Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classify each statement appearing below. -Using his own funds,Horace establishes a savings account designating ownership as follows: "Horace and Nadine as joint tenants with right of survivorship." Horace later withdraws all of the funds.

A) No taxable transfer occurs

B) Gift tax applies

C) Estate tax applies

E) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The death of a tenant in common will cancel his or her interest in the property.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Classify each statement appearing below. a.No taxable transfer occurs b.Gift tax applies c.Estate tax applies -Under a prenuptial agreement,Herbert transfers stock to Norma.One month later,Herbert and Norma are married.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each statement with the correct choice. Some choices may be used more than once or not at all. a.In the current year, Debby, a widow, dies. Two years ago she inherited a large amount of wealth from her brother. b.Death does not defeat an owner's interest in property. c.Exists only if husband and wife are involved. d.A type of state tax on transfers by death. e.Must decrease the amount of the gross estate. f.Annual exclusion not allowed. g.Cumulative in effect. h.Right of survivorship present as to type of ownership. i.Overrides the terminable interest rule of the marital deduction. j.Exemption equivalent. k.Bypass amount. l.No correct match provided. -Future interest

Correct Answer

verified

Correct Answer

verified

Multiple Choice

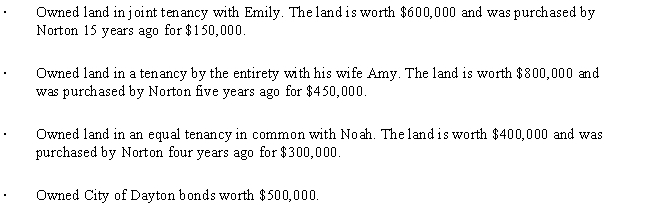

At the time of his death,Norton was involved in the following transactions.

What amount is included in Norton's gross estate?

What amount is included in Norton's gross estate?

A) $900,000

B) $1,100,000

C) $1,700,000

D) $2,100,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Classify each statement appearing below. a.No taxable transfer occurs b.Gift tax applies c.Estate tax applies -Under her father's will,Faith is to receive 10,000 shares of GE common stock.Ten months after her father's death,Faith disclaims 10,000 shares.

Correct Answer

verified

Correct Answer

verified

True/False

Peggy gives $200,000 to her grandson.This is an example of a direct skip for purposes of the GSTT (generation-skipping transfer tax).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

At the time of his death,Gene held a Roth IRA account with his wife as the designated beneficiary.The IRA is included in Gene's gross estate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classify each of the independent statements appearing below. -Proceeds of an insurance policy on decedent's life.Decedent's son purchased the policy and is its owner and beneficiary.

A) Some or all of the asset is included in the decedent's gross estate.

B) None of the asset is included in the decedent's gross estate.

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

The Federal transfer tax system includes three separate taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For Federal estate tax purposes,the gross estate cannot include property the decedent does not own.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each statement with the correct choice. Some choices may be used more than once or not at all. a.In the current year, Debby, a widow, dies. Two years ago she inherited a large amount of wealth from her brother. b.Death does not defeat an owner's interest in property. c.Exists only if husband and wife are involved. d.A type of state tax on transfers by death. e.Must decrease the amount of the gross estate. f.Annual exclusion not allowed. g.Cumulative in effect. h.Right of survivorship present as to type of ownership. i.Overrides the terminable interest rule of the marital deduction. j.Exemption equivalent. k.Bypass amount. l.No correct match provided. -Tenancy in common

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classify each statement appropriately. -State death tax imposed on the estate.

A) Deductible from the gross estate in arriving at the taxable estate.

B) Not deductible from the gross estate in arriving at the taxable estate.

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classify each statement appropriately. -Payment of unpaid gift taxes.

A) Deductible from the gross estate in arriving at the taxable estate.

B) Not deductible from the gross estate in arriving at the taxable estate.

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

Ray purchases U.S.savings bonds which he lists as "Ray and Donna" as co-owners.Donna is Ray's daughter.Donna predeceases Ray.No gift or estate tax consequences result from this situation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For Federal estate,gift,and generation-skipping tax purposes,the exemption equivalent is the same thing as the exclusion amount.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sally's will passes real estate to Otto (her surviving husband).The real estate is worth $800,000 but is subject to a mortgage of $200,000.The transfer provides Sally's estate with a marital deduction of $600,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classify each statement appropriately. -Mortgage on land included in gross estate and willed to decedent's children.

A) Deductible from the gross estate in arriving at the taxable estate.

B) Not deductible from the gross estate in arriving at the taxable estate.

D) undefined

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each statement with the correct choice. Some choices may be used more than once or not at all. a.In the current year, Debby, a widow, dies. Two years ago she inherited a large amount of wealth from her brother. b.Death does not defeat an owner's interest in property. c.Exists only if husband and wife are involved. d.A type of state tax on transfers by death. e.Must decrease the amount of the gross estate. f.Annual exclusion not allowed. g.Cumulative in effect. h.Right of survivorship present as to type of ownership. i.Overrides the terminable interest rule of the marital deduction. j.Exemption equivalent. k.Bypass amount. l.No correct match provided. -Federal gift tax

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 167

Related Exams