A) any price below $6.00.

B) a price between $4.00 and $6.00.

C) a price between $6.00 and $8.00.

D) any price above $6.00.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Unlike minimum wage laws,wage subsidies

A) discourage firms from hiring the working poor.

B) cause unemployment.

C) help only wealthy workers.

D) raise living standards of the working poor without creating unemployment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term tax incidence refers to the

A) widespread view that taxes always will be a fact of life.

B) ongoing debate about which types of taxes make the most economic sense.

C) division of the tax burden between buyers and sellers.

D) division of the tax burden between sales taxes and income taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of these cases will the tax burden fall most heavily on buyers of the good?

A) The demand curve is relatively steep and the supply curve is relatively flat.

B) The demand curve is relatively flat and the supply curve is relatively steep.

C) The demand curve and the supply curve are both relatively flat.

D) The demand curve and the supply curve are both relatively steep.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the demand for picture frames is inelastic and the supply of picture frames is elastic.A tax of $1 per frame levied on buyers of picture frames will increase the equilibrium price paid by buyers of picture frames by

A) $1.

B) more than $0.50 but less than $1.00.

C) a positive amount but less than $0.50.

D) It is impossible to say without more information.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of TVs

A) leads sellers to supply a smaller quantity at every price.

B) leads buyers to demand a smaller quantity at every price.

C) leads sellers to supply a larger quantity at every price.

D) causes the supply curve to shift to the right.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a price ceiling is imposed in a market and the ceiling is binding,

A) price no longer serves as a rationing device.

B) the quantity supplied at the price ceiling exceeds the quantity that would have been supplied without the price ceiling.

C) buyers and sellers both benefit in equal measure.

D) buyers and sellers both are harmed in equal measure.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

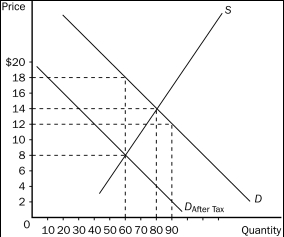

Figure 6-9

-Refer to Figure 6-9.The effective price paid by buyers after the tax is imposed is

-Refer to Figure 6-9.The effective price paid by buyers after the tax is imposed is

A) $18.

B) $14.

C) $12.

D) $8.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most labor economists believe that the supply of labor is

A) less elastic than demand and, therefore, firms bear most of the burden of the payroll tax.

B) less elastic than demand and, therefore, workers bear most of the burden of the payroll tax.

C) more elastic than demand and, therefore, workers bear most of the burden of the payroll tax.

D) more elastic than demand and, therefore, firms bear most of the burden of the payroll tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Policymakers sometimes are attracted to price controls because

A) they view the market's outcome as inefficient.

B) they view the market's outcome as unfair.

C) it is politically popular to impose price controls in markets in which the demand for the good or service is inelastic.

D) they are required to do so under the Employment Act of 1946.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of lemonade,

A) the sellers bear the entire burden of the tax.

B) the buyers bear the entire burden of the tax.

C) the burden of the tax will be always be equally divided between the buyers and the sellers.

D) the burden of the tax will be shared by the buyers and the sellers, but the division of the burden is not always equal.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An outcome that can result from either a price ceiling or a price floor is

A) a surplus in the market.

B) a shortage in the market.

C) a nonbinding price control.

D) long lines of frustrated buyers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Economic policies often have effects that their architects did not intend or anticipate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price ceiling is imposed to benefit buyers,a result is that

A) every buyer in the market benefits.

B) every seller in the market benefits, but the overall benefit to sellers is smaller than the overall benefit to buyers.

C) every buyer in the market benefits and every seller in the market is harmed.

D) some buyers will not be able to buy any amount of the good.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Most economists are in favor of price controls as a way of allocating resources in the economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

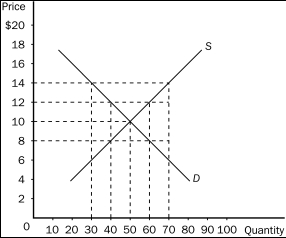

Figure 6-2

-Refer to Figure 6-2.In which of the following cases would sellers have to develop a rationing mechanism?

-Refer to Figure 6-2.In which of the following cases would sellers have to develop a rationing mechanism?

A) A price ceiling is set at $8.

B) A price ceiling is set at $12.

C) A price floor is set at $8.

D) A price floor is set at $10.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price floor

A) is a legal minimum on the price at which a good can be sold.

B) can result when sellers of a good are successful in their attempts to convince the government that the market outcome without a price floor is unfair to them.

C) can create inequities in a market.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

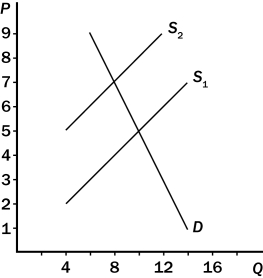

Figure 6-11. On the graph below, the shift of the supply curve from S₁ to S₂ represents the imposition of a tax on a good. On the axes, Q represents the quantity of the good and P represents the price.

-Consider Figure 6-11.Suppose the demand curve is not the one drawn on the graph;instead,the demand curve is a vertical line passing through the point (Q = 10,P = 5) .Using the two supply curves that are drawn,which of the following statements would describe the effects of the tax correctly?

-Consider Figure 6-11.Suppose the demand curve is not the one drawn on the graph;instead,the demand curve is a vertical line passing through the point (Q = 10,P = 5) .Using the two supply curves that are drawn,which of the following statements would describe the effects of the tax correctly?

A) The price paid by buyers would be $9.

B) The price received by sellers (after paying the tax) would be $6.50.

C) The government would collect $27 from the tax.

D) Buyers of the good would bear 100 percent of the burden of the tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on bicycles that buyers of bicycles are required to pay shifts

A) the demand curve downward, causing both the price received by sellers and the equilibrium quantity to fall.

B) the demand curve upward, causing both the price received by sellers and the equilibrium quantity to rise.

C) the supply curve downward, causing the price received by sellers to fall and the equilibrium quantity to rise.

D) the supply curve upward, causing the price received by sellers to rise and the equilibrium quantity to fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a price ceiling is not binding;this means that

A) the equilibrium price is above the price ceiling.

B) the equilibrium price is below the price ceiling.

C) it has no legal enforcement mechanism.

D) people are finding a way to circumvent the law.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 252

Related Exams