A) both an increase in the budget deficit and capital flight

B) an increase in the budget deficit, but not capital flight

C) capital flight, but not an increase in the budget deficit

D) neither an increase in the budget deficit nor capital flight

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. put an import quota on clothing, it would

A) raise U.S. net exports of clothing and raise net exports of other U.S. goods.

B) raise U.S. net exports of clothing and lower net exports of other U.S. goods.

C) lower U.S. net exports of clothing and raise net exports of other U.S. goods.

D) lower U.S. net exports of clothing and lower net exports of other U.S. goods.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an open economy,

A) net capital outflow = imports.

B) net capital outflow = net exports.

C) net capital outflow = exports.

D) None of the above is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the British government raised its budget deficit, then the pound (Britain's currency) would

A) depreciate and British net exports would rise.

B) depreciate and British net exports would fall.

C) appreciate and British net exports would rise.

D) appreciate and British net exports would fall.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. government increased its deficit, then

A) U.S. bonds would pay higher interest but a dollar would purchase fewer foreign goods.

B) U.S. bonds would pay higher interest and a dollar would purchase more foreign goods.

C) U.S. bonds would pay lower interest and a dollar would purchase fewer foreign goods.

D) U.S. bonds would pay lower interest but a dollar would purchase more foreign goods.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the government budget deficit shifts the demand for loanable funds to the right.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States in the early 1980s, there was a government budget

A) surplus and a trade surplus.

B) deficit and a trade deficit.

C) surplus and a trade deficit.

D) deficit and a trade surplus.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If policymakers impose import restrictions on clothing, the U.S. trade deficit will shrink.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country raises its budget deficit then

A) both its supply of and demand for loanable funds shift.

B) its supply of but not its demand for loanable funds shifts.

C) its demand for but not its supply of loanable funds shifts.

D) neither its supply nor its demand for loanable funds shift.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the supply of loanable funds shifts left, then

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantity of loanable funds falls.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

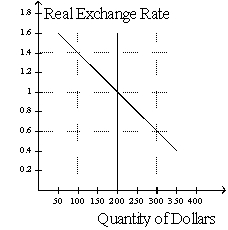

Figure 19-2  -Refer to Figure 19-2. If the real exchange rate is .6, then there is a

-Refer to Figure 19-2. If the real exchange rate is .6, then there is a

A) surplus of 100 so the real exchange rate will fall.

B) surplus of 100 so the real exchange rate will rise.

C) shortage of 100 so the real exchange rate will fall.

D) shortage of 100 so the real exchange rate will rise.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A rise in the budget deficit

A) shifts both the supply of loanable funds in the market for loanable funds and the supply of dollars in the market for foreign-currency exchange right.

B) shifts both the supply of loanable funds in the market for loanable funds and the supply of dollars in the market for foreign-currency exchange left.

C) shifts both the demand for loanable funds in the market for loanable funds and the demand for dollars in the market for foreign-currency exchange right.

D) shifts both the demand for loanable funds in the market for loanable funds and the demand for dollars in the market for foreign-currency exchange left.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model which of the following falls if there is an increase in the budget deficit?

A) the interest rate

B) net exports

C) the exchange rate

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The purchase of a capital asset adds to the demand for loanable funds only if that asset is a domestic one.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would both raise the U.S. exchange rate?

A) capital flight from other countries to the U.S. occurs and the U.S. moves from budget surplus to budget deficit

B) capital flight from other countries to the U.S. occurs and the U.S. moves from budget deficit to budget surplus

C) capital flight from the U.S. to other countries occurs, the U.S. moves from budget surplus to budget deficit

D) capital flight from U.S. to other countries occurs, the U.S. moves from budget deficit to budget surplus

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, if a country's interest rate rises, its net capital outflow

A) rises and the real exchange rate rises.

B) falls and the real exchange rate falls.

C) rises and the real exchange rate falls.

D) falls and the real exchange rate rises.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Mexico suffered from capital flight in 1994, Mexico's real interest rate

A) fell and the peso appreciated.

B) fell and the peso depreciated.

C) rose and the peso appreciated.

D) rose and the peso depreciated.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the open-economy macroeconomic model, if the United States moved from a government budget deficit to a government budget surplus, U.S. real interest rates would increase and the real exchange rate of the U.S. dollar would appreciate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If Argentina suffers from capital flight, Argentinean domestic investment and Argentinean net exports will both decline.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If government policy encouraged households to save more at each interest rate, then

A) the real exchange rate and net exports would rise.

B) the real exchange rate and net exports would fall.

C) the real exchange rate would rise and net exports would fall.

D) the real exchange rate would fall and net exports would rise.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 374

Related Exams