B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

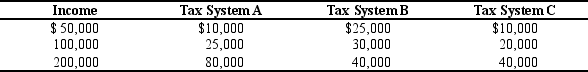

Table 12-13

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-Refer to Table 12-13 Which of the three tax systems is regressive?

-Refer to Table 12-13 Which of the three tax systems is regressive?

A) Tax System A

B) Tax System B

C) Tax System C

D) None of the systems are regressive.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

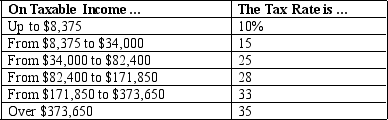

Table 12-1

-Refer to Table 12-1.If Agatha has $80,000 in taxable income,her average tax rate is

-Refer to Table 12-1.If Agatha has $80,000 in taxable income,her average tax rate is

A) 18.5%.

B) 20.2%.

C) 21.8%.

D) 25.0%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

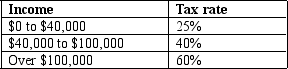

Table 12-6

-Refer to Table 12-6.What is the average tax rate for a person who makes $130,000?

-Refer to Table 12-6.What is the average tax rate for a person who makes $130,000?

A) 30%

B) 40%

C) 50%

D) 60%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

According to the benefits principle,it is fair for people to pay taxes based on the benefits they receive from the government.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One reason for the projected increase,over the next several decades,in government spending as a percentage of GDP is the projected increase in the size of the elderly population.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In many cases,tax loopholes are designed by Congress to

A) give special treatment to specific types of behavior.

B) reduce the overall administrative burden of the tax system.

C) raise revenues for special projects.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a country imposes a lump-sum income tax of $5,000 on each individual in the country.What is the average income tax rate for an individual who earns $40,000 during the year?

A) 0%

B) 10%

C) More than 10%

D) The average tax rate cannot be determined without knowing the entire tax schedule.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most analysts expect the largest federal spending category to continue to grow in importance for many years into the future.What category of spending is this?

A) national defense

B) Social Security

C) income security

D) farm support programs

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Tax evasion is illegal,but tax avoidance is legal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A mortgage interest deduction would be considered

A) tax evasion.

B) a subsidy to the poor.

C) a deduction that benefits all members of society equally.

D) a tax loophole.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Federal government spending on income security rose from 13 percent to 15 percent of total federal spending between 2006 and 2009.The most likely cause of this increase is

A) the recession and consequent increase in the number of unemployed citizens.

B) the shift in power from Republicans to Democrats.

C) wasteful spending due to an abundance of resources.

D) an increase in life expectancies.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Part of the administrative burden of a tax is

A) the money people pay to the government in taxes.

B) reducing the size of the market because of the tax.

C) the hassle of filling out tax forms that is imposed on taxpayers who comply with the tax.

D) the cost of administering programs that use tax revenue.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "other" category of federal spending consists of many less expensive functions of government,including all of the following except

A) housing credit programs.

B) farm support programs.

C) funding for the National Institutes of Health.

D) the federal court system.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If we want to gauge the sacrifice made by a taxpayer,we should use the

A) average tax rate.

B) marginal tax rate.

C) lump-sum tax rate.

D) sales tax rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,the average American paid approximately how much to the federal government in taxes?

A) $1,900

B) $4,500

C) $6,800

D) $8,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in 2012 the average citizen's federal tax bill is $14,888 per person,and total federal spending is $13,997 per person.In 2012,the federal government will have

A) a per person budget surplus of $891.

B) a per person budget deficit of $891.

C) horizontal equity.

D) vertical equity.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The U.S.tax burden is high compared to many European countries,but is low compared to many other nations in the world.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an administrative burden of our tax system?

A) government resources used to enforce tax laws

B) keeping tax records throughout the year

C) paying the taxes owed

D) time spent in April filling out forms

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

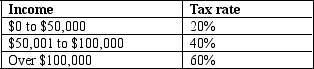

Table 12-7

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $37,000?

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $37,000?

A) 9.25%

B) 20%

C) 25%

D) 40%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 478

Related Exams