B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Mixster Concrete Company is considering buying a new cement truck.The owners and their accountants decide that this is the profitable thing to do.Before they can buy the truck,the interest rate and price of trucks change.In which case do these changes both make them less likely to buy the truck?

A) Interest rates rise and truck prices rise.

B) Interest rates fall and truck prices rise.

C) Interest rates rise and truck prices fall.

D) Interest rates fall and truck prices fall.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

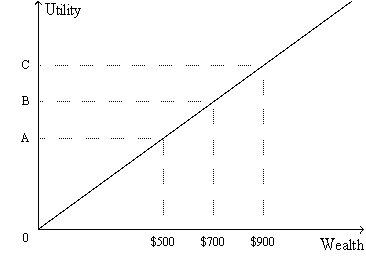

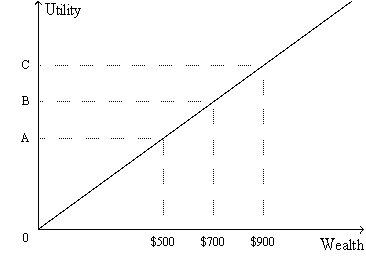

Figure 27-3.The figure shows a utility function for Rob.  -Refer to Figure 27-3.If most people's utility functions look like Rob's utility function,then it is easy to explain why

-Refer to Figure 27-3.If most people's utility functions look like Rob's utility function,then it is easy to explain why

A) people buy various types of insurance.

B) we observe a trade-off between risk and return.

C) most people prefer to hold diversified portfolios of assets to undiversified portfolios of assets.

D) None of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same,an increase in the interest rate makes the quantity of loanable funds demanded

A) rise,and investment spending rise.

B) rise,and investment spending fall.

C) fall,and investment spending rise.

D) fall,and investment spending fall.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct concerning stock market irrationality?

A) Bubbles could arise,in part,because the price that people pay for stock depends on what they think someone else will pay for it in the future.

B) Economists almost all agree that the evidence for stock market irrationality is convincing and the departures from rational pricing are important.

C) Some evidence for the existence of market irrationality is that informed and presumably rational managers of mutual funds generally beat the market.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If you believe the stock market is informationally efficient,then it is a waste of time to engage in fundamental analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If stock prices follow a random walk,it means

A) long periods of declining prices are followed by long periods of rising prices.

B) the greater the number of consecutive days of price declines,the greater the probability prices will increase the following day.

C) stock prices are unrelated to random events that shock the economy.

D) stock prices are just as likely to rise as to fall at any given time.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Risk aversion simply means that people dislike bad things to happen.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A measure of the volatility of a variable is its

A) present value.

B) future value.

C) return.

D) standard deviation.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The market for insurance is an example of diversification.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the rule of 70,if the interest rate is 10 percent,about how long will it take for the value of a savings account to double?

A) about 6.3 years

B) about 7 years

C) about 7.7 years

D) about 10 years

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The concept of present value helps explain why the quantity of loanable funds demanded decreases when the interest rate increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A high-ranking corporate official of a well-known company is unexpectedly sentenced to prison for criminal activity in trading stocks.This should

A) raise the price and raise the present value of the corporation's stock.

B) raise the price and lower the present value of the corporation's stock.

C) lower the price and raise the present value of the corporation's stock.

D) lower the price and lower the present value of the corporation's stock.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

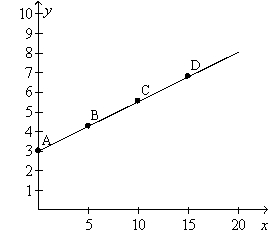

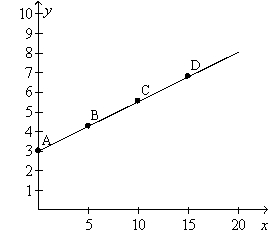

Figure 27-5.On the graph,x represents risk and y represents return.  -Refer to Figure 27-5.Which of the following statements is correct?

-Refer to Figure 27-5.Which of the following statements is correct?

A) At point A the standard deviation of the portfolio is 3.

B) A risk averse person always will choose to be at point A.

C) At point D the portfolio consists of about 15 percent stocks and 85 percent safe assets.

D) The figure shows that the greater the risk,the greater the return.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 27-3.The figure shows a utility function for Rob.  -Refer to Figure 27-3.From the appearance of Rob's utility function,we know that

-Refer to Figure 27-3.From the appearance of Rob's utility function,we know that

A) if Rob owns a house,then he definitely would buy fire insurance provided the cost of the insurance were reasonable.

B) Rob would voluntarily exchange a portfolio of stocks with a high average return and a high level of risk for a portfolio with a low average return and a low level of risk.

C) Rob is risk averse.

D) Rob is not risk averse.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tami knows that people in her family die young,and so she buys life insurance.Preston knows he is a reckless driver and so he applies for automobile insurance.

A) These are both examples of adverse selection.

B) These are both examples of moral hazard.

C) The first example illustrates adverse selection,and the second illustrates moral hazard.

D) The first example illustrates moral hazard,and the second illustrates adverse selection.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

From the standpoint of the economy as a whole,the role of insurance is to greatly reduce or eliminate the risks inherent in life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

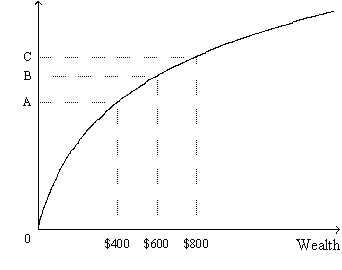

Figure 27-1.The figure shows a utility function.  -Refer to Figure 27-1.Which distance along the vertical axis represents the marginal utility of an increase in wealth from $600 to $800?

-Refer to Figure 27-1.Which distance along the vertical axis represents the marginal utility of an increase in wealth from $600 to $800?

A) the distance between the origin and point B

B) the distance between the origin and point C

C) the distance between point A and point C

D) the distance between point B and point C

F) B) and D)

Correct Answer

verified

D

Correct Answer

verified

True/False

If a savings account pays 5 percent annual interest,then the rule of 70 tells us that the account value will double in approximately 14 years.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Figure 27-5.On the graph,x represents risk and y represents return.  -Refer to Figure 27-5.Point A represents a situation in which

-Refer to Figure 27-5.Point A represents a situation in which

A) all of a person's savings are allocated to a class of safe assets.

B) the person knows with certainty that his or her return will be 3 percent.

C) the standard deviation of the person's portfolio is zero.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 67

Related Exams