Filters

Question type

A) If Boris is self-employed, he may deduct $7,200 as a deduction for AGI.

B) If Boris is self-employed, he may deduct $3,400 as a deduction for AGI and may include the $3,800 premium when calculating his itemized medical expense deduction.

C) If Boris is an employee, he may deduct $7,200 as a deduction for AGI.

D) If Boris is an employee, he may include $7,200 when calculating his itemized medical expense deduction.

E) None of the above.

F) None of the above

G) All of the above

G) All of the above

Correct Answer

verified

Correct Answer

verified

Question 62

Multiple Choice

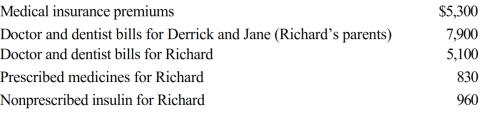

Richard, age 50, is employed as an actuary. For calendar year 2018, he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Richard's dependents except that they file a joint return. Richard's medical insurance policy does not cover them. Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019. What is Richard's maximum allowable medical expense deduction for 2018?

Derrick and Jane would qualify as Richard's dependents except that they file a joint return. Richard's medical insurance policy does not cover them. Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019. What is Richard's maximum allowable medical expense deduction for 2018?

A) $0

B) $7,090

C) $10,340

D) $20,090

E) None of the above

F) A) and D)

G) C) and D)

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 63

Multiple Choice

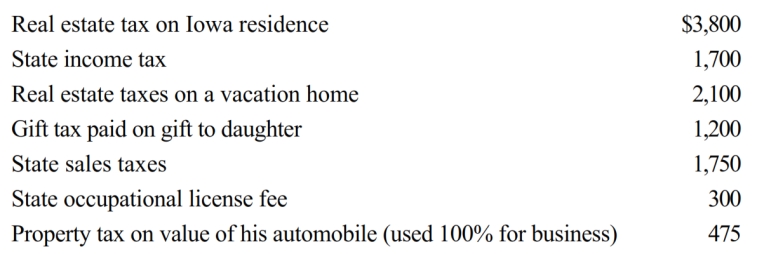

Hugh, a self-employed individual, paid the following amounts during the year:  What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

A) $7,650

B) $8,850

C) $9,625

D) $10,000

E) None of the above

F) C) and D)

G) A) and B)

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Question 64

True/False

Noah gave $750 to a good friend whose house was destroyed by an earthquake. In addition, Noah contributed his time, valued at $250, in the cleanup effort. Noah may claim a charitable deduction of $1,000 on his tax return for the current year.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 104 of 104

Related Exams