B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A calendar year C corporation reports a $41,000 NOL in 2011, but it elects S status for 2012 and generates an NOL of $30,000 in that year. At all times during 2012, the stock of the corporation was owned by the same 10 shareholders, each of whom owned 10% of the stock. Kris, one of the 10 shareholders, holds an S stock basis of $2,300 at the beginning of 2012. How much of the 2012 loss, if any, is deductible by Kris?

A) $0.

B) $2,300.

C) $3,000.

D) $7,100.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Four unrelated individuals acquire assets on behalf of Jump Corporation on May 21, 2012, purchased assets on June 5, 2012, and begin doing business on June 15, 2012.They subscribe to shares of stock, file articles of incorporation for Jump, and become shareholders on July 23, 2012.The S election must be filed no later than 2 1/2 months after:

A) May 21, 2012.

B) June 5, 2012.

C) June 15, 2012.

D) July 23, 2012.

E) December 31, 2012.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

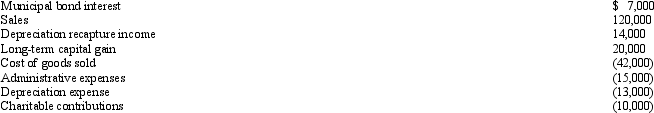

Estela, Inc., a calendar year S corporation, incurred the following items in 2012.

Calculate Estela's nonseparately computed income.

Calculate Estela's nonseparately computed income.

Correct Answer

verified

Correct Answer

verified

True/False

The passive loss limitations apply at the S corporation shareholder level.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

There is no limit on the amount of passive investment income that an S corporation can earn during the year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item has no effect on an S corporation's AAA?

A) Stock purchase by a shareholder.

B) Interest expense.

C) Cost of goods sold.

D) Capital loss.

E) All of the above modify AAA.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

If an S corporation has C corporate E & P and passive income in excess of ____________________ % of its gross receipts for ____________________ consecutive taxable years, the S election is terminated at the beginning of the ____________________ year. or or

Correct Answer

verified

Correct Answer

verified

Short Answer

If an S corporation shareholder's basis in a loan to the entity has been _________________, the shareholder recognizes gross income when the S corporation repays the shareholder.

Correct Answer

verified

Correct Answer

verified

True/False

A per-day, per-share allocation of flow-through S corporation items must be used, unless the shareholder disposes of the entire interest in the entity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Samantha owned 1,000 shares in Evita, Inc., an S corporation, that uses the calendar year. On October 11, 2012, Samantha sells all of her Evita stock. Her basis at the beginning of 2012 was $60,000. Her share of the corporate income for 2012 was $22,000, and she receives a distribution of $35,000 between January 1 and October 11, 2012. Her stock basis at the time of the sale is:

A) $117,000.

B) $82,000.

C) $60,000.

D) $47,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

It is not beneficial for an S corporation to issue § 1244 stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these tax provisions does not apply to an S corporation?

A) Section 1244 stock.

B) "Partial liquidation" stock redemption.

C) Tax-free "A" reorganization.

D) Section 1202 capital gain exclusion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An S election is made on the shareholder's Form 1040.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is correct with respect to an S corporation?

A) There is no advantage to also elect § 1244 stock.

B) An S corporation can own 85% of an insurance company.

C) An estate may be an S shareholder.

D) A voting trust arrangement is not available.

E) None of the above statements is correct.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Passive investment income includes net capital gains from the sale of stocks and securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation does not recognize a loss when distributing assets that are worth less than their basis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's basis is not decreased by distributions treated as being paid from AAA.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation that has total assets of at least $7.5 million on Schedule L at the end of the tax year must file a Schedule M-3.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

If an S corporation excludes cancellation of debt (COD) income from gross income, the excluded amount is applied to _________________ S corporation tax attributes.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 159

Related Exams