A) $37,800

B) $18,000

C) $2,000

D) $16,300

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed's control of the money supply is not precise because

A) Congress can also make changes to the money supply.

B) there are not always government bonds available for purchase when the Fed wants to perform open-market operations.

C) the Fed does not know where all U.S. currency is located.

D) the amount of money in the economy depends in part on the behavior of depositors and bankers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best illustrates the medium of exchange function of money?

A) You keep some money hidden in your shoe.

B) You keep track of the value of your assets in terms of currency.

C) You pay for your oil change using currency.

D) None of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liquidity refers to

A) the ease with which an asset is converted to the medium of exchange.

B) the measurement of the intrinsic value of commodity money.

C) the measurement of the durability of a good.

D) how many time a dollar circulates in a given year.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To increase the money supply, the Fed could

A) sell government bonds.

B) auction more loans to banks.

C) increase the reserve requirement.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a bank's Taccount, which are part of the bank's assets?

A) both deposits made by its customers and reserves

B) deposits made by its customers but not reserves

C) reserves but not deposits made by its customers

D) neither deposits made by its customers nor reserves

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary difference between commodity money and fiat money is that

A) commodity money is a medium of exchange but fiat money is not.

B) fiat money is a medium of exchange but commodity money is not.

C) commodity money has intrinsic value but fiat money does not.

D) fiat money has intrinsic value but commodity money does not.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a bank loans out $1,000, the money supply

A) does not change.

B) decreases.

C) increases.

D) may do any of the above.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A debit card is more similar to a credit card than to a check.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) All items that are included in M1 are included also in M2.

B) All items that are included in M2 are included also in M1.

C) Credit cards are included in both M1 and M2.

D) Savings deposits are included in both M1 and M2.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reserve requirement is 12 percent. Lucy deposits $600 into a bank. By how much do excess reserves change?

A) $600

B) $528

C) $72

D) $12

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

M1 equals currency plus demand deposits plus

A) nothing else.

B) other checkable deposits.

C) traveler's checks plus other checkable deposits.

D) traveler's checks plus other checkable deposits plus savings deposits.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The ease with which an asset can be converted into the economy's medium of exchange is known as__________________.

Correct Answer

verified

Correct Answer

verified

Essay

Suppose a bank has $3,000 in reserves, $25,000 of deposits, and a 10 percent reserve requirement. What is the amount of excess reserves?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

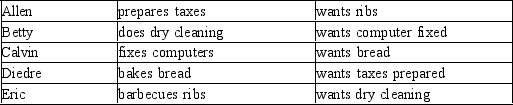

Consider five individuals with different occupations.  If this economy has money

If this economy has money

A) Allen will buy from Betty

B) Betty will buy from Calvin

C) Eric will buy from Allen

D) None of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A central bank's setting or altering) of the money supply is known as

A) open-market operation.

B) interest rate policy.

C) monetary policy.

D) employment policy.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) A bank's deposits at the Federal Reserve counts as part of the bank's reserves. The Federal Reserve pays interest on these deposits.

B) A bank's deposits at the Federal Reserve counts as part of the bank's reserves. The Federal Reserve does not pay interest on these deposits.

C) A bank's deposits at the Federal Reserve does not count as part of the bank's reserves. The Federal Reserve pays interest on these deposits.

D) A bank's deposits at the Federal Reserve does not count as part of the bank's reserves. The Federal Reserve does not pay interest on these deposits.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

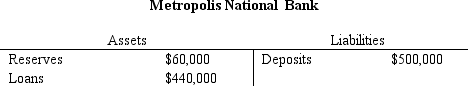

Table 29-9

Metropolis National Bank is currently holding 2% of its deposits as excess reserves.

-Refer to Table 29-9. Metropolis National Bank is currently holding 2% of deposits as excess reserves. Assuming that all banks have the same required reserve ratio, and then none want to hold excess reserves what is the value of the money multiplier?

-Refer to Table 29-9. Metropolis National Bank is currently holding 2% of deposits as excess reserves. Assuming that all banks have the same required reserve ratio, and then none want to hold excess reserves what is the value of the money multiplier?

A) 8.25

B) 10

C) 12

D) 20

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a 100-percent-reserve banking system, if people decided to decrease the amount of currency they held by increasing the amount they held in checkable deposits, then

A) M1 would increase.

B) M1 would decrease.

C) M1 would not change.

D) M1 might rise or fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If people decide to hold more currency relative to deposits, the money supply

A) falls. The larger the reserve ratio is, the more the money supply falls.

B) falls. The larger the reserve ratio is, the less the money supply falls.

C) rises. The larger the reserve ratio is, the more the money supply rises.

D) rises. The larger the reserve ratio is, the less the money supply rises.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 401 - 420 of 517

Related Exams