B) False

Correct Answer

verified

Correct Answer

verified

True/False

Taxpayer owns a home in Atlanta.His company transfers him to Chicago on January 2, 2012, and he sells the Atlanta house in early February.He purchases a residence in Chicago on February 3, 2012.On December 15, 2012, taxpayer's company transfers him to Los Angeles.In January 2013, he sells the Chicago residence and purchases a residence in Los Angeles.Because multiple sales have occurred within a two-year period, § 121 treatment does not apply to the sale of the second home.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The basis of personal use property converted to business use is:

A) Always the lower of its adjusted basis or fair market value on the date of conversion.

B) Always its adjusted basis on the date of conversion.

C) Always its fair market value on the date of conversion.

D) Always the higher of its adjusted basis or fair market value on the date of conversion.

E) None of the above.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The basis of property received by gift is always a carryover basis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The holding period of replacement property where the election to postpone gain is made includes the holding period of the involuntarily converted property.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If Wal-Mart stock increases in value during the tax year by $4,500, the amount realized is a positive $4,500.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Broker's commissions, legal fees, and points paid by the seller reduce the seller's amount realized.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The basis of property acquired in a bargain purchase is the cost of the asset. The bargain amount (fair market value - cost) is recognized when the asset is sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) The gain basis for property received by gift is the lesser of the donor's adjusted basis or the fair market value on the date of the gift.

B) The loss basis for property received by gift is the same as the donor's basis.

C) The gain basis for inherited property is the same as the decedent's basis.

D) The loss basis for inherited property is the lesser of the decedent's basis or the fair market value on the date of the decedent's death.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to qualify for like-kind exchange treatment under § 1031, which of the following requirements must be satisfied?

A) The form of the transaction is an exchange.

B) Both the property transferred and the property received are held either for productive use in a trade or business or for investment.

C) The exchange must be completed by the end of the second tax year following the tax year in which the taxpayer relinquishes his or her like-kind property.

D) Only a.and b.

E) a., b., and c.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

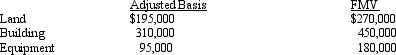

Mona purchased a business from Judah for $1,000,000. Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Etta received nontaxable stock rights on October 3, 2012.She allocated $12,000 of the $30,000 basis for the associated stock to the stock rights.The stock rights are exercised on November 8, 2012.The exercise price for the stock is $42,000.What is Etta's basis for the acquired stock?

A) $12,000.

B) $42,000.

C) $54,000.

D) $72,000.

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Section 1033 (nonrecognition of gain from an involuntary conversion) applies to both gains and losses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

At a particular point in time, a taxpayer can have one or two principal residences for § 121 exclusion purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Stuart owns land with an adjusted basis of $190,000 and a fair market value of $500,000.If the property is going to be given to Stuart's nephew, Alex, it is preferable for the transfer to be by inheritance rather than by gift.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pam exchanges a rental building, which has an adjusted basis of $520,000, for investment land which has a fair market value of $700,000.In addition, Pam receives $100,000 in cash.What is the recognized gain or loss and the basis of the investment land?

A) $0 and $420,000.

B) $100,000 and $420,000.

C) $100,000 and $520,000.

D) $280,000 and $700,000.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Monroe's delivery truck is damaged in an accident.Monroe's adjusted basis for the delivery truck prior to the accident is $20,000.If Monroe receives insurance proceeds of $21,000 and recognizes a casualty gain of $1,000, his adjusted basis for the delivery truck after the accident is $21,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Noelle owns an automobile which she uses for personal use.Her adjusted basis is $45,000 (i.e., the original cost) .The car is worth $22,000.Which of the following statements is correct?

A) If Noelle sells the car for $22,000, her realized loss of $23,000 is not recognized.

B) If Noelle exchanges the car for another car worth $22,000, her realized loss of $23,000 is not recognized.

C) If the car is stolen and it is uninsured, Noelle may be able to recognize part of her realized loss of $23,000.

D) Only a.and b.are correct.

E) a., b., and c.are correct.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alvin is employed by an automobile dealership as its manager.As such, he purchased an SUV for $32,000 (fair market value is $48,000) .No other employees are permitted a discount.What is Alvin's basis in the SUV?

A) $16,000.

B) $32,000.

C) $48,000.

D) $80,000.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer who sells his or her principal residence at a realized loss can elect to recognize the loss even if a qualified residence is acquired during the statutory time period.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 200

Related Exams