A) those who hold a lot of currency and accounts for a large share of U.S. government revenue.

B) those who hold a lot of currency but accounts for a small share of U.S. government revenue.

C) those who hold little currency and accounts for a large share of U.S. government revenue.

D) those who hold little currency but accounts for a small share of U.S. government revenue.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Norma complains that she is not receiving the full benefit of her six percent raise, because inflation is two percent. You tell her that nominal incomes tend to rise with inflation, therefore

A) she really is worse off.

B) her real income increased eight percent.

C) menu costs have reduced her purchasing power.

D) she is committing the inflation fallacy.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs of inflation can be significant even if actual inflation and expected inflation are the same?

A) menu costs

B) inflation tax

C) shoeleather costs

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If money is neutral and velocity is stable, an increase in the money supply creates a proportional increase in

A) real output only.

B) nominal output only.

C) the price level only.

D) both the price level and nominal output.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, a decrease in the money supply leads people to

A) spend more so the value of a dollar rises.

B) spend more so the value of a dollar falls.

C) spend less so the value of a dollar rises.

D) spend less so the value of a dollar falls.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The claim that increases in the growth rate of the money supply increase nominal interest rates but not real interest rates is known as the

A) Friedman Effect.

B) Hume Effect.

C) Fisher Effect.

D) the inflation tax.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a given real interest rate, an increase in inflation makes the after-tax real interest rate

A) decrease, which encourages savings.

B) decrease, which discourages savings.

C) increase, which encourages savings.

D) increase, which discourages savings.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Money neutrality states that a change in the money supply affects _____ variables only. Most economists believe that money neutrality is a good description of how money affects the economy in the _____.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose monetary neutrality holds and velocity is constant. A 4 percent increase in the money supply

A) increases the price level by more than 4 percent.

B) increases the price level by 4 percent.

C) increases the price level by less than 4 percent.

D) increases real GDP by 4 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

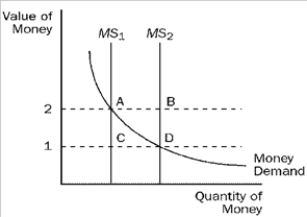

Figure 30-1  -Refer to Figure 30-1. When the money supply curve shifts from MS1 to MS2,

-Refer to Figure 30-1. When the money supply curve shifts from MS1 to MS2,

A) the demand for goods and services decreases.

B) the economy's ability to produce goods and services increases.

C) the equilibrium price level decreases.

D) None of the above is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Governments may prefer an inflation tax to some other type of tax because the inflation tax

A) is easier to impose.

B) reduces inflation.

C) falls mainly on high-income individuals.

D) reduces the real cost of government expenditure.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If M = 6,000, P = 3, and Y = 3,000, what is velocity?

A) 6

B) 1.5

C) 0.67

D) 0.167

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People can reduce the inflation tax by

A) reducing savings.

B) increasing deductions on their income tax.

C) reducing cash holdings.

D) None of the above is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the classical dichotomy, which of the following is not influenced by monetary factors?

A) real GDP.

B) real wages.

C) real interest rates.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Changes in nominal variables are determined mostly by the quantity of money and the monetary system according to

A) both the classical dichotomy and the quantity theory of money.

B) the classical dichotomy, but not the quantity theory of money.

C) the quantity theory of money, but not the classical dichotomy.

D) neither the classical dichotomy nor the quantity theory of money.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

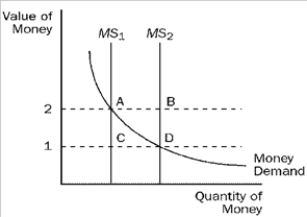

Figure 30-1  -Refer to Figure 30-1. If the money supply is MS2 and the value of money is 2, then

-Refer to Figure 30-1. If the money supply is MS2 and the value of money is 2, then

A) the quantity of money demanded is greater than the quantity supplied; the price level will rise.

B) the quantity of money demanded is greater than the quantity supplied; the price level will fall.

C) the quantity of money supplied is greater than the quantity demanded; the price level will rise.

D) the quantity of money supplied is greater than the quantity demanded; the price level will fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When shopping you notice that a pair of jeans costs $20 and that a tee-shirt costs $10. You compute the price of jeans relative to tee-shirts.

A) The dollar price of jeans and the relative price of jeans are both nominal variables.

B) The dollar price of jeans and the relative price of jeans are both real variables.

C) The dollar price of jeans is a nominal variable; the relative price of jeans is a real variable.

D) The dollar price of jeans is a real variable; the relative price of jeans is a nominal variable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following cases was the inflation rate 12 percent over the last year?

A) One year ago the price index had a value of 110 and now it has a value of 120.

B) One year ago the price index had a value of 120 and now it has a value of 132.

C) One year ago the price index had a value of 134 and now it has a value of 150.

D) One year ago the price index had a value of 145 and now it has a value of 163.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation can be measured by the

A) change in the consumer price index. Inflation in the U.S. has averaged about 2.5% over the last 80 years.

B) change in the consumer price index. Inflation in the U.S. has averaged about 4% over the last 80 years.

C) percentage change in the consumer price index. Inflation in the U.S. has averaged about 3.6% over the last 80 years.

D) percentage change in the consumer price index. Inflation in the U.S. has averaged about 4% over the last 80 years.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If real output in an economy is 1,000 goods per year, the money supply is $300, and each dollar is spent an average of 4 times per year, then according to the quantity equation, the average price level is

A) 3.33.

B) 0.83.

C) 1.20.

D) 13.33.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 487

Related Exams