A) 4 percent

B) 5 percent

C) 6 percent

D) None of the above would give a present value within a cent of $162.24.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

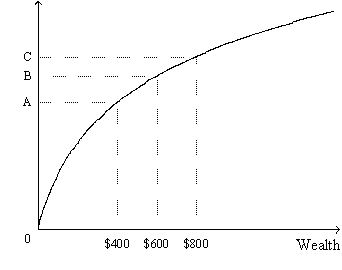

Figure 14-1. The figure shows a utility function.  -Refer to Figure 14-1. Which distance along the vertical axis represents the marginal utility of an increase in wealth from $600 to $800?

-Refer to Figure 14-1. Which distance along the vertical axis represents the marginal utility of an increase in wealth from $600 to $800?

A) the distance between the origin and point B

B) the distance between the origin and point C

C) the distance between point A and point C

D) the distance between point B and point C

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The market for insurance is one example of reducing risk by using diversification.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Albert can buy a bond for $1,000 that matures in two years and pays Albert $1,102.5 with certainty. He is indifferent between this bond and one that has some risk but on which the interest rate is 3% higher. How much, to the nearest penny, does the riskier bond pay in two years?

A) $1,160.00

B) $1,166.40

C) $1,168.65

D) $1,169.64

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct concerning diversification?

A) It only reduces firm-specific risk, but most of the reduction comes from increasing the number of stocks in a portfolio to well above 30.

B) It only reduces firm-specific risk; much of the reduction comes from increasing the number of stocks in a portfolio from 1 to 30.

C) It only reduces market risk, but most of the reduction comes from increasing the number of stocks in a portfolio to well above 30.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct expression for finding the present value of a $1,000 payment one year from today if the interest rate is 6 percent?

A) $1,000(1.06)

B) $1,000(1.06)

C) $1,000/(1.06)

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recently, Lisa's wealth increased by $500. If her wealth were to increase by another $500 in the near future, then her utility would increase, but not by as much as it increased with the recent increase to her wealth. Based on this information, Lisa's utility function

A) and marginal utility function are both upward sloping.

B) and marginal utility function are both downward sloping.

C) is upward sloping and her marginal utility function is downward sloping.

D) is downward sloping and her marginal utility function is upward sloping.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A scholarship gives you $1,000 today and promises to pay you $1,000 one year from today. What is the present value of these payments?

A) $2,000/(1 + r) 2.

B) $1,000 + $1,000/(1 + r)

C) $1,000/(1 + r) + $1,000/(1 + r) 2

D) $1,000(1 + r) + $1,000(1 + r) 2

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you deposit $900 into an account for two years and the interest rate is 4%, how much do you have at the end of the two years?

A) $972.00

B) $973.44

C) $974.19

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Diversification can reduce firm-specific risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the Internet you find the following offers for opening an online account. Which of them is the best offer if you have $2,000 to save for two years?

A) an interest rate of 5 percent, with the bank charging you a $15 processing fee at the time you open your account

B) an interest rate of 3.5 percent, with the bank giving you a $35 bonus to open your account

C) an interest rate of 4 percent, with the bank giving you a $20 bonus at the time you open your account

D) an interest rate of 4.5 percent, with no processing fee and no bonus

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

PZX Corporation has the opportunity to undertake an investment project that will cost $10,000 today and yield the company $13,310 in 3 years. PZX will forgo the project if the interest rate is higher than 10 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that interest rates unexpectedly rise and that Carter Corporation announces that revenues from last quarter were down but not as much as the public had anticipated they would be down. According to the efficient markets hypothesis, which of the these things make the price of Carter Corporation Stock fall?

A) both the interest rate rising and the revenue announcement

B) neither the interest rate rising nor the revenue announcement

C) only the interest rate rising

D) only the revenue announcement

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robert put $15,000 into an account with a fixed interest rate two years ago and now the account balance is $16,695.38. What rate of interest did Robert earn?

A) 4.5 percent

B) 5.5 percent

C) 6.5 percent

D) 8.0 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of present value helps explain why

A) investment decreases when the interest rate increases, and it also helps explain why the quantity of loanable funds demanded decreases when the interest rate increases.

B) investment decreases when the interest rate increases, but it is of no help in explaining why the quantity of loanable funds demanded decreases when the interest rate increases.

C) the quantity of loanable funds demanded decreases when the interest rate increases, but it is of no help in explaining why investment decreases when the interest rate increases.

D) None of the above are correct; the concept of present value is of no help in explaining why either investment or the quantity of loanable funds demanded decreases when the interest rate increases.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Adverse selection is illustrated by people who take greater risks after they purchase insurance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If asset markets are driven by the "animal spirits" of investors, then

A) those markets reflect rational behavior.

B) those markets reflect irrational behavior.

C) the efficient markets hypothesis is correct.

D) the stock market exhibits informational efficiency.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The performance of index funds

A) usually falls short of the performance of actively-managed funds.

B) provides evidence in support of the notion that stock prices do not depend upon supply and demand.

C) provides evidence in support of the efficient markets hypothesis.

D) provides evidence in support of the notion that stock-market participants are irrational.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the interest rate causes a decrease in the future value of $1,000 that you have in a bank account today.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following make(s) insurance premiums higher than otherwise?

A) adverse selection and moral hazard

B) adverse selection, but not moral hazard

C) moral hazard, but not adverse selection

D) neither adverse selection nor moral hazard

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 419

Related Exams