A) command and control solution

B) corrective tax

C) corrective subsidy

D) all of the above.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When externalities are present in a market,the well-being of market participants

A) and market bystanders are both directly affected.

B) and market bystanders are both indirectly affected.

C) is directly affected,and market bystanders are indirectly affected.

D) is indirectly affected,and market bystanders are directly affected.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

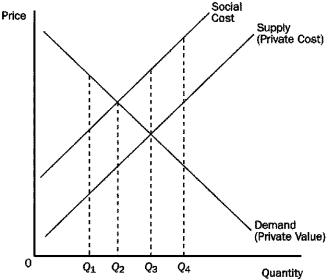

Figure 10-7  -Refer to Figure 10-7.To internalize the externality in this market,the government should

-Refer to Figure 10-7.To internalize the externality in this market,the government should

A) impose a tax on this product.

B) provide a subsidy for this product.

C) forbid production.

D) produce the product itself.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When a transaction between a buyer and seller directly affects a third party,the effect is called an externality.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

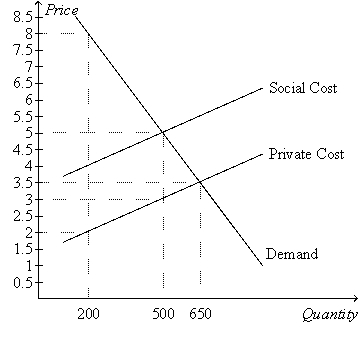

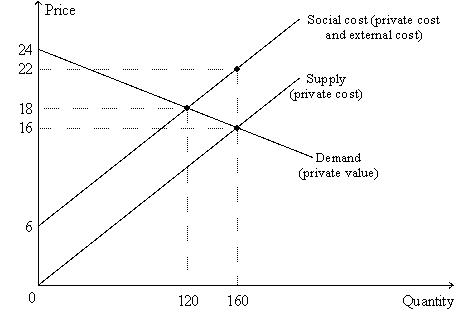

Figure 10-2.The graph depicts the market for plastic.  -Refer to Figure 10-2.Suppose that the production of plastic creates a social cost which is depicted in the graph above.What is the socially optimal quantity of plastic?

-Refer to Figure 10-2.Suppose that the production of plastic creates a social cost which is depicted in the graph above.What is the socially optimal quantity of plastic?

A) 200 units

B) 450 units

C) 500 units

D) 650 units

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In some circumstances,selling pollution permits may be better than levying a corrective tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Social welfare can be enhanced by allowing firms to trade their rights to pollute.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When market activity generates a negative externality,the level of output in the market equilibrium is lower than the socially optimal level.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the purpose of protecting the environment,upon which of the following approaches do we rely more and more as time goes by?

A) adherence to the notion of the invisible hand

B) command-and-control policies

C) the development and enforcement of regulations

D) the requirement that decision makers bear the full costs of their actions

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The impact of one person's actions on the well-being of a bystander is called

A) an economic dilemma.

B) deadweight loss.

C) a multi-party problem.

D) an externality.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

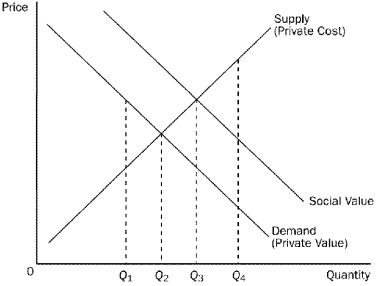

Figure 10-10  -Refer to Figure 10-10.The graph represents a market in which

-Refer to Figure 10-10.The graph represents a market in which

A) there is no externality.

B) there is a positive externality.

C) there is a negative externality.

D) The answer cannot be determined from inspection of the graph.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

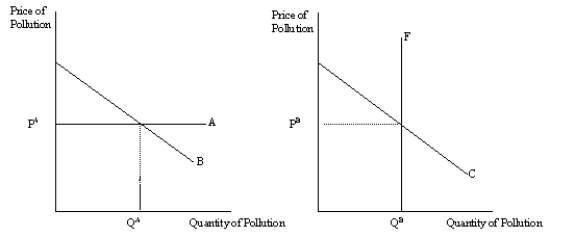

Figure 10-15  -Refer to Figure 10-15.Which graph illustrates a corrective tax?

-Refer to Figure 10-15.Which graph illustrates a corrective tax?

A) the left graph

B) the right graph

C) both graphs

D) neither graph

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that elementary education creates a positive externality.If the government subsidizes education by an amount equal to the per-unit externality it creates,then

A) the equilibrium quantity of education will equal the socially optimal quantity of education.

B) the equilibrium quantity of education will be greater than the socially optimal quantity of education.

C) the equilibrium quantity of education will be less than the socially optimal quantity of education.

D) There is not enough information to answer the question.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an advantage of tradable pollution permits?

A) Each firm is allowed to pollute exactly the same amount.

B) Revenue from the sale of permits is greater than revenue from a corrective tax.

C) The initial allocation of permits to firms does not affect the efficiency of the market.

D) Firms will engage in joint research efforts to reduce pollution.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 10-4  -Refer to Figure 10-4.This market is characterized by

-Refer to Figure 10-4.This market is characterized by

A) government intervention.

B) a positive externality.

C) a negative externality.

D) None of the above is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

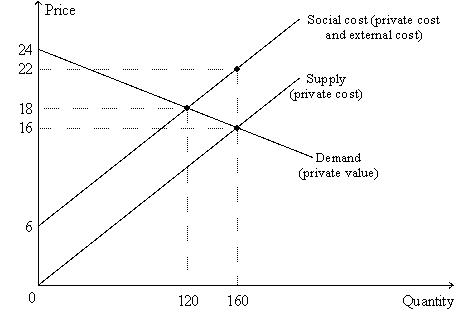

Figure 10-10  -Refer to Figure 10-10.An increase in output from 120 units to 160 units would

-Refer to Figure 10-10.An increase in output from 120 units to 160 units would

A) move the market from a socially efficient outcome to a socially inefficient outcome.

B) increase the external cost per unit of output.

C) increase total economic well-being.

D) be an action of which a benevolent social planner would approve.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Markets are often inefficient when negative externalities are present because

A) private costs exceed social costs at the private market solution.

B) externalities cannot be corrected without government regulation.

C) social costs exceed private costs at the private market solution.

D) production externalities lead to consumption externalities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A patent is used to

A) disseminate information.

B) offset the negative effects of taxes.

C) protect inventors for as long as they live.

D) assign property rights.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Coase theorem suggests that taxes should be enacted to alleviate the effects of negative externalities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Coase theorem,in the presence of externalities

A) private parties can bargain to reach an efficient outcome.

B) government assistance is necessary to reach an efficient outcome.

C) the assignment of legal rights can prevent externalities.

D) the initial distribution of property rights will determine the efficient outcome.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 70

Related Exams