A) says the government can generate revenue by printing money.

B) says there is a one for one adjustment of the nominal interest rate to the inflation rate.

C) explains how higher money supply growth leads to higher inflation.

D) explains how prices adjust to obtain equilibrium in the money market.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Real GDP measures output of final goods and services in physical units.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

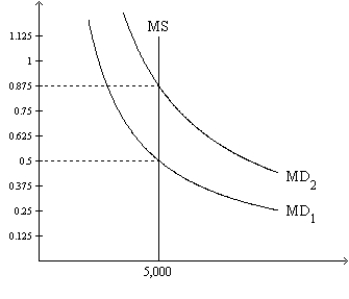

Figure 30-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.  -Refer to Figure 30-2. If the relevant money-demand curve is the one labeled MD1, then

-Refer to Figure 30-2. If the relevant money-demand curve is the one labeled MD1, then

A) when the money market is in equilibrium, one dollar purchases one-half of a basket of goods and services.

B) when the money market is in equilibrium, one unit of goods and services sells for 2 dollars.

C) there is an excess demand for money if the value of money in terms of goods and services is 0.375.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct? Inflation

A) impedes financial markets in their role of allocating resources.

B) reduces the purchasing power of the average consumer.

C) generally increases after-tax real interest rates.

D) is most costly when anticipated.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If V and M are constant and Y doubles, the quantity equation implies that the price level

A) falls to half its original level.

B) does not change.

C) doubles.

D) more than doubles.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose over some period of time the money supply tripled, velocity was unchanged, and real GDP doubled. According to the quantity equation the price level is now

A) 6 times its old value.

B) 3 times its old value.

C) 1.5 times its old value.

D) 0.75 times its old value

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The story The Wizard of Oz can be interpreted as an allegory about U.S. monetary policy in the late 19th century.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the principle of monetary neutrality, a decrease in the money supply will not change

A) nominal GDP.

B) the price level.

C) unemployment.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If M = 9,000, P = 6, and Y = 1,500, what is velocity?

A) 0.167.

B) 1.

C) 4.

D) 36.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Steve purchases some land for $30,000. He maintains it, but makes no improvements to it. One year later he sells it for $32,000. Stephanie puts $30,000 in a savings account that pays 6% interest. Steve has to pay the 50% capital gains tax, Stephanie is in the 35% tax bracket. The inflation rate was 2%. Who had the higher before-tax real gain and who had the higher after-tax real gain?

A) Steve had both the higher before-tax real gain and the higher after-tax real gain.

B) Steve had the higher before-tax real gain but Stephanie had the higher after-tax real gain.

C) Stephanie had the higher before-tax real gain but Steve had the higher after-tax real gain.

D) Stephanie had both the higher before-tax real gain and the higher after-tax real gain.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given a nominal interest rate of 8 percent, in which of the following cases would you earn the highest after-tax real interest rate?

A) Inflation is 5 percent; the tax rate is 40 percent.

B) Inflation is 4 percent; the tax rate is 30 percent.

C) Inflation is 3 percent; the tax rate is 45 percent.

D) Inflation is 2 percent; the tax rate is 50 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The classical dichotomy refers to the idea that the supply of money

A) is irrelevant for understanding the determinants of nominal and real variables.

B) determines nominal variables, but not real variables.

C) determines real variables, but not nominal variables.

D) is a determinant of both real and nominal variables.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price level increased from 120 to 130, then what was the inflation rate?

A) 1.1 percent.

B) 7.7 percent.

C) 10.0 percent.

D) 8.3 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If when the money supply changes, real output and velocity do not change, then a 2 percent increase in the money supply

A) decreases the price level by 2 percent.

B) decreases the price level by less than 2 percent.

C) increases the price level by less than 2 percent.

D) increases the price level by 2 percent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe people going to the bank more frequently. Other things the same this could result from

A) an increase in inflation which increases money demand.

B) an increase in inflation which reduces money demand.

C) a decrease in inflation which increases money demand.

D) a decrease in inflation which reduces money demand.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

An increase in the price level means that a dollar buys __________ goods and services so the value of a dollar __________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in some tax year you earned a nominal interest rate of 6 percent. During the time you held these funds inflation was 1 percent. You compute that you made a real after-tax interest rate of 3 percent. What was your tax rate?

A) 40 percent.

B) 33.3 percent.

C) 25 percent.

D) 50 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Inflation impedes financial markets in their role of allocating savings to alternative investments.

B) Inflation encourages savings through the tax treatment on capital gains.

C) Inflation encourages larger holdings of currency by the public.

D) Inflation reduces people's real purchasing power.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S., from the early 1980s through the early 1990s,

A) both inflation and nominal interest rates rose.

B) both inflation and nominal interest rates fell.

C) the inflation rate fell and the nominal interest rate rose.

D) the inflation rate rose and the nominal interest rate fell.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When deflation exists,

A) the real interest rate is less than the nominal interest rate.

B) the real interest rate is greater than the nominal interest rate.

C) the real interest rate and inflation are less than the nominal interest rate.

D) prices rise.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 487

Related Exams