B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Changing the basis of taxation from income earned to amount spent will

A) necessarily reduce tax revenues.

B) lower effective interest rates on savings.

C) distort incentives to earn income.

D) eliminate disincentives to save.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kyle places a $10 value on a glass of red wine,and Keith places an $8 value on it.If there is no tax on glasses of red wine,the price of a glass of red wine reflects the cost of making it.The equilibrium price for a glass of red wine is $6.Suppose the government levies a tax of $2 on each glass of red wine,and the equilibrium price of a glass of red wine increases to $8.How much tax revenue is collected?

A) $0

B) $2

C) $4

D) $6

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

According to the benefits principle,it is fair for people to pay taxes based on their ability to shoulder the tax burden.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why do some policymakers support a consumption tax rather than an earnings tax?

A) Because the average tax rate would be lower under a consumption tax.

B) Because a consumption tax would encourage people to save earned income.

C) Because a consumption tax would raise more revenues than an income tax.

D) Because the marginal tax rate would be higher under an earnings tax.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that people in equal conditions should pay equal taxes is referred to as

A) horizontal equity.

B) vertical equity.

C) the ability-to-pay principle.

D) the marriage tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A budget deficit occurs when government receipts fall short of government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Senator Foghorn promised during his campaign for re-election that he would support family values and end the marriage tax.He also promised to make the rich pay their fair share in taxes,so he would make the income tax more progressive.In addition,he promised that all couples with the same income would pay the same tax and that people with no income would not be taxed.Can Senator Foghorn keep all of his promises?

A) Yes, as long as he makes sure that the average tax rate remains lower than the marginal tax rate.

B) Yes, as long as he makes sure that the marginal tax rate remains lower than the average tax rate.

C) Yes, as long as the highest marginal tax rate on married couples is no higher than the highest marginal tax rate on individuals.

D) No, the promises cannot all be met at the same time.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

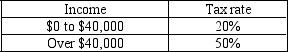

Table 12-5

-Refer to Table 12-5.What is the marginal tax rate for a person who makes $60,000?

-Refer to Table 12-5.What is the marginal tax rate for a person who makes $60,000?

A) 20%

B) 30%

C) 40%

D) 50%

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In practice,the U.S.income tax system is filled with special provisions that alter a family's tax based on its specific circumstances.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax system with little deadweight loss and a small administrative burden would be described as

A) equitable.

B) communistic.

C) capitalistic.

D) efficient.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Nebraska imposed a tax on milk of 10 cents per gallon,

A) this is an excise tax.

B) this is an income tax.

C) tax revenue will fall.

D) the supply of milk will rise.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

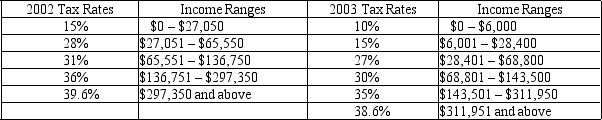

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.What type of tax structure did the United States have in 2002 for single individuals?

-Refer to Table 12-2.What type of tax structure did the United States have in 2002 for single individuals?

A) a proportional tax structure

B) a regressive tax structure

C) a progressive tax structure

D) a lump-sum tax structure

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When taxes are imposed on a commodity,

A) there is never a deadweight loss.

B) some consumers alter their consumption by not purchasing the taxed commodity.

C) tax revenue will rise by the amount of the tax multiplied by the before-tax level of consumption.

D) the taxes do not distort incentives.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local government spending on public welfare includes

A) trash removal.

B) transfer payments to the poor.

C) libraries.

D) road repairs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

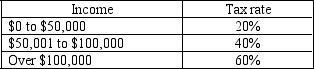

Table 12-7

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $120,000?

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $120,000?

A) 25%

B) 35%

C) 45%

D) 60%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goals of efficiency and equity in tax policy are

A) complementary in most countries.

B) necessary for application of the ability-to-pay principle.

C) often in conflict with each other.

D) easier to achieve when tax codes are complex.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The flypaper theory of tax incidence

A) ignores the indirect effects of taxes.

B) assumes that most taxes should be "stuck on " the rich.

C) says that once a tax has been imposed, there is little chance of it changing, so in essence people are stuck with it.

D) suggests that taxes are like flies because they are everywhere and will never go away.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sue earns income of $80,000 per year.Her average tax rate is 40 percent.Sue paid $4,500 in taxes on the first $30,000 she earned.What was the marginal tax rate on the rest of her income?

A) 15 percent

B) 32 percent

C) 40 percent

D) 55 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tax systems is the most fair?

A) proportional taxes

B) regressive taxes

C) progressive taxes

D) There is no objective way to assess fairness among the three systems.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 328

Related Exams