B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 17-2. Imagine that two oil companies, Mobile and Cargo, own adjacent oil fields. Under the fields is a common pool of oil worth $96 million. Drilling a well to recover oil costs $3 million per well. If each company drills one well, each will get half of the oil and earn a $45 million profit ($48 million in revenue - $3 million in costs) . Assume that having X percent of the total wells means that a company will collect X percent of the total revenue. -Refer to Scenario 17-2.If Mobile were to drill a second well,what would its profit be if Cargo did not drill a second well?

A) $29 million

B) $58 million

C) $61 million

D) $64 million

F) All of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

In 1971,Congress passed a law that banned cigarette advertising on television.After the ban it is most likely that the (i) profits of cigarette companies increased. (ii) prices of cigarettes increased. (iii) total costs incurred by cigarette companies increased.

A) (i) only

B) (i) and (ii)

C) (ii) and (iii)

D) (i) , (ii) , and (iii)

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 17-5 Assume that a local bank sells two services, checking accounts and ATM card services. The bank's only two customers are Mr. Donethat and Ms. Beenthere. Mr. Donethat is willing to pay $8 a month for the bank to service his checking account and $2 a month for unlimited use of his ATM card. Ms. Beenthere is willing to pay only $5 for a checking account, but is willing to pay $9 for unlimited use of her ATM card. Assume that the bank can provide each of these services at zero marginal cost. -Refer to Scenario 17-5.If the bank is able to use tying to price checking account and ATM services,what is the profit-maximizing price to charge for the "tied" good?

A) $14

B) $10

C) $9

D) $8

F) C) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Laurel and Janet are competitors in a local market and each is trying to decide if it is worthwhile to advertise.If both of them advertise,each will earn a profit of $5,000.If neither of them advertise,each will earn a profit of $10,000.If one advertises and the other doesn't,then the one who advertises will earn a profit of $12,000 and the other will earn $2,000.In this version of the prisoners' dilemma,if the game is played only once,Laurel should

A) advertise, but if the game is to be repeated many times she should probably not advertise.

B) advertise, and if the game is to be repeated many times she should still probably advertise.

C) not advertise, but if the game is to be repeated many times she should probably advertise.

D) not advertise, and if the game is to be repeated many times she should still not advertise.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

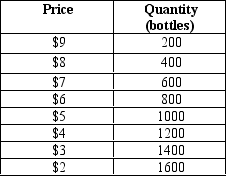

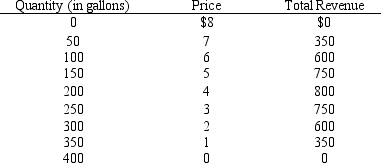

Table 17-8. For a certain small town, the table shows the demand schedule for water. Assume the marginal cost of supplying water is constant at $4 per bottle.

-Refer to Table 17-8.If there are two suppliers of water,Victor and Sami,and if they have successfully formed a cartel,then what would be the price and the market quantity?

-Refer to Table 17-8.If there are two suppliers of water,Victor and Sami,and if they have successfully formed a cartel,then what would be the price and the market quantity?

A) The price would be $7 per bottle and the market quantity would be 600 bottles.

B) The price would be $6 per bottle and the market quantity would be 800 bottles.

C) The price would be $5 per bottle and the market quantity would be 1000 bottles.

D) The price would be $4 per bottle and the market quantity would be 1200 bottles.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cartels in the United States are

A) legal if price is competitively determined.

B) legal if all firms in the industry agree to the terms of the cartel.

C) legal if all conditions of the cartel are made public.

D) illegal.

F) None of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

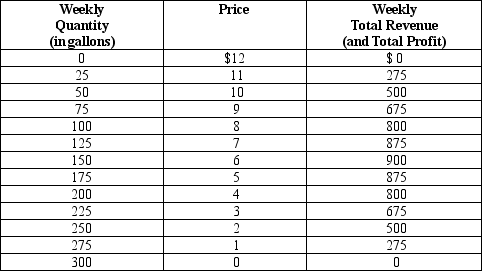

Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

-Refer to Table 17-5.As long as Kunal and Naj operate as a profit-maximizing monopoly,what will their combined weekly revenue amount to?

-Refer to Table 17-5.As long as Kunal and Naj operate as a profit-maximizing monopoly,what will their combined weekly revenue amount to?

A) $450

B) $675

C) $875

D) $900

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Sherman Antitrust Act prohibits competing firms from even talking about fixing prices.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

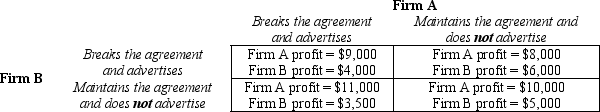

Table 17-23

Two bottled beverage manufacturers (Firm A and Firm B) determine that they could lower their costs, and thus increase their profits, if they reduced their advertising budgets. But in order for the plan to work, each firm must agree to refrain from advertising. Each firm believes that advertising works by increasing the demand for the firm's product, but each firm also believes that if neither firm advertises, the costs savings will outweigh the lost sales. Listed in the table below are the individual profits for each firm.

-Refer to Table 17-23.At the Nash equilibrium,how much profit will Firm A earn?

