A) $2.

B) $37.

C) $52.

D) $97.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One advantage of a lump-sum tax over other taxes is that it

A) is both equitable and efficient.

B) doesn't cause deadweight loss.

C) would place a larger tax burden on the rich.

D) would raise more revenues.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket.In addition,suppose the price of a movie ticket is $5. -Refer to Scenario 12-2.Suppose the government levies a tax of $1 on a movie ticket and that,as a result,the price of a movie ticket increases to $6.If Bob and Lisa both purchase a movie ticket,what is the deadweight loss from the tax?

A) $0

B) $1

C) $2

D) $3

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's tax liability refers to

A) the percentage of income that a person must pay in taxes.

B) the amount of tax a person owes to the government.

C) the amount of tax the government is required to refund to each person.

D) deductions that can be legally subtracted from a person's income each year.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

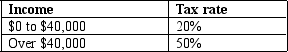

Table 12-5

-Refer to Table 12-5.What is the average tax rate for a person who makes $60,000?

-Refer to Table 12-5.What is the average tax rate for a person who makes $60,000?

A) 20%

B) 30%

C) 40%

D) 50%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If Mary earns $80,000 in taxable income and pays $40,000 in taxes,her marginal tax rate must be 50 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following countries,which country's government collects the largest amount of tax revenue as a percentage of that country's total income?

A) France

B) United States

C) Canada

D) Sweden

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat calculates that for every extra dollar she earns,she owes the government 33 cents.Her total income now is $35,000,on which she pays taxes of $7,000.Determine her average tax rate and her marginal tax rate.

A) Her average tax rate is 33% and her marginal tax rate is 20%.

B) Her average tax rate is 20% and her marginal tax rate is 33%.

C) Her average tax rate is 20% and her marginal tax rate is 20%.

D) Her average tax rate is 33% and her marginal tax rate is 33%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If revenue from a gasoline tax is used to build and maintain public roads,the gasoline tax may be justified on the basis of

A) the benefits principle.

B) the ability-to-pay principle.

C) vertical equity.

D) horizontal equity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Suppose Jim and Joan receive great satisfaction from their consumption of cheesecake.Joan would be willing to purchase only one slice and would pay up to $6 for it.Jim would be willing to pay $9 for his first slice,$7 for his second slice,and $3 for his third slice.The current market price is $3 per slice. -Refer to Scenario 12-1.How much consumer surplus does Joan receive from consuming her slice of cheesecake?

A) $3

B) $6

C) $9

D) $12

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Individual income taxes and social insurance taxes generate the highest tax revenue for the federal government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lump-sum tax

A) is most frequently used to tax real property.

B) does not distort incentives.

C) distorts incentives more than any other type of tax.

D) is the most fair tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of a "welfare program" is most closely associated with which particular federal government program?

A) Spending on medical research

B) Temporary Assistance for Needy Families (TANF)

C) Medicare

D) Social Security

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A budget surplus occurs when government receipts exceed government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes a situation where tax laws give preferential treatment to specific types of behavior?

A) Tax evasion

B) A political payoff

C) A tax loophole

D) Compensation for the benefit of society

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Some states do not have a state income tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a poor family has three children in public school and a rich family has two children in private school,the benefits principle would suggest that

A) the poor family should pay more in taxes to pay for public education than the rich family.

B) the rich family should pay more in taxes to pay for public education than the poor family.

C) the benefits of private school exceed those of public school.

D) public schools should be financed by property taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Deadweight losses arise because a tax causes some individuals to change their behavior.

B) False

Correct Answer

verified

Correct Answer

verified

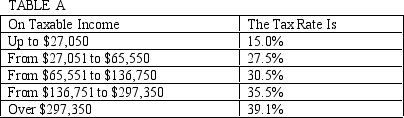

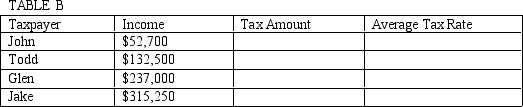

Essay

Use Table A to complete Table B.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept that people should pay taxes based on the benefits they receive from government services is called

A) the ability-to-pay principle.

B) the benefits principle.

C) horizontal equity.

D) vertical equity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 397

Related Exams