B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If P = 4 and Y = 450, then which of the following pairs of values are possible?

A) M = 800, V = 4

B) M = 600, V =3

C) M = 400, V =2

D) M = 200, V =1

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You bought some shares of stock and, over the next year, the price per share decreased by 7 percent and the price level decreased by 9 percent. Before taxes, you experienced

A) both a nominal gain and a real gain.

B) a nominal gain and a real loss.

C) a nominal loss and a real gain.

D) both a nominal loss and a real loss.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, the price level increases if

A) either money demand or money supply shifts right.

B) either money demand or money supply shifts left.

C) money demand shifts right or money supply shifts left.

D) money demand shifts left or money supply shifts right.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An excess supply of money is eliminated by a falling price level

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed increases the money supply, then 1/P

A) falls, so the value of money falls.

B) falls, so the value of money rises.

C) rises, so the value of money falls.

D) rises, so the value of money rises.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the assumptions of the Fisher effect and monetary neutrality, if the money supply growth rate falls, then

A) both the nominal and the real interest rate fall.

B) neither the nominal nor the real interest rate fall.

C) the nominal interest rate falls, but the real interest rate does not.

D) the real interest rate falls, but the nominal interest rate does not.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

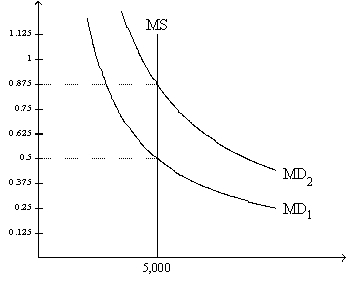

Figure 17-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.  -Refer to Figure 17-2. Which of the following events could explain a shift of the money-demand curve from MD1 to MD2?

-Refer to Figure 17-2. Which of the following events could explain a shift of the money-demand curve from MD1 to MD2?

A) an increase in the value of money

B) a decrease in the price level

C) an open-market purchase of bonds by the Federal Reserve

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Inflation distorts savings when real interest income, rather than nominal interest income, is taxed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The inflation tax

A) is an alternative to income taxes and government borrowing.

B) taxes most those who hold the most money.

C) is the revenue created when the government prints money.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kaitlyn purchased one share of Northwest Energy stock for $200; one year later she sold that share for $400. The inflation rate over the year was 50 percent. The tax rate on nominal capital gains is 50 percent. What was the tax on Kaitlyn's capital gain?

A) $50

B) $75

C) $100

D) $200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money supply is 4,000, nominal GDP is 8,000, and real GDP is 4,000, Which of the following is 2?

A) The price level and velocity

B) the price level but not velocity

C) the price level and velocity.

D) neither the price level nor velocity

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Steve purchases some land for $30,000. He maintains it, but makes no improvements to it. One year later he sells it for $32,000. Stephanie puts $30,000 in a savings account that pays 6% interest. Steve has to pay the 50% capital gains tax, Stephanie is in the 35% tax bracket. The inflation rate was 2%. Who had the higher before-tax real gain and who had the higher after-tax real gain?

A) Steve had both the higher before-tax real gain and the higher after-tax real gain.

B) Steve had the higher before-tax real gain but Stephanie had the higher after-tax real gain.

C) Stephanie had the higher before-tax real gain but Steve had the higher after-tax real gain.

D) Stephanie had both the higher before-tax real gain and the higher after-tax real gain.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The United States has never had deflation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, the money demand curve slopes

A) upward, because at higher prices people want to hold more money.

B) downward, because at higher prices people want to hold more money.

C) downward, because at higher price people want to hold less money.

D) upward, because at higher prices people want to hold less money.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Serena purchased 10 shares of GLC, Inc.stock for $200 per share; one year later she sold the 10 shares for $220 a share. Over the year, the price level increased from 135.0 to 143.1. The tax rate on capital gains is 50 percent. If the capital gains tax is on nominal gains, how much tax does Serena pay on her gain?

A) $90

B) $95

C) $100

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

One study found that unemployment is the economic term mentioned most often in U.S. newspapers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The money demand curve shifts to the left when the Fed buys government bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Velocity is computed as

A) (PY) /M.

B) (PM) /Y.

C) (YM) /P.

D) (YM) /V.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tara deposits money into an account with a nominal interest rate of 6 percent. She expects inflation to be 2 percent. Her tax rate is 20 percent. Tara's after-tax real rate of interest

A) will be 2.8 percent if inflation turns out to be 2 percent; it will be higher if inflation turns out to be higher than 2 percent.

B) will be 2.8 percent if inflation turns out to be 2 percent; it will be lower if inflation turns out to be higher than 2 percent.

C) will be 3.2 percent if inflation turns out to be 2 percent; it will be higher if inflation turns out to be higher than 2 percent.

D) will be 3.2 percent if inflation turns out to be 2 percent; it will be lower if inflation turns out to be higher than 2 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 388

Related Exams