A) A payment of $100 to be received one year from today,with a 2 percent interest rate,has a present value of $98.81.

B) A payment of $200 to be received two years from today,with a 3 percent interest rate,has a present value of $188.52.

C) A payment of $300 to be received three years from today,with a 4 percent interest rate,has a present value of $234.34.

D) None of the above are correct to the nearest cent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best illustrates moral hazard?

A) After a person obtains life insurance,she takes up skydiving.

B) A person obtains insurance knowing he is in poor health.

C) A person holds stock only in very risky corporations.

D) A person holds stocks from only a few corporations.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By diversifying,the risk of holding stock

A) can be eliminated.On average over the past two centuries stocks paid a higher average real return than bonds.

B) can be eliminated.On average over the past two centuries stocks paid a lower average real return than bonds.

C) can be reduced but not eliminated.On average over the past two centuries stocks paid a higher average real return than bonds.

D) can be reduced but not eliminated.On average over the past two centuries stocks paid a lower average real return than bonds.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the standpoint of the economy as a whole,the role of insurance is

A) to entice risk-loving people to become risk averse.

B) to promote the phenomenon of adverse selection.

C) not to eliminate the risks inherent in life,but to spread them around more efficiently.

D) not to spread risks,but to eliminate them for individual policy holders.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following changes would decrease the present value of a future payment?

A) a decrease in the size of the payment

B) an increase in the time until the payment is made

C) an increase in the interest rate

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sari puts $100 into an account with an interest rate of 10 percent.According to the rule of 70,about how much does she have at the end of 21 years?

A) $210

B) $300

C) $800

D) $1,010

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

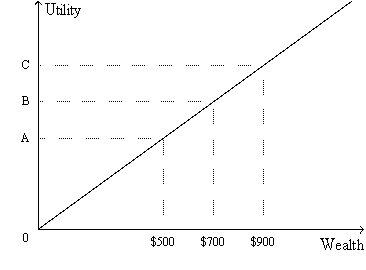

Figure 19-3.The figure shows a utility function for Rob.  -Refer to Figure 19-3.From the appearance of Rob's utility function,we know that

-Refer to Figure 19-3.From the appearance of Rob's utility function,we know that

A) if Rob owns a house,then he definitely would buy fire insurance provided the cost of the insurance were reasonable.

B) Rob would voluntarily exchange a portfolio of stocks with a high average return and a high level of risk for a portfolio with a low average return and a low level of risk.

C) Rob is risk averse.

D) Rob is not risk averse.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $35.00 two years from today equal to about $30.00 today?

A) 5 percent

B) 6 percent

C) 7 percent

D) 8 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If more people think a corporation's stock is overvalued than think it is undervalued then there is a

A) surplus,so its price will rise.

B) surplus,so its price will fall.

C) shortage,so its price will rise.

D) shortage,so its price will fall.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By purchasing shares in a mutual fund that holds a portfolio of stocks,a person can

A) benefit from fundamental analysis,since the mutual fund requires its shareholders to perform fundamental analysis on their own.

B) benefit from fundamental analysis,since the mutual fund hires one or more individuals to perform fundamental analysis for the fund.

C) eliminate market risk.

D) reduce the standard deviation of his or her portfolio to zero.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 25,1980 three pals graduated from high school,pooled together $3,000 and put the money into an account promising to pay 8% for the next 30 years.On May 25,2010 they withdrew all the money from the account.To the nearest dollar,how much did they withdraw?

A) $25,962

B) $27,297

C) $30,188

D) None of the above are correct to the nearest dollar.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have a bond that entitles you to a one-time payment of $10,000 one year from now.The interest rate is 10 percent per year.How much is the bond worth today?

A) $9,090.91

B) $10,000.00

C) $8,264.46

D) $9,523.81

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

James offers you $1,000 today or $X in 7 years.If the interest rate is 4.5 percent,then you would prefer to take the $1,000 today if and only if

A) X < 1,045.00.

B) X < 1,188.89.

C) X < 1,266.67.

D) X < 1,360.86.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A soup manufacturer unexpectedly announces that it has hired a new manager.It is widely believed that this manager will raise the profitability of the corporation.At the same time interest rates unexpectedly rise.Which of the above would tend to make the price of the stock rise?

A) the announcement and the rise in interest rates

B) the announcement but not the rise in interest rates

C) the rise in interest rates,but not the announcement

D) neither the announcement nor the rise in interest rates

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct way to compute the future value of $1 put into an account that earns 5 percent interest for 16 years?

A) $1(1 + .05) 16

B) $1(1 + .0516) 16

C) $1(1 + .0516)

D) $1(1 + 16/.05) 16

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following concepts is most helpful in explaining why investment increases when the interest rate falls?

A) deadweight loss

B) present value

C) economic growth

D) financial intermediation

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diversification

A) increases the likely fluctuation in a portfolio's return.Thus,the likely standard deviation of the portfolio's return is higher.

B) increases the likely fluctuation in a portfolio's return.Thus,the likely standard deviation of the portfolio's return is lower.

C) reduces the likely fluctuation in a portfolio's return.Thus,the likely standard deviation of the portfolio's return is higher.

D) reduces the likely fluctuation in a portfolio's return.Thus,the likely standard deviation of the portfolio's return is lower.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

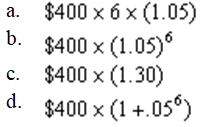

If you put $400 into a bank account today and it promises to pay 5% interest for 6 years,how much is in the account at the end of the six years?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose interest of 5% for two years can be earned on $1,000 saved today with no risk.What is the least amount a person would need to have a 50% chance of winning to be willing to face a 50% chance of losing $1,000 today and be considered risk averse?

A) $907.03 to be paid in two years

B) $1,000.01 to be paid in two years

C) $1,100.01 to be paid in two years

D) $1,102.51 to be paid in two years

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If you believe the stock market is informationally efficient,then it is a waste of time to engage in fundamental analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 421

Related Exams