A) all the burden of the tax ultimately falls on the corporation's owners.

B) the corporation is more like a tax collector than a taxpayer.

C) output must increase to compensate for reduced profits.

D) less deadweight loss will occur since corporations are entities and not people who respond to incentives.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

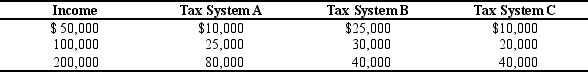

Table 12-15

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-Refer to Table 12-15.Which of the three tax systems is proportional?

-Refer to Table 12-15.Which of the three tax systems is proportional?

A) Tax System A

B) Tax System B

C) Tax System C

D) None of the systems are proportional.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States,the payroll tax is also called a

A) dividend income tax.

B) social insurance tax.

C) value added tax.

D) capital gains tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tax systems could not be structured to satisfy conditions of vertical equity?

A) A proportional tax

B) A regressive tax

C) A progressive tax

D) A lump-sum tax

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The average American pays a higher percent of his income in taxes today than he would have in the late 18th century.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Vertical equity is the idea that taxpayers with similar abilities to pay taxes should pay the same amount.

B) Horizontal equity is the idea that taxes should be levied on a person according to how well that person can shoulder the burden.

C) A regressive tax would mean that high-income tax payers pay a larger fraction of their income in taxes than would low-income taxpayers.

D) A proportional tax would mean that high-income and low-income taxpayers pay the same fraction of income in taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's tax obligation divided by her income is called her

A) marginal social tax rate.

B) marginal private tax rate.

C) marginal tax rate.

D) average tax rate.

F) None of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Goals of efficiency and equity in tax policy are

A) complementary in most countries.

B) necessary for application of the ability-to-pay principle.

C) often in conflict with each other.

D) easier to achieve when tax codes are complex.

F) All of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

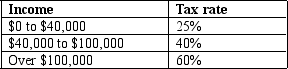

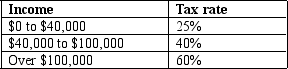

Table 12-6

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $35,000?

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $35,000?

A) 25%

B) 30%

C) 40%

D) 60%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

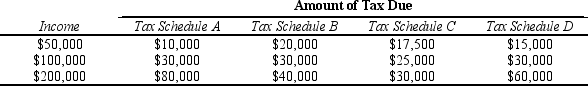

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the lowest marginal tax rate?

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the lowest marginal tax rate?

A) Tax Schedule B

B) Tax Schedule C

C) Tax Schedule D

D) It is impossible to determine which tax schedule has the lowest marginal tax rate from the given information.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If we want to gauge the sacrifice made by a taxpayer,we should use the

A) average tax rate.

B) marginal tax rate.

C) lump-sum tax rate.

D) sales tax rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes on specific goods such as gasoline and alcoholic beverages are called

A) excise taxes.

B) payroll taxes.

C) sales taxes.

D) social insurance taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Among the major spending categories for state and local governments,which of the following statements is correct?

A) The biggest single expenditure is education.

B) The public welfare category does not include the costs of administering some federal programs.

C) As a general rule,spending on public schools and public universities exceeds that spent on all other services combined.

D) Local services such as libraries,police,trash removal,fire protection,and park maintenance,are a very small share of expenditures overall.

F) C) and D)

Correct Answer

verified

A

Correct Answer

verified

True/False

According to the benefits principle,it is fair for people to pay taxes based on the benefits they receive from the government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-6

-Refer to Table 12-6.What is the average tax rate for a person who makes $130,000?

-Refer to Table 12-6.What is the average tax rate for a person who makes $130,000?

A) 30%

B) 40%

C) 50%

D) 60%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In designing a tax system,policymakers have two objectives that are often conflicting.They are

A) maximizing revenue and minimizing costs to taxpayers.

B) efficiency and minimizing costs to taxpayers.

C) efficiency and equity.

D) maximizing revenue and reducing the national debt.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

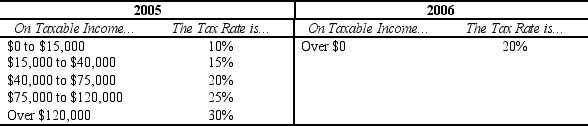

Table 12-10

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-10.For an individual who earned $35,000 in taxable income in both years,which of the following describes the change in the individual's marginal tax rate between the two years?

-Refer to Table 12-10.For an individual who earned $35,000 in taxable income in both years,which of the following describes the change in the individual's marginal tax rate between the two years?

A) The marginal tax rate increased from 2005 to 2006.

B) The marginal tax rate decreased from 2005 to 2006.

C) The marginal tax rate remained constant from 2005 to 2006.

D) The change in the marginal tax rate cannot be determined for the two tax schedules shown.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight losses occur in markets in which

A) firms decide to downsize.

B) the government imposes a tax.

C) profits fall because of low consumer demand.

D) equilibrium prices fall.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

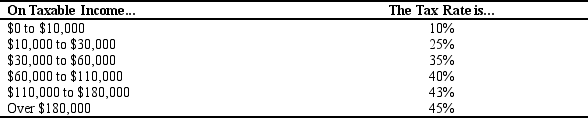

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the average tax rate for an individual with $280,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the average tax rate for an individual with $280,000 in taxable income?

A) 39.9%

B) 40.2%

C) 42.7%

D) 44.8%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most health care economists believe that it will be very difficult to stem the rise in health care costs because

A) government intervention is unpopular with most citizens,especially the elderly.

B) improvements in medical technology have not kept pace with technological improvements in other sectors of the economy.

C) increased competition will increase rather than reduce costs.

D) medical advances are providing better ways to extend and improve human lives but at high costs.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 397

Related Exams