A) A country's standard of living depends on its ability to produce goods & People face tradeoffs.

B) Prices rise when the government prints too much money & Governments can sometimes improve market outcomes.

C) Governments can sometimes improve market outcomes & People face tradeoffs.

D) People face tradeoffs & Prices rise when the government prints too much money .

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

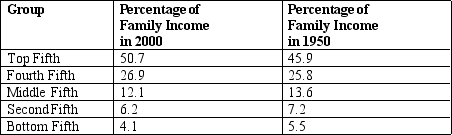

Table 20-2

Percentage of Before-Tax Income Received by Families in Hapland

-Refer to Table 20-2.According to the table,from 1950 to 2000,Hapland income distribution became

-Refer to Table 20-2.According to the table,from 1950 to 2000,Hapland income distribution became

A) less equal.

B) more equal.

C) more equal at the lowest level of income but less equal at highest level of income.

D) less equal at the lowest level of income but more equal at highest level of income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The only qualification to receive government assistance under a negative income tax is

A) pre-school children.

B) to be enrolled in job training.

C) a working head-of-household.

D) a low income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relative to direct cash payments,in-kind transfers have the advantage of being

A) more politically popular.

B) more efficient.

C) more respectful of the poor.

D) of a higher dollar value than cash payments.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The poverty rate is a measure of people unable to meet the government's poverty line.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

According to libertarians,the government should redistribute income from rich individuals to poor individuals to achieve a more equal distribution of income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum wage laws

A) benefit all unskilled workers.

B) create unemployment,but if demand is relatively elastic,the unemployment effects will be minor.

C) may help the nonpoor,such as teenagers from wealthy families.

D) reduce poverty by reducing unemployment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic mobility refers to the

A) government's attempt to distribute monetary assistance to areas most in need.

B) ability of families to freely relocate to find good jobs.

C) movement of people among income classes.

D) movement of resources from one country to another.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following programs would be opposed by philosopher John Rawls?

A) A negative income tax.

B) The Supplemental Security Income (SSI) program.

C) A tax plan creating a perfectly egalatarian income distribution.

D) Rawls would oppose all of the programs.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The United States has a more equal distribution of income than other developed countries such as Japan and Germany.

B) The statement "a rising tide lifts all boats" illustrates how economic growth reduces the number of people with income levels below the poverty line.

C) The economic life cycle explains why people base spending decisions on transitory income.

D) The libertarian political philosophy follows the maximin criterion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

About half of black and Hispanic children in female-headed households live in poverty.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The English philosophers Jeremy Bentham and John Stuart Mill founded the school of thought called

A) liberalism.

B) libertarianism.

C) mobilism.

D) utilitarianism.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-1 Suppose that a society is made up of five families whose incomes are as follows: $120,000;$90,000;$30,000;$30,000;and $18,000. The federal government is considering two potential income tax plans: Plan A is a negative income tax plan where the taxes owed equal 1/3 of income minus $20,000. Plan B is a two-tiered plan where the poverty line is $35,000;families earning over $35,000 pay 10% of their income in taxes,and families earning less than $35,000 pay no income tax. -Refer to Scenario 20-1.Assuming that utility is directly proportional to the cash value of after-tax income,which government policy would an advocate of utilitarianism prefer?

A) Plan A

B) Plan B

C) either Plan A or Plan B

D) neither Plan A nor Plan B because any plan that forcibly redistributes income is against the philosophy

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The utilitarian case for redistributing income is based on the assumption of

A) collective consensus.

B) a notion of fairness engendered by equality.

C) diminishing marginal utility.

D) rising marginal utility.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to utilitarians,the ultimate objective of public actions should be to

A) enhance the income of the rich.

B) ensure an egalitarian distribution of income.

C) maximize the sum of individual utility.

D) provide for the betterment of the poor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

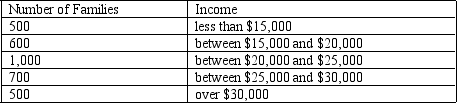

Multiple Choice

The distribution of income for Danville is as follows:

Where would the government in Danville set the poverty line to establish a poverty rate of 33.3 percent?

Where would the government in Danville set the poverty line to establish a poverty rate of 33.3 percent?

A) $15,000.

B) $20,000.

C) $25,000.

D) $30,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Libertarianism identifies a redistribution of income role for government when

A) individual incomes vary widely.

B) the income distribution is altered by illegal means (e.g.theft) .

C) a social planner is needed to smooth out the transitory income stream.

D) workers lose their jobs as a result of structural changes in the economy.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

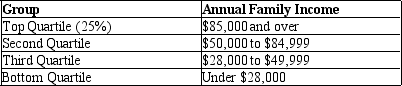

Table 20-1

-Refer to Table 20-1.Seventy-five percent of all families have incomes below what level?

-Refer to Table 20-1.Seventy-five percent of all families have incomes below what level?

A) $28,000

B) $50,000

C) $85,000

D) There is insufficient information to answer this question.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-4

Poverty Thresholds in 2002,by Size of Family and Number of Related Children Under 18 Years

[Dollars]

![Table 20-4 Poverty Thresholds in 2002,by Size of Family and Number of Related Children Under 18 Years [Dollars] Source: U.S.Bureau of the Census,Current Population Survey. -Refer to Table 20-4.What is the poverty line for a family of three with one child? A) $12,072 B) $12,400 C) $14,480 D) $14,494](https://d2lvgg3v3hfg70.cloudfront.net/TB4796/11ea69b9_50ed_8174_b0c5_1d973309e361_TB4796_00_TB4796_00_TB4796_00_TB4796_00_TB4796_00.jpg) Source: U.S.Bureau of the Census,Current Population Survey.

-Refer to Table 20-4.What is the poverty line for a family of three with one child?

Source: U.S.Bureau of the Census,Current Population Survey.

-Refer to Table 20-4.What is the poverty line for a family of three with one child?

A) $12,072

B) $12,400

C) $14,480

D) $14,494

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In-kind transfers are

A) obtained only by those who have political connections.

B) provided only by the U.S.government.

C) non-monetary items given to the poor.

D) obtained primarily through soup kitchens and private charities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 312

Related Exams