Correct Answer

verified

Correct Answer

verified

Multiple Choice

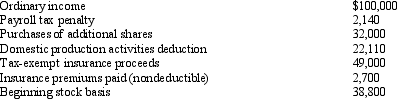

You are given the following facts about a one-shareholder S corporation. Prepare the shareholder's ending stock basis.

A) $168,660.

B) $192,850.

C) $214,960.

D) $263,960.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Compensation for services rendered to an S corporation is subject to FICA taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

S corporation status allows shareholders to realize tax benefits from corporate losses ____________________.

Correct Answer

verified

Correct Answer

verified

Short Answer

Realized gain is recognized by an S corporation on its distribution of ____________________ property.

Correct Answer

verified

Correct Answer

verified

True/False

The Schedule M-3 is the same for a C corporation and an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation can take advantage of the dividends received deduction.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

In the case of a complete termination of an S corporation interest, a ____________________ tax year may occur.

Correct Answer

verified

Correct Answer

verified

Essay

Compare the distribution of property rules for an S corporation with the corresponding partnership rules.

Correct Answer

verified

The major difference involves distributi...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

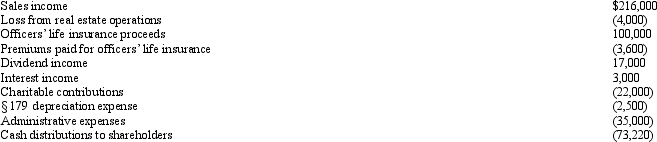

Towne, Inc., a calendar year S corporation, has an AAA amount of $627,050 at the beginning of 2012. During the year, the following items occur.

Calculate Towne's ending AAA balance.

Calculate Towne's ending AAA balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An S corporation with substantial AEP has operating revenues of $410,000, taxable interest income of $390,000, operating expenses of $260,000, and deductions attributable to the interest of $150,000.The passive income penalty tax payable, if any, is:

A) $0.

B) $40,923.

C) $116,923.

D) $136,500.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When loss assets are distributed by an S corporation, a shareholder's basis is equal to the asset's fair market value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The maximum number of shareholders in an S corporation is:

A) 75.

B) 100.

C) 200.

D) Indeterminable.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which equity arrangement cannot be used by an S corporation?

A) Phantom stock.

B) Stock appreciation rights.

C) Warrants.

D) Straight debt.

E) An insurance company structure.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A) Charitable contributions.

B) Unreasonable compensation.

C) Payroll tax penalty assessed.

D) Domestic production activities deduction.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Tax-exempt income is listed on Schedule ____________________ of Form 1120S.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yates Corporation elects S status, effective for calendar year 2012.Yates' only asset has a basis of $50,200 and a fair market value of $110,400 as of January 1, 2012.The asset is sold at the end of 2012 for $130,800.What amount must Mark Farris, a 60% owner and subject to a 15% income tax rate, pay, if any?

A) $5,358.

B) $12,642.

C) $21,070.

D) $35,718.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation can be a shareholder in another corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Advise your client how income, expenses, gain, and losses are allocated to shareholders of an S corporation.

Correct Answer

verified

In general, S corporation items are divi...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

The carryover period for the NOLs of a C corporation continues to run during S corporation years.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 159

Related Exams