Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 82

True/False

If the fair market value of the property on the date of death is greater than on the alternate valuation date, the use of the alternate valuation amount is mandatory.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 83

Multiple Choice

Kelly inherits land which had a basis to the decedent of $95,000 and a fair market value of $50,000 on August 4, 2017, the date of the decedent's death. The executor distributes the land to Kelly on November 12, 2017, at which time the fair market value is $49,000. The fair market value on February 4, 2018, is $45,000. In filing the estate tax return, the executor elects the alternate valuation date. Kelly sells the land on June 10, 2018, for $48,000. What is her recognized gain or loss?

A) ($1,000)

B) ($2,000)

C) ($47,000)

D) $1,000

E) None of the above

F) A) and B)

G) A) and C)

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Question 84

True/False

If the alternate valuation date is elected by the executor in 2017, the total basis of inherited property will be more than what it would have been if the primary valuation date and amount had been used.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 85

Multiple Choice

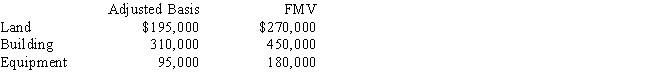

Mona purchased a business from Judah for $1,000,000. Judah's records and an appraiser provided her with the following information regarding the assets purchased:

What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

F) A) and E)

G) C) and D)

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 86

True/False

Purchased goodwill is assigned a basis equal to cost, which is calculated using the residual method associated with the purchase of a business.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 87

True/False

Transactions between related parties that result in disallowed losses might later provide a tax benefit to the related party buyer.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 88

True/False

The holding period for nontaxable stock dividends that are the same type (i.e., common on common) includes the holding period of the original shares, but the holding period for nontaxable stock dividends that are not the same type (i.e., preferred on common) is new and begins on the date the dividend is received.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 148 of 148

Related Exams