-Refer to Table 17-23.At the Nash equilibrium,how much profit will Firm A earn?

A) $8,000 because firm A will maintain the agreement not to advertise, but firm B will break the agreement and choose to advertise.

B) $9,000 because each firm will break the agreement and choose to advertise.

C) $10,000 because each firm will maintain the agreement and choose not to advertise.

D) $11,000 because firm B will maintain the agreement not to advertise, but firm A will break the agreement and choose to advertise.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The oligopoly price will be greater than marginal cost but less than the monopoly price when

A) the oligopolists collude by jointly choosing a quantity to produce and maintaining their agreement.

B) the oligopolists collude by jointly choosing a price to charge and maintaining their agreement.

C) each oligopolist individually chooses a quantity to produce to maximize profit.

D) each oligopolist's objective is minimization of average total cost, rather than maximization of profit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In some games,the noncooperative equilibrium is bad for the players and bad for society.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cooperative agreement among oligopolists is less likely to be maintained,

A) the greater the number of oligopolists.

B) the larger the number of buyers of the oligopolists' product.

C) the smaller the number of buyers of the oligopolists' product.

D) the more likely it is that the game among the oligopolists will be played over and over again.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

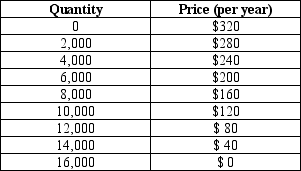

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

-Refer to Table 17-4.Assume there are two high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.What price will they charge for a subscription when this market reaches a Nash equilibrium?

-Refer to Table 17-4.Assume there are two high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.What price will they charge for a subscription when this market reaches a Nash equilibrium?

A) $120

B) $160

C) $200

D) $240

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

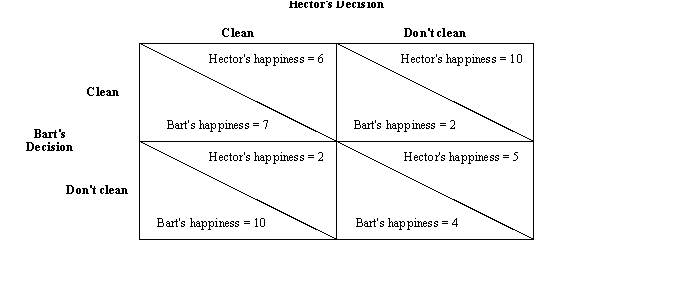

Figure 17-2. Hector and Bart are roommates. On a particular day, their apartment needs to be cleaned. Each person has to decide whether to take part in cleaning. At the end of the day, either the apartment will be completely clean (if one or both roommates take part in cleaning) , or it will remain dirty (if neither roommate cleans) . With happiness measured on a scale of 1 (very unhappy) to 10 (very happy) , the possible outcomes are as follows:

-Refer to Figure 17-2.The dominant strategy for Hector is to

-Refer to Figure 17-2.The dominant strategy for Hector is to

A) clean, and the dominant strategy for Bart is to clean.

B) clean, and the dominant strategy for Bart is to refrain from cleaning.

C) refrain from cleaning, and the dominant strategy for Bart is to clean.

D) refrain from cleaning, and the dominant strategy for Bart is to refrain from cleaning.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 17-10

The table shows the town of Driveaway's demand schedule for gasoline. Assume the town's gasoline seller(s) incurs a cost of $2 for each gallon sold, with no fixed cost.

-Refer to Table 17-10.If there are exactly five sellers of gasoline in Driveaway and if they collude,then which of the following outcomes is most likely?

-Refer to Table 17-10.If there are exactly five sellers of gasoline in Driveaway and if they collude,then which of the following outcomes is most likely?

A) Each seller will sell 50 gallons and charge a price of $3.

B) Each seller will sell 40 gallons and charge a price of $4.

C) Each seller will sell 30 gallons and charge a price of $4.

D) Each seller will sell 30 gallons and charge a price of $5.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 17-4. Consider two cigarette companies, PM Inc. and Brown Inc. If neither company advertises, the two companies split the market and earn $50 million each. If they both advertise, they again split the market, but profits are lower by $10 million since each company must bear the cost of advertising. Yet if one company advertises while the other does not, the one that advertises attracts customers from the other. In this case, the company that advertises earns $60 million while the company that does not advertise earns only $30 million. -Refer to Scenario 17-4.PM Inc.'s dominant strategy is to

A) refrain from advertising regardless of whether Brown Inc. advertises.

B) advertise only if Brown Inc. advertises.

C) advertise only if Brown Inc. does not advertise.

D) advertise regardless of whether Brown Inc. advertises.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Resale price maintenance involves a firm

A) colluding with another firm to restrict output and raise prices.

B) selling two individual products together for a single price rather than selling each product individually at separate prices.

C) temporarily cutting the price of its product to drive a competitor out of the market.

D) requiring that the firm reselling its product do so at a specified price.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Predatory pricing refers to

A) a firm selling certain products together rather than separately.

B) a monopoly firm reducing its price in an attempt to maintain its monopoly.

C) firms colluding to set prices.

D) All of the above are examples of predatory pricing.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A tit-for-tat strategy,in a repeated game,is one in which a player starts by cooperating and then does whatever the other player did last time.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 410

Related Exams