A) has decreased from about 20 percent to about 10 percent.

B) has remained constant at about 10 percent.

C) has risen from less than 2 percent to about 44.4 percent.

D) has risen from less than 5 percent to about 33.3 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the benefits principle,it is fair for people to pay taxes based on their ability to shoulder the tax burden.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A general sales tax on food is regressive when low-income taxpayers spend a larger proportion of their income on food than high-income taxpayers.

B) A general sales tax on food is regressive when middle income taxpayers spend a smaller proportion of their income on food than high-income taxpayers.

C) A general sales tax on food is regressive when high-income taxpayers spend a larger proportion of their income on food than middle income taxpayers.

D) A general sales tax on food is regressive when high-income taxpayers spend a larger proportion of their income on food than low-income taxpayers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average tax rate measures the

A) fraction of spending paid in taxes.

B) fraction of income paid in taxes.

C) incremental rate of tax on income.

D) average deadweight loss from all taxes.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Deadweight losses and administrative burdens are key factors considered when determining the efficiency of the tax system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government finances the budget deficit by

A) borrowing from the public.

B) borrowing solely from the Federal Reserve Bank.

C) printing currency in the amount of the budget deficit.

D) requiring that budget surpluses occur every other year to pay off the deficits.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that people in equal conditions should pay equal taxes is referred to as

A) horizontal equity.

B) vertical equity.

C) the ability-to-pay principle.

D) the marriage tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A budget surplus occurs when government receipts fall short of government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With a lump-sum tax,the

A) marginal tax rate is always less than the average tax rate.

B) average tax rate is always less than the marginal tax rate.

C) marginal tax rate falls as income rises.

D) marginal tax rate rises as income rises.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

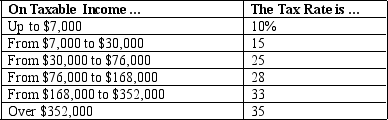

Table 12-1

-Refer to Table 12-1.If Barb has $126,000 in taxable income,her tax liability will be

-Refer to Table 12-1.If Barb has $126,000 in taxable income,her tax liability will be

A) $27,940.

B) $28,270.

C) $29,650.

D) $35,280.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-3.A taxpayer faces the following tax rates on her income: 20 percent of the first $40,000 of her income; 30 percent of all her income above $40,000. -Refer to Scenario 12-3.At what level of income would the taxpayer's marginal tax rate be 30 percent and her average tax rate be 25 percent?

A) $42,000

B) $57,000

C) $60,000

D) $80,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

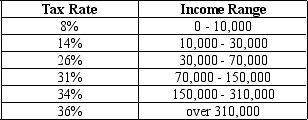

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Max has taxable income of $227,000,his tax liability is

-Refer to Table 12-2.If Max has taxable income of $227,000,his tax liability is

A) $57,220.

B) $60,870.

C) $64,980.

D) $68,770.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.federal government collects taxes in a number of ways.Rank the following sources of revenue from the largest to the smallest.

A) Corporate income taxes,individual income taxes,social insurance taxes

B) Social insurance taxes,individual income taxes,corporate income taxes

C) Individual income taxes,social insurance taxes,corporate income taxes

D) Individual income taxes,corporate income taxes,social insurance taxes

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The public welfare spending category for state and local governments includes

A) many programs that are initiated by private foundations.

B) contributions in support of public universities.

C) some federal programs that are administered by state and local governments.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because the marginal tax rate rises as income rises,

A) higher income families,in general,pay a larger percentage of their income in taxes.

B) lower income families,in general,pay a larger percentage of their income in taxes.

C) a disproportionately large share of the tax burden falls upon the poor.

D) higher income families pay the same percentage of their income in taxes as lower-income families.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

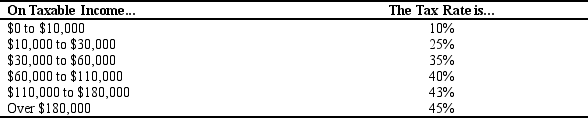

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the marginal tax rate for an invidvidual with $212,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the marginal tax rate for an invidvidual with $212,000 in taxable income?

A) 0%

B) 1%

C) 2%

D) 45%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

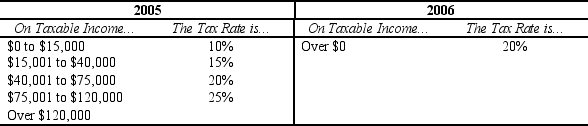

Table 12-13

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-13.Suppose one goal of the tax system was to achieve vertical equity.While people may disagree about what is "equitable," based on the marginal tax rates given for the two years,which of the following statements is true?

-Refer to Table 12-13.Suppose one goal of the tax system was to achieve vertical equity.While people may disagree about what is "equitable," based on the marginal tax rates given for the two years,which of the following statements is true?

A) Vertical equity is possible in both years.

B) Vertical equity is possible in 2005 but not in 2006.

C) Vertical equity is not possible in 2005 but is possible in 2006.

D) Vertical equity is not possible in either year.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Temporary Assistance for Needy Families (TANF) falls into which spending category?

A) Medicare

B) Income security

C) Guaranteed social eligibility

D) Social Security

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate profits are

A) included in payroll taxes.

B) exempt from taxes.

C) taxed twice,once as profit and once as dividends.

D) taxed to pay for Medicare.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) National defense and health care are the two largest spending categories for the federal government.

B) Welfare programs and highways are the two largest spending categories for state and local governments.

C) Sales taxes and property taxes are the two most important revenue sources for state and local governments.

D) Corporate income taxes are the largest source of revenue for the federal government.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 397

Related Exams