B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The long-run effects of rent controls are a good illustration of the principle that

A) society faces a short-run tradeoff between unemployment and inflation.

B) the cost of something is what you give up to get it.

C) people respond to incentives.

D) government can sometimes improve on market outcomes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

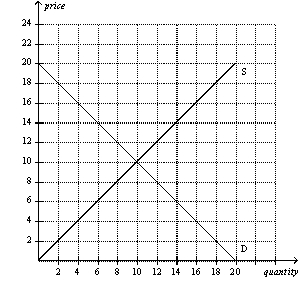

Figure 6-7  -Refer to Figure 6-7.Which of the following statements is correct?

-Refer to Figure 6-7.Which of the following statements is correct?

A) A price floor set at $6 will be binding and will result in a surplus of 8 units.

B) A price floor set at $6 will be binding and will result in a surplus of 4 units.

C) A price floor set at $16 will be binding and will result in a surplus of 12 units.

D) A price floor set at $16 will be binding and will result in a surplus of 6 units.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed on the sellers of a good,the supply curve shifts

A) upward by the amount of the tax.

B) downward by the amount of the tax.

C) upward by less than the amount of the tax.

D) downward by less than the amount of the tax.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The minimum wage is more often binding for teenagers than for other members of the labor force.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A price floor set below the equilibrium price is binding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose buyers of liquor are required to send $1.00 to the government for every bottle of liquor they buy.Further,suppose this tax causes the effective price received by sellers of liquor to fall by $0.60 per bottle.Which of the following statements is correct?

A) This tax causes the supply curve for liquor to shift upward by $1.00 at each quantity of liquor.

B) The price paid by buyers is $0.40 per bottle more than it was before the tax.

C) Sixty percent of the burden of the tax falls on buyers.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes the price paid by buyers to be different than the price received by sellers?

A) a binding price floor

B) a binding price ceiling

C) a tax on the good

D) More than one of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a binding price floor is imposed on a market for a good,some people who want to sell the good cannot do so.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

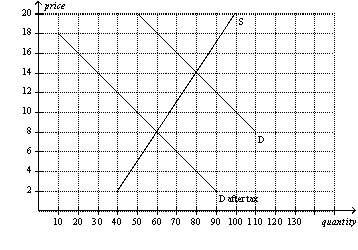

Figure 6-10  -Refer to Figure 6-10.The amount of the tax per unit is

-Refer to Figure 6-10.The amount of the tax per unit is

A) $4.

B) $5.

C) $6.

D) $10.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A shortage results when

A) a nonbinding price ceiling is imposed on a market.

B) a nonbinding price ceiling is removed from a market.

C) a binding price ceiling is imposed on a market.

D) a binding price ceiling is removed from a market.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the sellers of a product,then there will be a(n)

A) downward shift of the supply curve.

B) upward shift of the supply curve.

C) movement up and to the right along the supply curve.

D) movement down and to the left along the supply curve.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is not binding,then

A) there will be a surplus in the market.

B) there will be a shortage in the market.

C) the market will be less efficient than it would be without the price ceiling.

D) there will be no effect on the market price or quantity sold.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is imposed on a market with inelastic demand and elastic supply,then

A) buyers will bear most of the burden of the tax.

B) sellers will bear most of the burden of the tax.

C) the burden of the tax will be shared equally between buyers and sellers.

D) it is impossible to determine how the burden of the tax will be shared.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of popcorn

A) increases the size of the popcorn market.

B) decreases the size of the popcorn market.

C) has no effect on the size of the popcorn market.

D) may increase,decrease,or have no effect on the size of the popcorn market.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

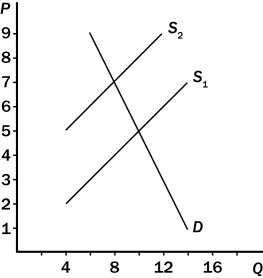

Figure 6-11  -Refer to Figure 6-11.How much tax revenue does this tax generate for the government?

-Refer to Figure 6-11.How much tax revenue does this tax generate for the government?

A) $75

B) $125

C) $175

D) $300

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

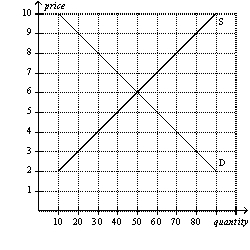

Figure 6-4  -Refer to Figure 6-4.Suppose a price floor of $7 is imposed on this market.As a result,

-Refer to Figure 6-4.Suppose a price floor of $7 is imposed on this market.As a result,

A) buyers' total expenditure on the good decreases by $20.

B) the supply curve shifts to the left so as to now pass through the point (quantity = 40,price = $7) .

C) the quantity of the good demanded decreases by 20 units.

D) the price of the good continues to serve as the rationing mechanism.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set below the equilibrium price is binding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $2.00 tax levied on the buyers of lawnmowers will shift the demand curve

A) upward by exactly $2.00.

B) upward by less than $2.00.

C) downward by exactly $2.00.

D) downward by less than $2.00.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2007,the U.S.minimum wage according to federal law was

A) $4.25 per hour.

B) $5.15 per hour.

C) $5.75 per hour.

D) $7.25 per hour.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 459

Related Exams