A) sales taxes.

B) the federal government.

C) corporate income taxes.

D) customs duties.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 10 percent on the first $40,000 of income and 20 percent on all income above $40,000.What is the average tax rate when income is $50,000?

A) 20 percent

B) 15 percent

C) 12 percent

D) 10 percent

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The most important revenue-generating taxes for the federal government are individual income taxes and payroll taxes for social insurance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

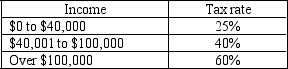

Table 12-6

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $50,000?

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $50,000?

A) 25%

B) 28%

C) 40%

D) 60%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1980s,President Ronald Reagan argued that high tax rates distorted economic incentives to work and save.In the 1990s,President Bill Clinton argued that the rich were not paying their fair share of taxes.Which of the following statements best summarizes the economic theories behind the differing philosophies?

A) President Reagan was concerned about vertical equity, whereas President Clinton was concerned about horizontal equity.

B) President Reagan was concerned about average tax rates, whereas President Clinton was concerned about horizontal equity.

C) President Reagan was concerned about marginal tax rates, whereas President Clinton was concerned about vertical equity.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a nation gets richer,the government typically takes

A) a constant share of income in taxes.

B) a smaller share of income in taxes.

C) a larger share of income in taxes.

D) There is little evidence of a relationship between income and taxes for most countries.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A budget surplus occurs when government receipts exceed government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In many cases,tax loopholes are designed by Congress to

A) give special treatment to specific types of behavior.

B) reduce the overall administrative burden of the tax system.

C) raise revenues for special projects.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government were to impose a tax that assigned everyone the same tax liability,it would be

A) a lump-sum tax.

B) an equitable tax.

C) supported by the poor.

D) a progressive tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax takes a smaller fraction of income as income rises,it is

A) proportional.

B) regressive.

C) progressive.

D) based on the ability-to-pay principle.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The U.S.federal government collects about one-half of the taxes in our economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vertical equity and horizontal equity are associated with

A) the benefits principle of taxation.

B) the ability-to-pay principle of taxation.

C) taxes that have no deadweight losses.

D) falling marginal tax rates.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about the percent of total income the U.S.government takes as taxes?

A) In 1902 the government collected 7 percent of total income; in 2004, it collected 30 percent.

B) In 1902 the government collected 30 percent of total income; in 2004, it collected 7 percent.

C) In 1902 the government collected 7 percent of total income; in 2004, it collected 7 percent.

D) In 1902 the government collected 30 percent of total income; in 2004, it collected 30 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"A $1,000 tax paid by a poor person may be a larger sacrifice than a $10,000 tax paid by a wealthy person" is an argument based on

A) the horizontal equity principle.

B) the benefits principle.

C) a regressive tax argument.

D) the ability-to-pay principle.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

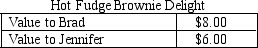

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Total consumer surplus

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Total consumer surplus

A) falls by less than the tax revenue generated.

B) falls by more than the tax revenue generated.

C) falls by the same amount as the tax revenue generated.

D) will not fall since Jennifer will no longer be in the market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rank the following state and local government expenditure categories from largest to smallest.

A) education, public welfare, highways

B) transfer payments to the poor, education, public safety

C) police, road maintenance, education

D) public health, public safety, public utilities

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following countries has the largest tax burden?

A) Mexico

B) Russia

C) United States

D) France

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) A gasoline tax can be an example of a benefits tax.

B) A progressive tax attempts to achieve vertical equity.

C) A progressive tax can be an example of the ability-to-pay principle.

D) A regressive tax attempts to achieve horizontal equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If we want to gauge the sacrifice made by a taxpayer,we should use the

A) average tax rate.

B) marginal tax rate.

C) lump-sum tax rate.

D) sales tax rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

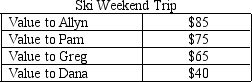

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.What is the value of the surplus that accrues to all four skiers from their weekend trip?

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.What is the value of the surplus that accrues to all four skiers from their weekend trip?

A) $265

B) $113

C) $140

D) $105

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 328

Related Exams