B) False

Correct Answer

verified

Correct Answer

verified

True/False

Jill transfers property worth $200,000 (basis of $190,000) to Blue Corporation. In return, she receives 80% of the stock in Blue Corporation (fair market value of $180,000) and a long-term note, executed by Blue and made payable to Jill (fair market value of $20,000). Jill recognizes gain of $20,000 on the transfer.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joe and Kay form Gull Corporation. Joe transfers cash of $250,000 for 200 shares in Gull Corporation. Kay transfers property with a basis of $50,000 and fair market value of $240,000. She agrees to accept 200 shares in Gull Corporation for the property and for providing bookkeeping services to the corporation in its first year of operation. The value of Kay's services is $10,000. With respect to the transfer:

A) Gull Corporation has a basis of $240,000 in the property transferred by Kay.

B) Neither Joe nor Kay recognizes gain or income on the exchanges.

C) Gull Corporation has a business deduction under § 162 of $10,000.

D) Gull capitalizes $10,000 as organizational costs.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A shareholder's holding period for stock received under § 351 includes the holding period of the property transferred to the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jane and Walt form Orange Corporation. Jane transfers equipment worth $475,000 (basis of $100,000) and cash of $25,000 to Orange Corporation for 50% of its stock. Walt transfers a building and land worth $525,000 (basis of $200,000) for 50% of Orange's stock and $25,000 cash.

A) Jane recognizes a gain of $375,000; Walt recognizes a gain of $325,000.

B) Jane recognizes a gain of $25,000; Walt recognizes no gain.

C) Neither Jane nor Walt recognizes gain.

D) Jane recognizes no gain; Walt recognizes a gain of $25,000.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sarah and Tony (mother and son) form Dove Corporation with the following investments: cash by Sarah of $55,000; land by Tony (basis of $35,000 and fair market value of $45,000) . Dove Corporation issues 200 shares of stock, 100 each to Sarah and Tony. Thus, each receives stock in Dove worth $50,000.

A) Section 351 cannot apply since Sarah should have received 110 shares instead of only 100.

B) As a result of the transfer, Tony recognizes a gain of $10,000.

C) Tony's basis in the stock of Dove Corporation is $50,000.

D) Section 351 may apply because stock need not be issued to Sarah and Tony in proportion to the value of the property transferred.

E) None of the above.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Carmen and Carlos form White Corporation. Carmen transfers cash of $100,000 for 100 shares in White. Carlos transfers property (basis of $20,000 and fair market value of $80,000) and agrees to serve as manager of White Corporation for one year; in return, Carlos receives 100 shares in White. The value of Carlos's services is $20,000. White Corporation can deduct $20,000 as compensation expense for the value of the services Carlos will render.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When depreciable property is transferred to a controlled corporation under § 351, any recapture potential disappears and does not carry over to the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tara incorporates her sole proprietorship, transferring it to newly formed Black Corporation. The assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000. Also transferred was $10,000 in liabilities, $1,000 of which was personal and the balance of $9,000 being business related. In return for these transfers, Tara receives all of the stock in Black Corporation.

A) Black Corporation has a basis of $241,000 in the property.

B) Black Corporation has a basis of $240,000 in the property.

C) Tara's basis in the Black Corporation stock is $241,000.

D) Tara's basis in the Black Corporation stock is $249,000.

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wade and Paul form Swan Corporation with the following investments. Wade transfers machinery (basis of $40,000 and fair market value of $100,000) , while Paul transfers land (basis of $20,000 and fair market value of $90,000) and services rendered (worth $10,000) in organizing the corporation. Each is issued 25 shares in Swan Corporation. With respect to the transfers:

A) Wade has no recognized gain; Paul recognizes income/gain of $80,000.

B) Neither Wade nor Paul has recognized gain or income on the transfers.

C) Swan Corporation has a basis of $30,000 in the land transferred by Paul.

D) Paul has a basis of $30,000 in the 25 shares he acquires in Swan Corporation.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Allen transfers marketable securities with an adjusted basis of $120,000, fair market value of $300,000, for 85% of the stock of Heron Corporation. In addition, he receives cash of $40,000. Allen recognizes a capital gain of $40,000 on the transfer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a corporation is thinly capitalized, all debt is reclassified as equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wren Corporation (a minority shareholder in Lark Corporation) has made loans to Lark Corporation that become worthless in the current year.

A) Wren Corporation is not permitted a deduction for the loans.

B) The loans result in a nonbusiness bad debt deduction to Wren Corporation.

C) The loans provide Wren Corporation with a business bad debt deduction.

D) Wren claims a capital loss due to the uncollectible loans.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In a § 351 transfer, the receipt of boot is not taxed if the shareholder has a realized loss.

B) False

Correct Answer

verified

Correct Answer

verified

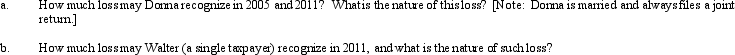

Essay

In 2004, Donna transferred assets (basis of $300,000 and fair market value of $250,000) to Egret Corporation in return for 200 shares of § 1244 stock. Due to § 351, the transfer was nontaxable; therefore, Donna's basis in the Egret stock is $300,000. In 2005, Donna sells 100 of these shares to Walter (a family friend) for $100,000. In 2011, Egret Corporation files for bankruptcy, and its stock becomes worthless.

Correct Answer

verified

Correct Answer

verified

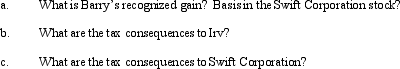

Essay

Barry and Irv form Swift Corporation. Barry transfers cash of $100,000 and equipment (basis of $300,000 and fair market value of $400,000) for 50% of Swift's stock. Irv transfers land and building (basis of $510,000 and fair market value of $450,000) and agrees to manage the business for one year for the other 50% of Swift's stock. The value of Irv's services for one year is $50,000.

Correct Answer

verified

Correct Answer

verified

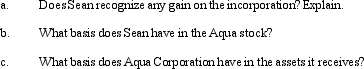

Essay

Sean, a sole proprietor, is engaged in a service business and uses the cash basis of accounting. In the current year, Sean incorporates his business by forming Aqua Corporation. In exchange for all of its stock, Aqua receives: assets (basis of $400,000 and fair market value of $2 million), trade accounts payable of $110,000, and loan due to a bank of $390,000. The proceeds from the bank loan were used by Sean to provide operating funds for the business. Aqua Corporation assumes all of the liabilities transferred to it.

Correct Answer

verified

Correct Answer

verified

True/False

A shareholder lends money to his corporation in his capacity as an investor. If the loans become worthless, a business bad debt results.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to induce Yellow Corporation to build a new manufacturing facility in Knoxville, Tennessee, the city donates land (fair market value of $400,000) and cash of $100,000 to the corporation. Several months after the donation, Yellow Corporation spends $450,000 (which includes the $100,000 received from Knoxville) on the construction of a new plant located on the donated land.

A) Yellow recognizes income of $100,000 as to the donation.

B) Yellow has a zero basis in the land and a basis of $450,000 in the plant.

C) Yellow recognizes income of $500,000 as to the donation.

D) Yellow has a zero basis in the land and a basis of $350,000 in the plant.

E) None of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If both §§ 357(b) and (c) apply to the same transfer (i.e., the liability is not supported by a bona fide business purpose and also exceeds the basis of the properties transferred), § 357(c) predominates.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 93

Related Exams