A) less than 25 units

B) 25 units

C) between 25 units and 50 units

D) greater than 50 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Long lines

A) and discrimination according to seller bias are both inefficient rationing mechanisms because they both waste buyers' time.

B) and discrimination according to seller bias are both inefficient rationing mechanisms because the good does not necessarily go to the buyer who values it most highly.

C) are an inefficient rationing mechanism because they waste buyers' time, and discrimination according to seller bias is an inefficient rationing mechanism because the good does not necessarily go to the buyer who values it most highly.

D) are an inefficient rationing mechanism because the good does not necessarily go to the buyer who values it most highly, and discrimination according to seller bias is an inefficient rationing mechanism because it wastes buyers' time.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) The economy contains many labor markets for different types of workers.

B) The impact of the minimum wage depends on the skill and experience of the worker.

C) The minimum wage is binding for workers with high skills and much experience.

D) The minimum wage is not binding when the equilibrium wage is above the minimum wage.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price received by sellers in a market will increase if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) imposes a binding price ceiling in that market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on buyers of tea,

A) buyers of tea and sellers of tea both are made worse off.

B) buyers of tea are made worse off, and the well-being of sellers is unaffected.

C) buyers of tea are made worse off, and sellers of tea are made better off.

D) the well-being of both buyers of tea and sellers of tea is unaffected.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Even though federal law mandates that workers and firms each pay half of the total FICA tax, the tax burden may not fall equally on workers and firms.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A large majority of economists favor eliminating the minimum wage.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a tax is imposed on the sellers of a product, then the tax burden will fall entirely on the sellers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

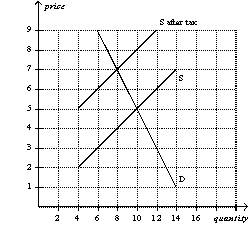

Figure 6-19  -Refer to Figure 6-19. The price paid by buyers after the tax is imposed is

-Refer to Figure 6-19. The price paid by buyers after the tax is imposed is

A) $3.

B) $4.

C) $5.

D) $7.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The wedge between the buyers' price and the sellers' price is the same, regardless of whether the tax is levied on buyers or sellers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009, the U.S. minimum wage according to federal law was

A) $4.25 per hour.

B) $5.15 per hour.

C) $5.75 per hour.

D) $7.25 per hour.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government has imposed a price floor on cellular phones. Which of the following events could transform the price floor from one that is binding to one that is not binding?

A) Cellular phones become less popular.

B) Traditional land line phones become more expensive.

C) The components used to produce cellular phones become less expensive.

D) Firms expect the price of cellular phones to fall in the future.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the equilibrium wage is $4 per hour and the minimum wage is $5.15 per hour, then a shortage of labor will exist.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The housing shortages caused by rent control are larger in the long run than in the short run because both the supply of housing and the demand for housing are more elastic in the long run.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Lawmakers can decide whether the buyers or the sellers must send a tax to the government, but they cannot legislate the true burden of a tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on a market with elastic demand and elastic supply will shrink the market more than a tax on a market with inelastic demand and inelastic supply will shrink the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose sellers of perfume are required to send $1.00 to the government for every bottle of perfume they sell. Further, suppose this tax causes the price paid by buyers of perfume to rise by $0.60 per bottle. Which of the following statements is correct?

A) The effective price received by sellers is $0.40 per bottle less than it was before the tax.

B) Sixty percent of the burden of the tax falls on sellers.

C) This tax causes the demand curve for perfume to shift downward by $1.00 at each quantity of perfume.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The proportion of minimum-wage earners who are in families with incomes below the poverty line is

A) less than one-third.

B) between one-third and one-half.

C) between one-half and two-thirds.

D) greater than two-thirds.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Binding price ceilings benefit consumers because they allow consumers to buy all the goods they demand at a lower price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, before OPEC increased the price of crude oil in 1973, there was

A) no price ceiling on gasoline.

B) a nonbinding price ceiling on gasoline.

C) a binding price ceiling on gasoline.

D) a nonbinding price floor on gasoline.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 421 - 440 of 556

Related Exams