paid by buyers of boats would

A) increase by more than $1,000.

B) increase by exactly $1,000.

C) increase by less than $1,000.

D) decrease by an indeterminate amount.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal government uses the revenue from the FICA (Federal Insurance Contribution Act) tax to pay for

A) unemployment compensation.

B) the salaries of members of Congress.

C) Social Security and Medicare.

D) housing subsidies for low-income people.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage creates unemployment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

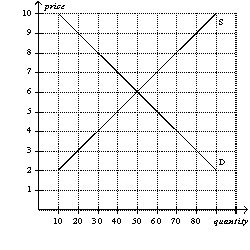

Figure 6-7

-Refer to Figure 6-7.Suppose a price floor of $7 is imposed on this market.As a result,

-Refer to Figure 6-7.Suppose a price floor of $7 is imposed on this market.As a result,

A) buyers' total expenditure on the good decreases by $20.

B) the supply curve shifts to the left so as to now pass through the point (quantity = 40, price = $7) .

C) the quantity of the good demanded decreases by 20 units.

D) the price of the good continues to serve as the rationing mechanism.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set above the equilibrium price causes quantity demanded to exceed quantity supplied.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 557

Related Exams