A) $23,800.

B) $36,000.

C) $45,000.

D) $47,698.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in 2015 the average citizen's federal tax bill is $11,987,and total federal spending is $12,294 per person.In 2015,the federal government will have

A) a budget surplus.

B) a budget deficit.

C) horizontal equity.

D) vertical equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-3 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket. In addition, suppose the price of a movie ticket is $5. -Refer to Scenario 12-3.Suppose the government levies a tax of $1 on each movie ticket and that,as a result,the price of a movie ticket increases to $6.00.If Bob and Lisa both purchase a movie ticket,what is total consumer surplus for Bob and Lisa?

A) $0.00

B) $0.50

C) $5.00

D) $6.00

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) All states have state income taxes, but the percentages vary widely.

B) Sales taxes and property taxes are important revenue sources for state and local governments.

C) Medicare spending has increased because the percentage of the population that is elderly and the cost of health care have both increased.

D) A budget deficit occurs when government spending exceeds government receipts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat calculates that for every extra dollar she earns,she owes the government 33 cents.Her total income now is $35,000,on which she pays taxes of $7,000.Determine her average tax rate and her marginal tax rate.

A) Her average tax rate is 33% and her marginal tax rate is 20%.

B) Her average tax rate is 20% and her marginal tax rate is 33%.

C) Her average tax rate is 20% and her marginal tax rate is 20%.

D) Her average tax rate is 33% and her marginal tax rate is 33%.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

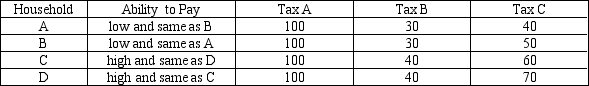

Table 12-16

The table below provides information on the 4 households that make up a small economy and how much they would pay in taxes under 3 types of taxes.

-Refer to Table 12-16.In this economy Tax C exhibits

-Refer to Table 12-16.In this economy Tax C exhibits

A) horizontal and vertical equity.

B) horizontal equity but not vertical equity.

C) vertical equity but not horizontal equity.

D) neither horizontal nor vertical equity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Vertical and horizontal equity are widely accepted and applying them to evaluate a tax system is always straightforward.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a characteristic of a more efficient tax system?

A) The system minimizes deadweight loss.

B) The system raises the same amount of revenue at a lower cost.

C) The system minimizes administrative burdens.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Skip places a $20 value on a bottle of wine, and Walt places a $17 value on it. The equilibrium price for a bottle of wine is $15. -Refer to Scenario 12-1.Suppose the government levies a tax of $3 on each bottle of wine,and the equilibrium price of a bottle of wine increases to $18.What is total consumer surplus after the tax is levied?

A) $0

B) $2

C) $5

D) $6

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

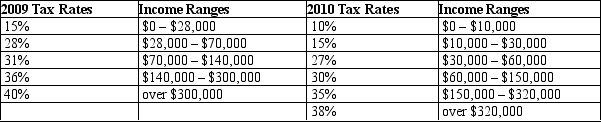

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What happened to his average tax rate between 2009 and 2010?

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What happened to his average tax rate between 2009 and 2010?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your income is $50,000,your income tax liability is $10,000,and you paid $0.25 in taxes on the last dollar you earned,your

A) marginal tax rate is 20 percent.

B) average tax rate is 5 percent.

C) marginal tax rate is 25 percent.

D) average tax rate is 25 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

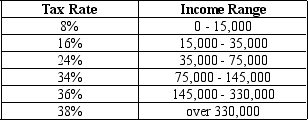

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Livi has taxable income of $78,000,her tax liability is

-Refer to Table 12-2.If Livi has taxable income of $78,000,her tax liability is

A) $7,800.

B) $9,900.

C) $10,200.

D) $15,020.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The argument that each person should pay taxes according to how well the individual can shoulder the burden is called

A) the ability-to-pay principle.

B) the equity principle.

C) the benefits principle.

D) regressive.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal taxes owed by a taxpayer depend

A) only upon the marginal tax rate on the taxpayer's first $25,000 of income.

B) only upon the marginal tax rate on the taxpayer's last $10,000 of income.

C) upon all the marginal tax rates up to the taxpayer's overall level of income.

D) upon all the marginal tax rates, including those for income levels that exceed the taxpayer's overall level of income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payroll tax differs from the individual income tax because the payroll tax is primarily earmarked to pay for

A) employer-provided pensions.

B) Social Security and Medicare.

C) employer-provided health benefits.

D) job loss and training programs.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The claim that all citizens should make an "equal sacrifice" to support government programs is usually associated with

A) the ability-to-pay principle.

B) the benefits principle.

C) efficiency arguments.

D) regressive tax arguments.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

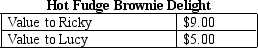

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $4.00 to $6.00.Deadweight loss arises because

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $4.00 to $6.00.Deadweight loss arises because

A) Lucy will pay more tax as a percentage of her value of delights than Ricky.

B) Ricky must pay the $2.00 tax from his consumer surplus.

C) Ricky will have to pay a higher price for delights.

D) Lucy will leave the market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are trying to design a tax system that will simultaneously achieve both of the following goals: 1) a person with no income would pay no taxes,and 2) a high-income person would pay a higher fraction of income in taxes than a low-income person.Which of the following statements is correct?

A) A lump-sum tax would achieve the second goal but not the first.

B) A regressive tax would achieve the second goal but not the first.

C) A progressive tax could achieve both goals.

D) A proportional tax could achieve the second goal but not the first.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax takes a constant fraction of income as income rises,it is

A) regressive.

B) proportional.

C) progressive.

D) based on the ability-to-pay principle.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One advantage of a lump-sum tax over other taxes is that it

A) is both equitable and efficient.

B) doesn't cause deadweight loss.

C) would place a larger tax burden on the rich.

D) would raise more revenues.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 478

Related Exams